Over the course of the 15-year bull market, investors have seen important pockets of leadership emerge.

And, as we have highlighted several times, leadership has come in large part due to tech stocks and, more specifically, semiconductor stocks.

Today, we highlight a pattern that could be pointing to weakness in leadership.

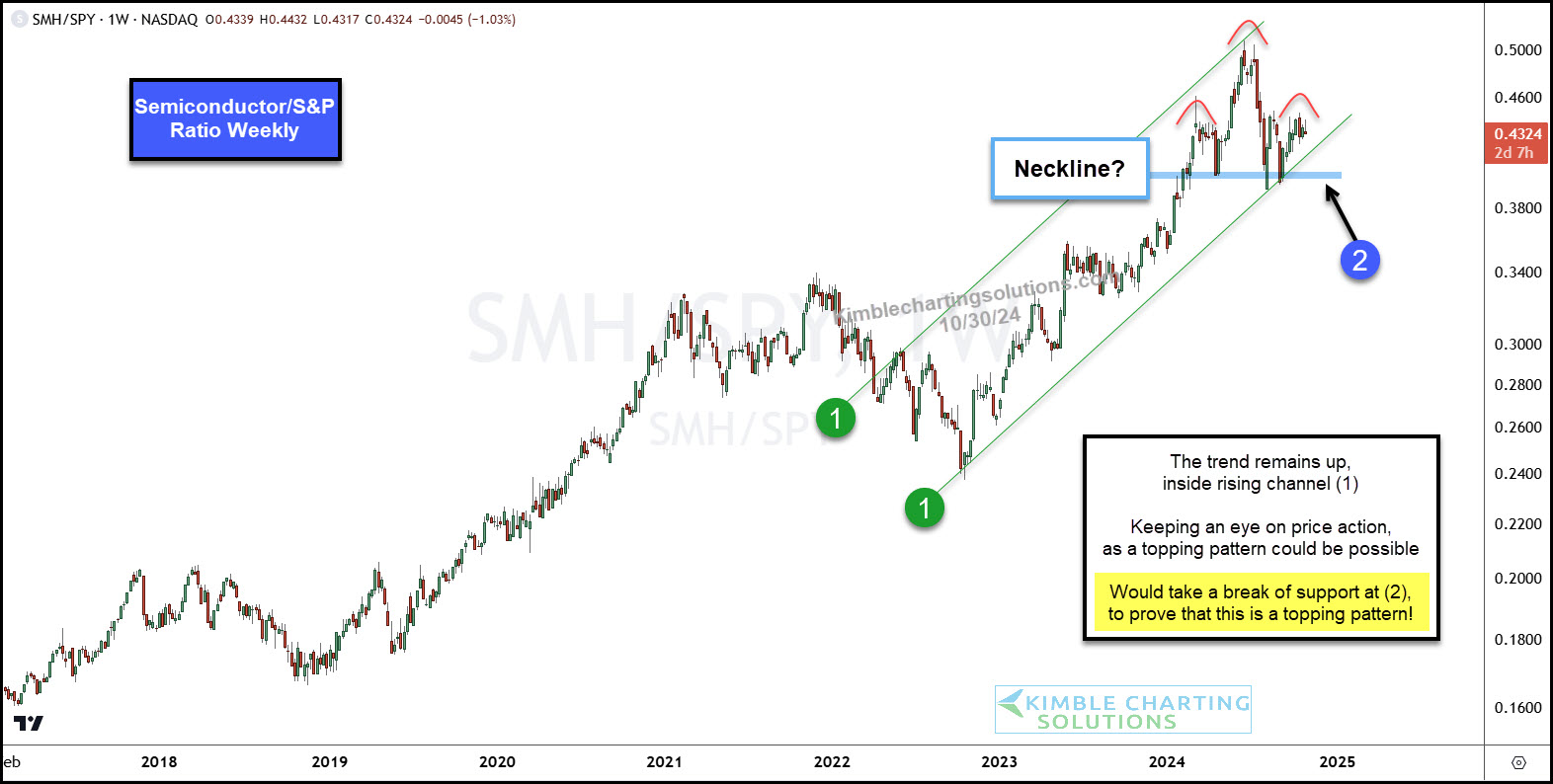

Below is a “weekly” performance ratio chart of the Semiconductors Sector ETF (NASDAQ:SMH) to the S&P 500 ETF (NYSE:SPY).

As you can see, the Semiconductors sector (SMH) has shown weakness in 2024. In fact, the ratio peaked on the first day of summer before making a lower high recently.

That weakness, however, has not led to a wholesale selloff… yet. BUT if this head and shoulders pattern continues to take shape and breaks support at (2), it would suggest that Tech leadership is taking a breather… And a bigger selloff may be afoot.

Seems like an important ratio to watch! Stay tuned!