By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

With less than 24 hours to go before the FOMC announcement, we’ve seen very little consistency in the performance of the dollar. The greenback strengthened against sterling and the commodity currencies, traded lower versus the Japanese yen and held steady against the euro and Swiss franc. While the Federal Reserve may be disappointed by Tuesday’s softer consumer spending report, the release should not alter their plans to raise interest rates in 2016. Retail sales in February declined but the downward revision in January was even weaker, which means U.S. first quarter GDP growth could be less than 1%, especially with the trade balance widening in January. The year is off to a soft start but the improvement in the labor market, easing of financial conditions and rise in commodity prices signals a brighter outlook that should keep the Fed on track to normalize monetary policy. Their greatest fear is that by raising rates too slowly, they will eventually find themselves behind the curve on inflation leading to the risk of asset bubbles. With oil prices up 12% since the last meeting and 38% from its February lows, rising inflation will most certainly be on the central bank’s mind.

Aside from the Fed’s decision on interest rates, there are 3 other things that could affect how the dollar trades:

- Fed’s Dot Plot Forecast

- Latest Economic Projections

- Janet Yellen’s Forward Guidance

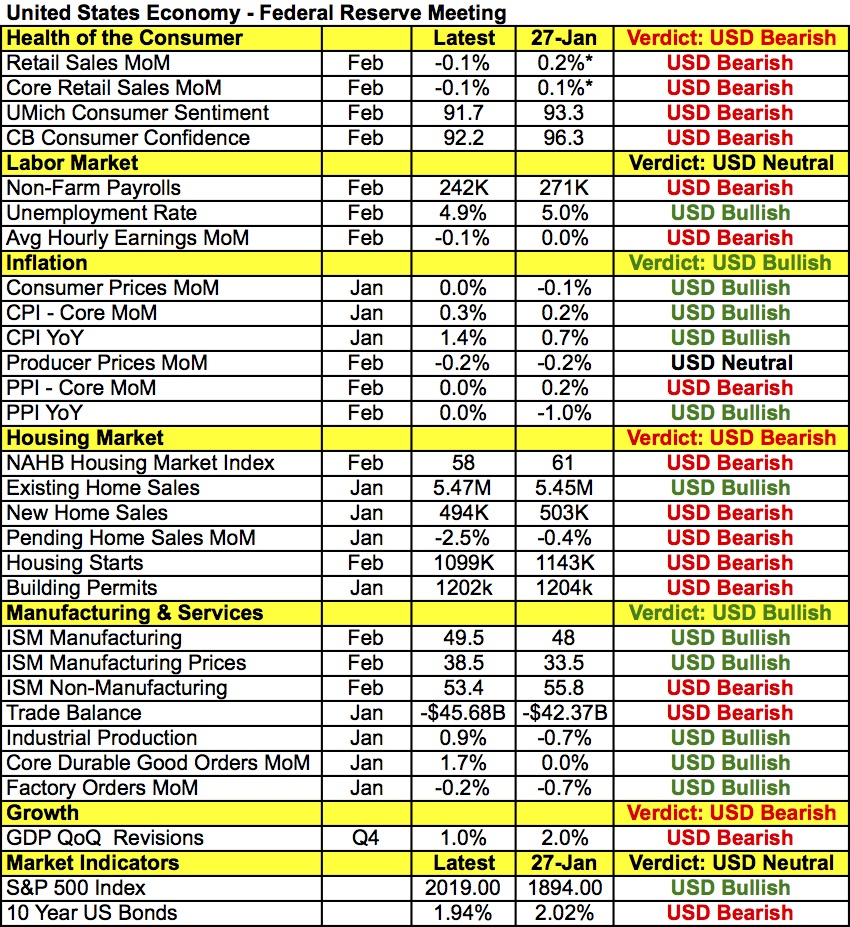

One of the most highly anticipated releases will be the Fed’s “dot plot” forecast for interest rates. Back in December, when the forecast was last released, policymakers were looking for 4 rate hikes in 2016. According to the Fed Fund futures, the market is currently pricing in a 79% chance of 1 rate hike this year – so clearly there is a major misalignment between the market and the Fed’s expectations. There’s no question that the dot-plot forecast will be revised to account for less tightening but will the majority of policy makers look for 1, 2 or 3 rate hikes this year? If the Fed is still anticipating 3 more rate hikes in 2016, the dollar will soar as investors rush to price in tightening in June. However, if the forecast is lowered to 1 rate hike, matching the market’s expectations, we expect the dollar to fall sharply as this suggests that the central bank is more worried about growth than inflation. Chances are the dot plot will indicate 2 rate hikes, which will probably lead to a quick but short-lived decline in the greenback. The economic projections are also important but they will have less impact on the dollar. Many central banks have lowered their inflation projections but according to the table below, consumer and producer price pressures improved since the last meeting. We don’t expect any major revisions to their projections at this time as the Fed waits to see if the improvements last.

Janet Yellen’s forward guidance, on the other hand, will be extremely market moving. Back in December Yellen spent the large part of her press conference expressing confidence in the U.S. economy and the ability of inflation to return to 2% once transitory factors fade. But in January, every change to the FOMC statement reflected more concern about inflation. The central bank was particularly worried about the decline in oil prices and global equities. Fast forward 7 weeks and Yellen should be smiling about the strong recovery in commodities and stocks. Her optimism about the economy and the transitory decline in inflation have been validated so chances are she will maintain her positive outlook and view that rates will rise this year. So in a nutshell, we expect the Fed announcement to help more than hurt the dollar.

