During the year, NVIDIA Corporation's (NASDAQ:NVDA) stock gained 163% in value to its shareholders. Despite the hefty market pullback on August 7th when Nvidia shares dropped to $98, the stock recovered and gained its mid-July range, now priced at $128 per share.

At 4.29% of Nvidia shares held by all insiders, CEO Jen Hsun (“Jensen”) Huang sold around $1.4 billion worth of NVDA shares since 2020. The bulk of sales concentrated during this summer at over $500 million.

Alongside Jensen, insider sales amounted to 7.2 million shares over the last six months against the 1.3 million NVDA shares bought, giving a lopsided insider sale-to-purchase ratio of 5.5. Given strong recession signals going into 2025, should investors expect further selloffs after Nvidia’s next earnings report on August 28th?

Or would another market pullback constitute a similar “buy the dip” opportunity?

Nvidia’s Next Earnings Expectations

Over the last six quarters, Nvidia has consecutively beat earnings per share (EPS) expectations, with the quarter ending April beaten by a positive surprise of 13.73%, or $0.51 forecasted vs. $0.58 EPS reported.

For the fiscal quarter ending July 2024, which is scheduled to be reported on August 28th, Zacks Investment Research places an EPS consensus of $0.59 based on 13 analyst forecast inputs. In the prior quarter, Nvidia gave an outlook of $28 billion in revenue (+/- 2%) from Q1’s $22.6 billion, which itself tracked a 427% year-over-year growth.

In other words, Nvidia is the primary beneficiary of generative AI infrastructure demand and expectations. But is that likely to continue?

What about Nvidia’s Blackwell Delay?

Nvidia’s Blackwell architecture is the next step in Nvidia’s AI chip dominance. It was first unveiled at the GTC 2024 conference in March. Aimed at cost-effective training of large language models (LLMs), Blackwell chips pack 208 billion transistors using the cutting-edge 4NP (node process), courtesy of Taiwan Semiconductor Manufacturing Company (NYSE: TSM).

For AI workloads, Nvidia claims up to 25x reduced operational expenditures. For comparison, Blackwell would be 30x more efficient for LLM inference workloads against Nvidia’s H100 chips, which went into full production in September 2022. At that time, NVDA stock was priced at an incomprehensibly low point of ~$13 per share.

Suffice to say, investors expect a similar growth post-Blackwell, although it will be much subdued by Nvidia’s over-$1 trillion market weight. In early August, Microsoft (NASDAQ:MSFT) insiders leaked to The Information that chip-on-wafer-on-substrate (CoWoS) packaging complexities will lead to Blackwell shipments delay until Q1 2025.

However, KeyBanc Capital Markets equity researcher John Vinh noted that Blackwell delay will be neutralized by the remaining Hopper (H100 and H200 series) backlog.

“There’s going to be no near-term impact on that Blackwell delay in terms of their Q2 results and Q3 guidance. Blackwell was originally only going to start ramping maybe towards the end of the July quarter.”

John Vinh to Yahoo Finance’s Market Domination

But as Hopper backlog clears up by the end of the year, and Blackwell chips ramp up in the second half of 2025, investors should expect less impressive quarterly reports in that interim period.

What about AMD and Intel?

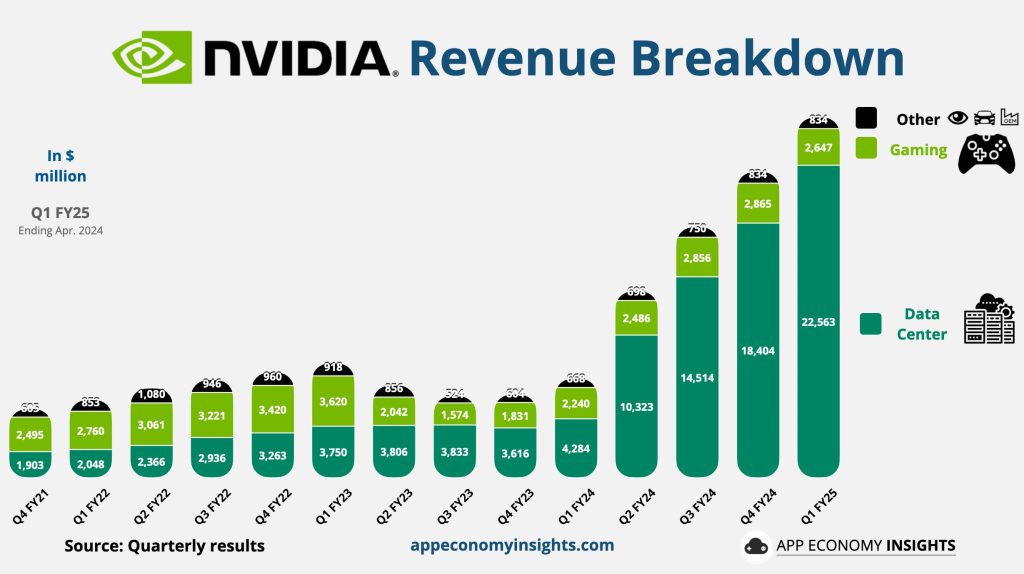

Since fiscal Q4 2023, Nvidia outgrew its origin story. The company firmly and rapidly transitioned from a video gaming GPU company to data center supplier company. While Nvidia’s gaming revenue is not much different from Q1 FY2022 level, its data center division ballooned by 6x.

Image credit: AppEconomyInsights

Relative to its competitors within the semiconductor sector, Nvidia holds 34.84% market share leaving behind AMD at 9.78%, Broadcom (NASDAQ: NASDAQ:AVGO) at 18.61% and Intel (NASDAQ:INTC) at 24% market share. Within the global GPU market, Nvidia holds near total dominance at 88% vs Advanced Micro Devices Inc's (NASDAQ:AMD) 12%, according to Jon Peddie AIB shipments data for Q1 2024.

Nvidia accomplished these market dominance feats by tethering its hardware to a full-stack software ecosystem. For machine learning specifically, the company optimized numerous open-source frameworks and libraries such as TensorFlow, PyTorch, JAX, DGL, NeMo, Kaldi, and others.

In other words, Nvidia followed an established pattern of creating standards for the most streamlined developer experience. Starting with the present CUDA (Compute Unified Device Architecture) platform, this approach hails back to Nvidia PhysX, RTX (real-time ray tracing), DLSS, and G-Sync standards.

To stay ahead in the data center AI business, AMD recently made an aggressive move by acquiring ZT Systems for $4.9 billion. When it comes to Intel, Blackwell’s delay should provide the emerging foundry giant with an opportunity to expand with its cost-effective Gaudi 3 chips.

After all, both AMD and Nvidia are fabless companies reliant on TSMC capacities, while Intel engages in costly foundry buildup.

Nvidia Stock Price Forecast

Notwithstanding more market pullbacks depending on recession signals materializing, NVDA stock is still a highly sought equity. According to Nasdaq forecasting data based on 39 analyst inputs, the average NVDA price target is $150.29 against the present $128.47 per share.

The high estimate goes as high as $200 while the low forecast is not that far from the present price at $100 per share. According to Mordor Intelligence, the global AI infrastructure market size is forecasted to grow at a CAGR of 20.12% between 2024 and 2029.

By all indicators, it is unlikely that Nvidia’s competitors will significantly infringe on the company’s successful implementation of cutting-edge hardware within its comprehensive software framework.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.