The S&P 500 index, (also sometimes referred to as the S&P), measures the stock performance of the largest publicly-traded 500 companies in the US. These companies make up around 80% of the overall US stock market's value and cover approximately 24 separate industry groups.

For many investors, the S&P's performance shows how US equities, in general, are performing. This capitalization-weighted index is one of the most widely followed equity benchmarks worldwide.

Larger companies make up a greater portion of the index's value and influence its performance. In other words, each company does not simply represent 1/500 of the index, but is represented to a larger or smaller degree depending on its market cap. With a market cap of over $1.5 trillion, right now Microsoft (NASDAQ:MSFT) tops the S&P 500 list.

Considering all of the above, here's why market participants who want to gain exposure to the S&P 500, without necessarily investing in specific stocks listed on the index could consider buying the SPDR S&P 500 ETF (NYSE:SPY), an exchange-traded fund (ETF) based on the index. It is sometimes referred to by its nickname, "Spider," and can be bought or sold through a broker.

The SPY ETF value proposition is simple: essentially, it tracks the performance of the S&P 500 index. Investors gain exposure to the growth and profitability of US-based businesses without having to rely too heavily on any individual company’s performance.

Why Invest In Index ETFs

An index typically tracks returns on a buy-and-hold basis and is therefore a passive investment approach. An ETF is a basket of securities — stocks, bonds, commodities, or some combination of these. Many ETFs track various indices, such as the S&P 500. Such broad-market index ETFs enable investors to diversify their portfolio holdings.

Launched in January 1993, SPY was the first exchange-traded fund listed in the US. Over the past three decades, ETFs have become one of the most popular passive investment vehicles among retail and professional investors. Low transaction costs and intraday liquidity are among their significant benefits for investors.

Unlike mutual funds, which allow investors to acquire or redeem shares only at the end of the trading day, ETFs enable market participants to trade their shares throughout the trading day continuously, just as one does with a stock.

Where SPY Is Now

- Current Price: $318.92

- 52-week Range: $218.26-$339.08

- Dividend Yield: 1.8%

- Expense Ratio: 0.0945% per year, or $9.45 on a $10,000 investment.

In the second quarter of 2020, the S&P 500 index produced its best quarterly return (i.e., over 20%) since the fourth quarter of 1998, which was when the tech bubble burst.

In Q2, SPY—which is the most popular ETF by daily trading volume overall—tracked that performance of the S&P 500 index.

