After ending 2018 in freefall, WTI crude futures have gained around 30% since the start of the year. The U.S. oil benchmark, which last week hit $60.39 a barrel, its highest level since November, is trading at $59.84 at time of writing.

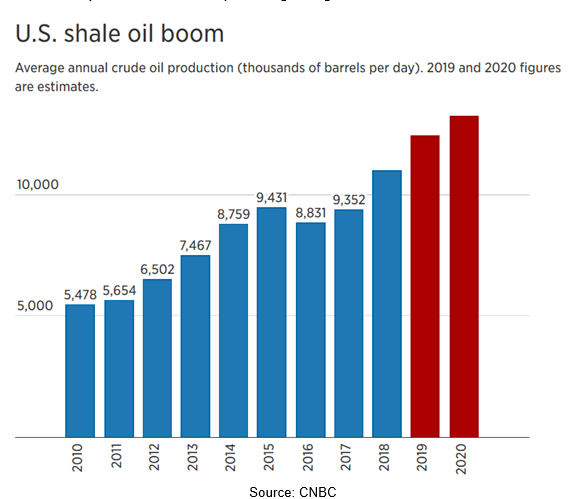

For much of 2019, the commodity's price has been supported by the efforts of the Organization of the Petroleum Exporting Countries (OPEC) and non-affiliated allies like Russia, who have pledged to withhold around 1.2 million barrels per day (bpd) of supply this year to prop up markets. But U.S. shale oil drillers have stepped in to fill the void—and then some; they're pumping at record levels, near 12 million bpd, according to weekly data from the Energy Information Administration (EIA).

As well, the International Energy Agency (IEA) forecasts U.S. shale output will soar by another 4 million bpd in the next five years, suggesting that crude production from shale basins will continue powering along.

Those increases would likely outpace the growth of global demand and give the U.S. an even bigger share of the global market, making it a more consequential exporter than Saudi Arabia.

Considering all this, we believe it's an ideal time for investors to go shopping for some shale oil drillers. Below, three stocks poised to outperform in the months ahead. In order to weed out the thousands of energy-related names trading in the market, we only considered companies in the sector that are U.S.-based and currently have a market capitalization of $2 billion and above.

1. EOG Resources: America's Leading Shale Producer

While EOG Resources (NYSE:EOG) might only be the third-largest oil producer in the U.S., trailing Chevron (NYSE:CVX) and Exxon Mobil, it's by far the country's leader in extracting oil from tight shale formations.

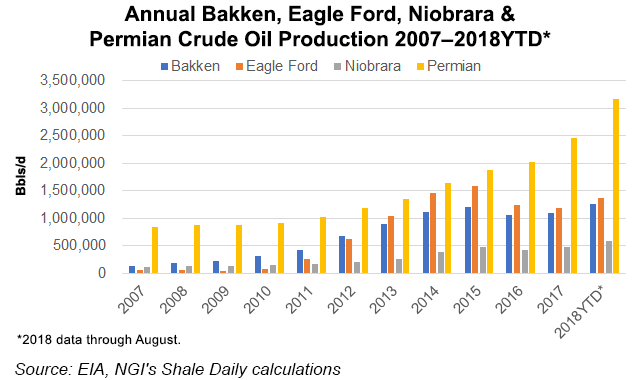

During the fourth quarter of 2018, EOG produced an average of 479,000 bpd from shale formations across the lower 48 states, more than double the level of its next largest peer, Pioneer Natural Resources (NYSE:PXD). The largest portion of that production came from the Eagle Ford, where the company is the top oil extractor, pumping out an average of 157,000 bpd last year.

EOG Resources also holds extensive acreage positions across the Permian, Bakken, DJ Basin and Powder River basins. The company's large supply of remaining drilling locations gives EOG the resources to grow its U.S. oil production at a 15% compound annual growth rate (CAGR) through 2020, assuming oil averages $50 a barrel, and by up to a 25% CAGR if crude is at $60 a barrel.

While the stock, which closed at $94.77 on Tuesday, is down almost 12% year-to-date, shares have gained 8.6% since the start of 2019.

2. Exxon Mobil: Rushing into Shale as Independents Scale Back

Global oil giant Exxon Mobil (NYSE:XOM) is the second-largest U.S. oil producer, with oil equivalent production of just over 4 million bpd.

After it largely missed out on the first phase of the Permian shale bonanza, which really started to pick up pace in 2013, Exxon Mobil is in the process of building a massive shale oil project in New Mexico's Chihuahuan Desert. The company's executives have boasted that the venture will allow Exxon Mobil to ride out the industry's notorious boom-and-bust cycles.

Its expansion comes as smaller independent producers are slowing exploration. They're also cutting staff and budgets amid investor pressure to control spending and boost returns.

Exxon operates 48 rigs in the region and plans to add seven more this year, according to research firm Drillinginfo Inc. Exxon Chief Executive Darren Woods said on March 6 that when it comes to shale, the company would change "the way that game is played." Exxon said, in its most recent earnings report on Feb. 1 that its output in the Permian Basin rose 90% from over a year ago.

The company's size and lines of business could allow Exxon to earn double-digit percentage returns in the Permian even if oil prices crashed to below $35, added Senior Vice President Neil Chapman. Shares are up 18.7% since the start of the year. They closed last night at $80.96.

3. Occidental Petroleum: Emergent Heavy Hitter in U.S. Oil Export Boom

Occidental Petroleum (NYSE:OXY) is the largest oil and gas producer in the Permian basin, which spans across western Texas and southeast New Mexico, making it a major player in the U.S. energy sector.

The company has emerged as one of the biggest exporters of U.S. shale oil, rivaling large energy trading firms such as Vitol Group and oil majors including Exxon and Chevron. It currently exports about 300,000 bpd of oil a day, roughly 10% of all U.S. crude exports.

With plans to double crude exports to 600,000 barrels per day in 2020, according to Cynthia Walker, senior vice president midstream and marketing at Occidental in March, Occidental is showing no signs of slowing down. Profits from the company's midstream and marketing segment, which includes exports, surged more than seventeen-fold to $1.9 billion in 2018, excluding items, mostly thanks to moving crude from the Permian to refining and export hubs in the Gulf Coast.

The company has the capability to send about 470,000 bpd out of the Permian via pipelines and expects to add more capacity in 2019, Chief Executive Vicki Hollub said at an industry conference last year. Occidental shares have gained about 10% so far in 2019; they closed at $67.08 yesterday.