The following table shows the areas of improvement and deterioration in the U.S. economy since the January FOMC meeting:

Meanwhile the Japanese yen soared after Monday night’s monetary policy announcement. While no one anticipated a change in policy from the Bank of Japan, many investors were looking for dovish comments that would set the stage for easing in the next few months. BoJ Governor Kuroda acknowledged the deterioration in inflation and weakness in exports but also noted the improvement in the labor market and record-breaking corporate profits. He did not rule out additional easing – in fact he said the BoJ will take appropriate steps if needed with 3 dimensions of potential changes – quantity, quality and rates. Yet they want more time to see how negative rates impact the economy before taking additional action and they are probably hoping that some of the upside momentum in the yen will be relieved by the Fed. Looking ahead, we continue to believe that the yen should be trading lower and view the latest decline as an opportunity to buy at lower levels.

The worst-performing currency Tuesday was the New Zealand dollar. The combination of lower commodity prices and the drop in dairy prices weighed heavily on the currency. The weakness was not limited to NZD alone – the Canadian and Australian dollars also experienced significant losses. There are definitely signs of a top in commodity prices and commodity currencies. Iran’s refusal to freeze production sparked the decline in oil and the Canadian dollar while the Australian dollar has been pressured by lower gold and copper prices. The Reserve Bank of Australia also released the minutes from its last monetary policy meeting. AUD dropped on the release because despite the RBA’s optimism about the labor market and non-mining sector, concerns about the slowdown in China remain. The central bank also felt that low inflation would provide scope to ease policy further, which indicates that they maintain a dovish bias. New Zealand current account numbers are scheduled for release tonight followed by the weekly oil-inventory data on Wednesday.

Tuesday's second-worst performer was the British pound. Brexit fears have returned with the U.K. Telegraph releasing a poll that said 52% of voters support leaving the European Union. While the Telegraph is a conservative, pro-Brexit paper and according to our colleague Boris Schlossberg, “the poll was conducted by telephone, which suggests that it was likely to contain a disproportionate number of older voter who favor the Leave vote and therefore may have been skewed, the fact that the Brexit issue effectively remains a toss up in UK politics is worry enough for the market to keep cable under pressure for the time being.” U.K. employment numbers are scheduled for release Wednesday and based on the PMIs, labor-market conditions weakened in the service, manufacturing and construction sectors. Softer numbers could take GBP/USD down to 1.4000.

Interestingly enough, the euro saw the least amount of volatility on Tuesday. The currency remains firm above its 1.1050 support level and at this stage, the next move for EUR/USD will be determined by the FOMC announcement.