Woolworths Ltd (ASX:WOW) has reported an increase in sales during the third quarter, despite ongoing industry-wide cost pressures that have kept shelf-price inflation at persistently high levels.

Let's take a closer look at its fundamentals using InvestingPro tools.

What Does the Company Do?

Woolworths Group Ltd is a diverse company with retail operations spanning destination and convenience stores, supermarkets, and online channels. The company sources food, beverages, general merchandise, and consumer electronics from various farmers, producers, and manufacturers to cater to their wide customer base.

The business is divided into several segments including Australian Food, Australian B2B (Business-to-Business), New Zealand Food, BIG W and Other. In Australia alone they operate over 1,086 supermarkets under the Woolworths Supermarkets and Metro Food Stores brands. Their Australian Food segment focuses on procuring food items for resale while also offering services to local customers.

Their B2B division concentrates on supplying food products for resale at other businesses in addition to providing supply chain solutions for corporate clients in Australia. Meanwhile across the Tasman Sea in New Zealand they have around 190 supermarkets operating under their New Zealand Food segment which specialize in sourcing quality foodstuffs for Kiwi consumers.

In addition to these supermarket chains they also manage approximately 177 BIG W locations that focus on discounted general merchandise sales throughout Australia. To support their eCommerce presence within both countries they have established seven customer fulfilment centers (CFCs) alongside two e-stores designed specifically to accommodate an ever-growing demand for convenient online shopping options.

Let's start by going through the financial statement history using the InvestingPro tools. This gives us several useful insights.

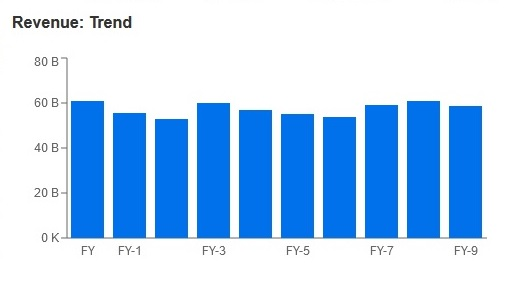

Woolworths Revenue Trend

Source: InvestingPro

Although full-year year revenues remain stable, the supermarket giant revealed a growth of 8% in its Q3 sales to $16.4 billion compared with last year. According to CEO Brad Banducci, value-conscious shoppers are now more mindful about their discretionary expenses, opting for affordable alternatives such as the company's own brands while seeking additional savings through digital platforms and reward programs.

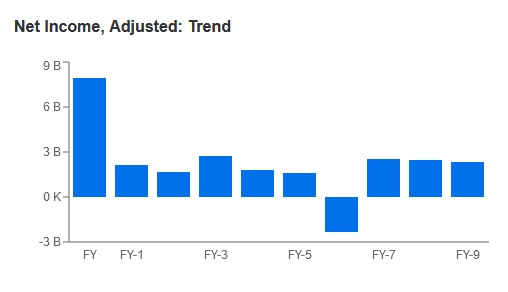

Woolworths Net Income Trend

Source: InvestingPro

The company has demonstrated stable income despite post-pandemic inflation pressures. Banducci acknowledged signs of moderating inflation within Woolworths' food sector but emphasized that it continues to be frustratingly elevated in many areas; hence the need for constant efforts towards offering customers better value propositions.

To cater effectively to consumers' needs amidst these challenges, Woolworths has been focusing on providing affordable protein options while leveraging its exclusive brands alongside seasonal promotions tailored specifically for members.

While product shortages have somewhat diminished since pre-pandemic times, they still remain above normal levels—an area where improvement is needed according to company officials.

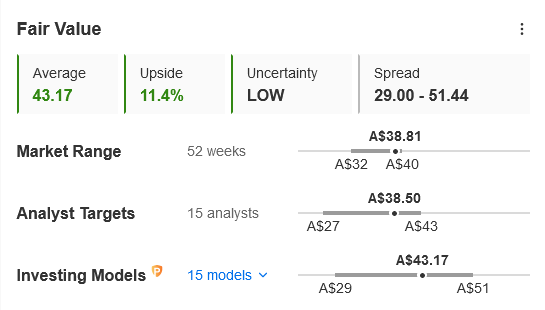

Fair Value Estimate

Currently, the stock is trading at $38.73, indicating a significantly underpriced value when compared to the fair value of $43.2. The fair value estimate is based on 15 different mathematical models, available on InvestingPro.

Woolworths Fair Value Estimates

Source: InvestingPro

With Woolworths Ltd (ASX:WOW) stock price trading 2.6% below April’s 16-month highs, the current valuations pose a high level of risk for market participants fearing a greater economic downturn in the second half of 2023. Investors should carefully evaluate their investment goals and risk tolerance before making any decisions.

The analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.