- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Trump Influence Bank Of Canada?

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

After the Italian referendum, the forex market turned its focus to 3 monetary-policy announcements. The Reserve Bank of Australia was the first central bank to meet Monday night -- it left interest rates unchanged and offered a benign outlook for the Australian economy. While the RBA said “some slowing in the year end growth rate is likely,” it also believes that it will pick up again as further “increases in exports of resources are expected as completed projects come on line.” It expects inflation to remain low but showed no indication that rates will fall further. AUD/USD traders were initially disappointed but shrugged off the rate decision in the European and North American sessions. At the end of the day, it is important to remember that Australia offers one of the highest yields among G10 nations and has no immediate plans to ease again. Third-quarter GDP numbers were scheduled for release Tuesday evening and we expect growth to accelerate, reinforcing the RBA’s outlook for Australia’s economy.

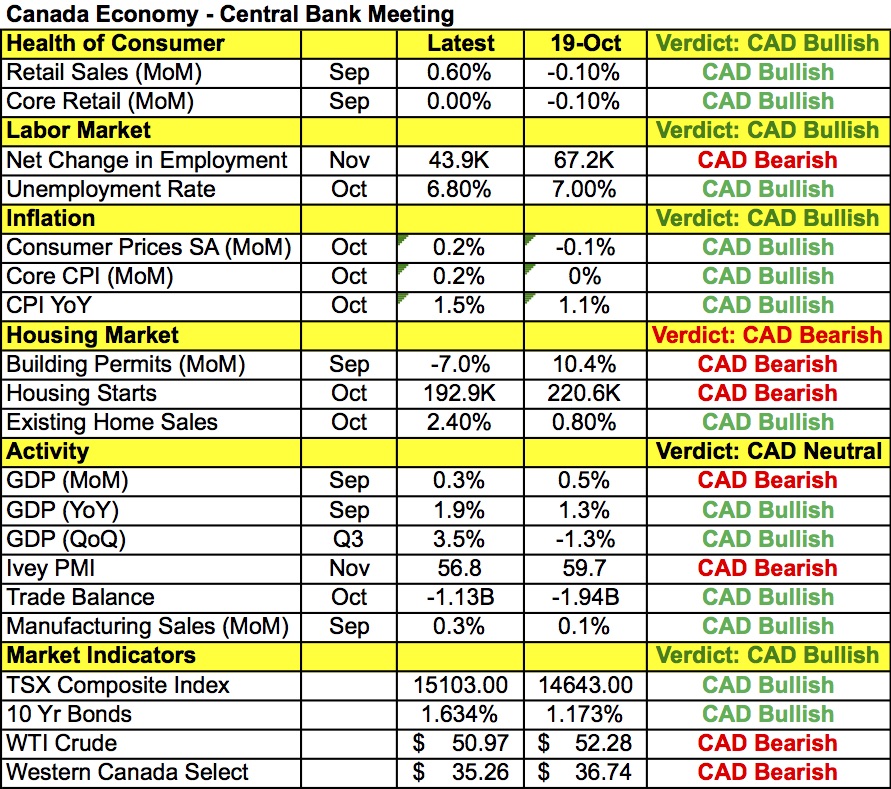

Wednesday's focus shifts to the Bank of Canada monetary-policy decision and its impact on the Canadian dollar. No changes are expected but the BoC’s tone will affect how the loonie trades. Although Tuesday morning’s economic reports were mixed with the trade deficit narrowing sharply, manufacturing activity slowed. According to the table below there’s still enough positive improvements in Canada’s economy to keep the central bank optimistic. Oil prices have bottomed after falling sharply in November, retail sales turned positive, the unemployment rate declined and most importantly, price pressures are on the rise. Year over year, CPI growth jumped to 1.5% from 1.1% in October, prompting Bank of Canada Governor Poloz to say he expects inflation to return to target by mid 2017. The Bank of Canada is not looking to change interest rates with policymakers recently saying that the economy would need to perform significantly different from their forecasts for rates to be cut again. The biggest risk for Canada is Donald Trump and his campaign promise to overhaul the North American Free Trade Agreement (NAFTA). His goal is to provide better trade terms to U.S. businesses at the expense of Canada. With 76% of Canadian exports destined for the U.S., the possible abandonment of NAFTA by the U.S. poses major risks for Canada’s economy. However if Trump’s recent track record is of any value, he’s likely to soften his views and settle for more nominal changes. There have also been a number of adjustments to NAFTA through the years and Canada’s economy has survived. So with that in mind, Governor Poloz has the choice of tabling the NAFTA issue for the time being, focusing on current developments (because they don’t know exactly what changes will be made and how long that will take) or incorporate the risk into their outlook. We believe they’ll opt to focus on the facts rather than the unknown and maintain an upbeat outlook that should be CAD positive.

It was a relatively quiet day for the U.S. dollar with the greenback trading slightly higher against most of the major currencies. Tuesday morning’s U.S. economic reports were mixed with a larger trade deficit offset by stronger durable goods and factory orders. With no major U.S. data on the calendar this week, the dollar is at risk of a deeper correction. The upward momentum in U.S. yields is waning and we would not be surprised if USD/JPY made another run for 113. Currencies in general should take their cue from global developments, including the outcome of the ECB, BoC meeting and the Australian GDP report. After Donald Trump’s tweets on China’s currency, there was some talk of China retaliating with a further yuan devaluation. Those rumors were baseless as no changes were made. If U.S.-Chinese relations become further strained under the Trump presidency, we could see a more significant impact on currencies.

EUR/USD took a nose dive below 1.0700 during Tuesday's North American trading session. The latest Eurozone economic reports were better than expected with third-quarter annualized GDP growth revised up to 1.7% from 1.6% but profit taking and the possibility of further ECB easing this week sent euro tumbling. German industrial production numbers are due on Wednesday and the upside surprise in factory orders points to a stronger report. While EUR/USD has pulled back sharply, we see limited downside ahead of the ECB. Some economists believe the ECB will ease further but central bank President Draghi has taken every opportunity to highlight the improvements in the Eurozone economy. The market damage from Italy’s referendum was also minimal, reducing pressure on the central bank to take further action.

Like the euro, sterling traded lower versus the U.S. dollar breaking 1.27 in the process. No economic reports were scheduled Tuesday but BoE FPC minutes were released and they confirmed the collection of previously released, post-Brexit data that showed the U.K. economy as a whole remains resilient and stable in light of political uncertainty. U.K. industrial production numbers are due on Wednesday and the lower manufacturing PMI report points to a softer release.

Related Articles

The dollar’s rebound faces a key test as traders assess Fed expectations, geopolitics, and slowing spending. With inflation cooling and rate-cut bets rising, markets eye jobs...

As markets assess the implications of the Zelenskyy-Trump clash on Friday, the focus today is whether US tariffs on Mexico and Canada will go ahead. The FX market is not pricing...

In response to criticism of tariff 'confusion', President Trump stepped in emphatically yesterday to announce that tariffs would be going ahead on Canada, Mexico, and China next...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.