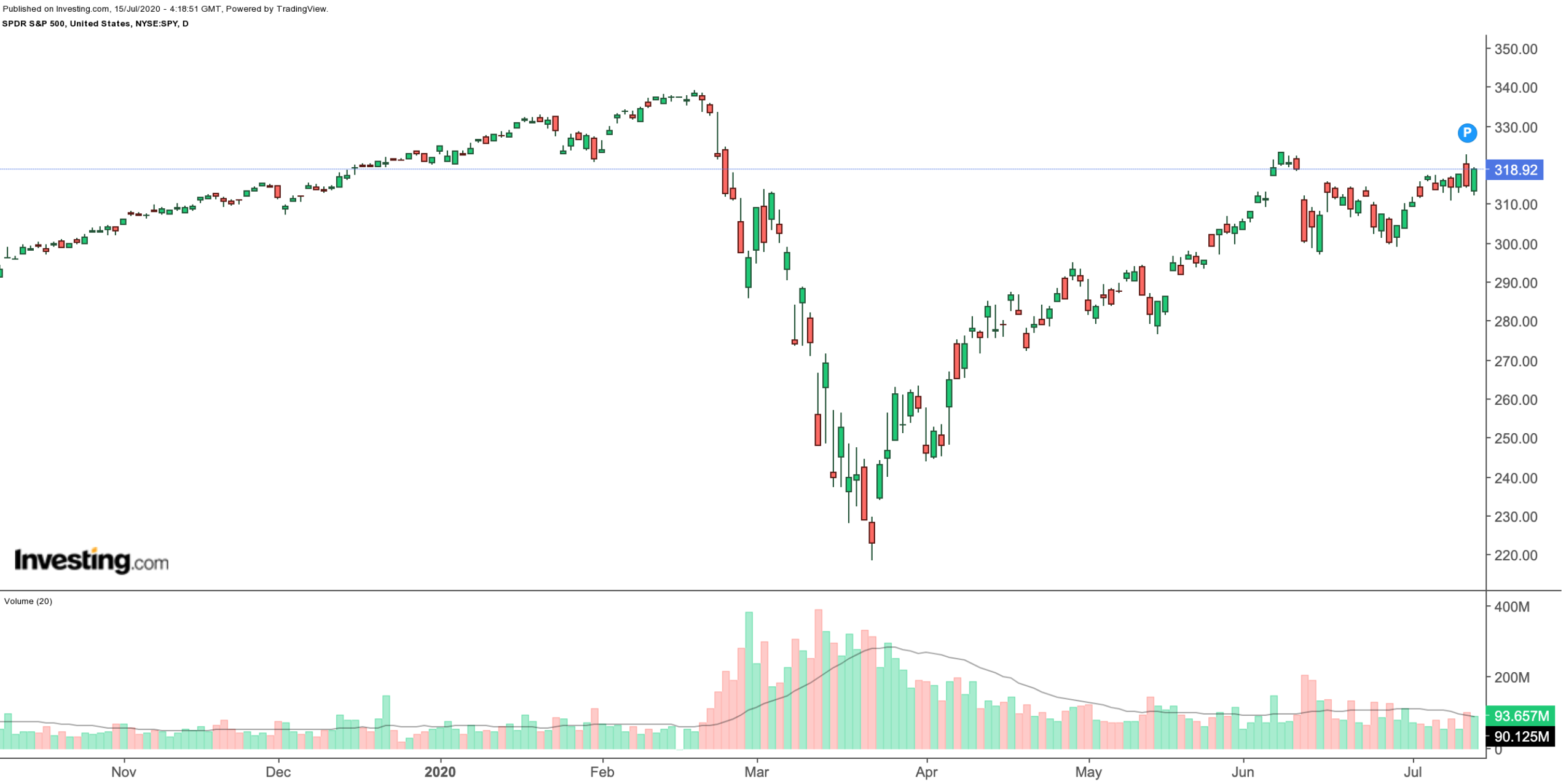

SPY started this year around $320, and on Feb. 19, hit an all-time high of $339.08. February and March saw the novel coronavirus become a global pandemic, affecting billions of people worldwide. As the size and nature of the health crisis became apparent, investors began de-risking their portfolios and stocks were rapidly sold off. On March 23, SPY hit a 52-week low of $218.26.

Since then, the comeback for the ETF has been remarkable. On July 13, SPY saw a recent intraday-high of $322.71. That means a return of over 47% in less than four months.

We have just entered a busy, and potentially mercurial earnings season. For example, on Tuesday, America's biggest banks reported second quarter results. In the coming weeks, given the recent stellar increase in the prices of many S&P 500 stocks, there may likely be short-term volatility and profit-taking in broader markets and SPY.

Microsoft, Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) are the ETF's three largest holdings, making up about 17% of the fund's roster. To be exact, SPY holds 505 stocks, owing to multiple share classes for constituents such as Alphabet (NASDAQ:GOOGL) and (NASDAQ:GOOG); Berkshire Hathaway (NYSE:BRKa) and (NYSE:BRKb), plus a few others. SPY's top 10 holdings combine close to 30% of the fund's list.

Bottom Line

Like any financial asset, an exchange-traded fund is not a one-size-fits-all solution. Investors would need to do full due diligence on a given ETF, such as the composition, managers, costs, and liquidity.

However, for new investors or those who do not want to select individual companies, SPY might be a potential cornerstone portfolio holding.