This article was written exclusively for Investing.com

- The crypto asset class offers many investment and trading options

- The higher the market cap, the greater the liquidity

- Monero: around since 2014

- Solana provides an open infrastructure

- With over 9000 tokens, liquidity is critical for success

As the two digital currencies with over 72% of the asset class’s market cap Bitcoin and Ethereum get all of the press. Futures contracts for both have also helped increase their profiles. ETF products, when they arrive, will do even more.

Most investors and traders have not come close to dipping a toe into the digital currency world. However, those with the foresight to become crypto devotees early enough to get in ahead of the crowd know that in the asset class there are many diamonds in the rough—along with many more duds. The digital currency market offers thousands of choices for those willing to do the work necessary to uncover value as well as the next explosive token.

Monero and Solana are two tokens that are in the top tier of the crypto hierarchy. As with any market, those who do the homework to uncover real value have the best chance to profit. In an asset class that is barely over a decade old, there are many risks and opportunities.

Since rewards are always a function of risks, the greater an investor's knowledge, the better.

The crypto asset class offers many investment and trading options

As of Mar. 30, 9,022 digital currencies aside from Bitcoin and Ethereum make up the entire asset class. The number of new tokens coming to market rises each day. Those other 9,022 coins make up 28.8% of the market cap.

As digital currencies mature, liquidity will build. As that occurs, the number of tokens is likely to peak, then decline as many fall by the wayside because they will not build the critical mass necessary to survive.

Volume, open interest, and widespread holdings are key factors for building liquidity. A currency is a means of exchange. An illiquid means of exchange does not support efficient transactions. As the number of tokens declines, a core group of liquid instruments will foster derivative products, including futures, options, ETFs, and ETN products.

A more active swap or inter-token trading market will develop. We already see this happening with the top-tier tokens. The Coinbase IPO will continue to foster the maturation process as a well-capitalized exchange platform will erase memories of the Mount Gox collapse.

Creating a liquid and transparent trading environment is a critical step in the asset class’s growth.

The higher the market cap, the greater the liquidity

Liquidity is a function of the market cap in the digital currency world. Bitcoin and Ethereum have become highly liquid.

Bitcoin’s over $1.1 trillion market cap was more than five times Ethereum’s $213.4 billion market valuation at the end of last week. The liquidity quickly shrinks once we go even lower on the list.

All other tokens have market caps below the $48 billion level. Only seven are worth between $25 and $41 billion. Thirty tokens have market caps over the $4 billion level.

Monero and Solana are among the top twenty-six in the cryptocurrency hierarchy.

Monero: around since 2014

Monero is a privacy-focused cryptocurrency first released in 2014. It uses a public ledger which means anyone can send or broadcast transactions, though no outside observer can identify the source, amount, or destination. A full description of Monero is available on its website, Mymonero.

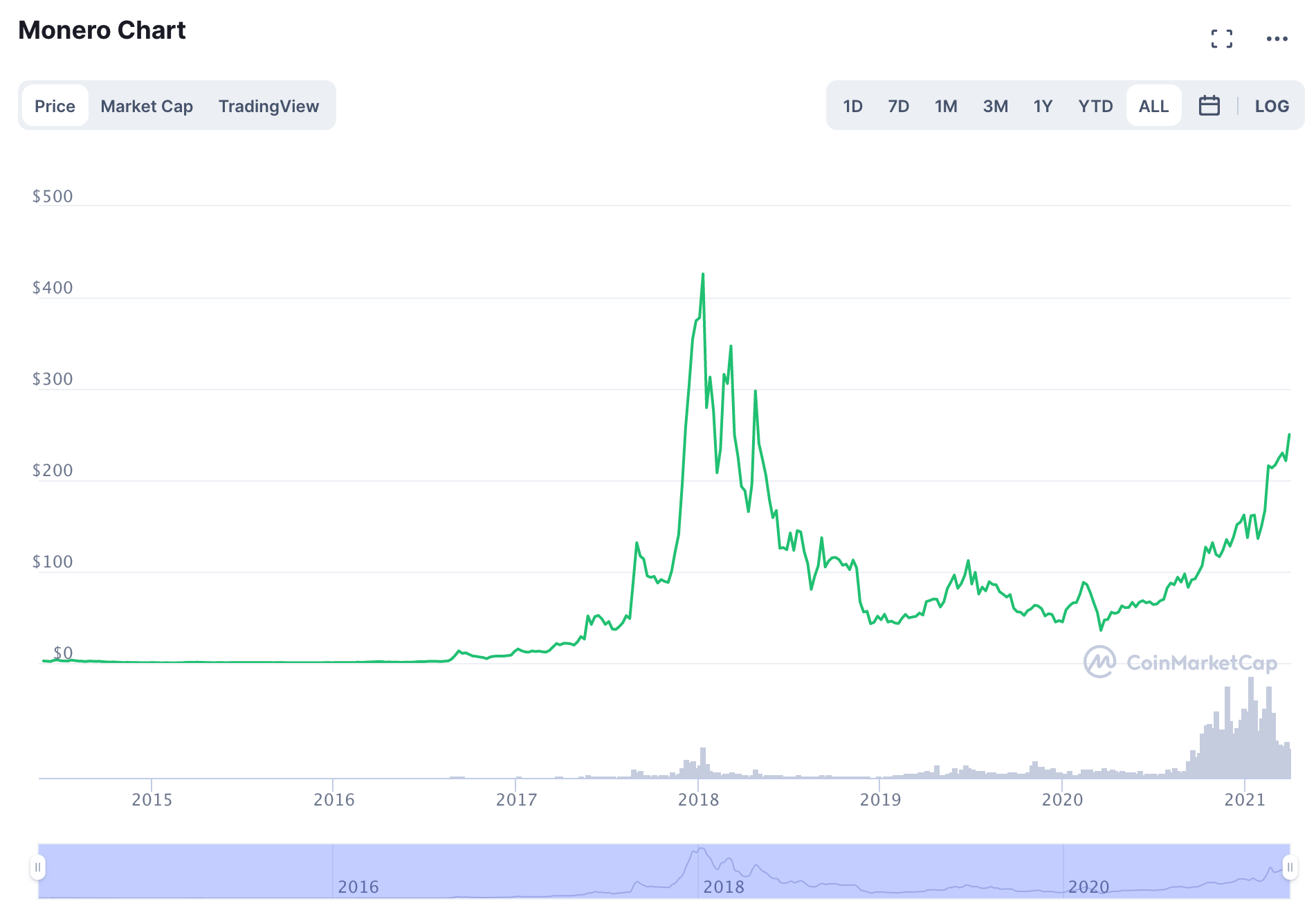

On Mar. 30, Monero’s market cap was at the $4.456 billion level, with the token trading at $249. Monero was the twenty-sixth leading cryptocurrency.

Source, all charts: CoinMarketCap

Since 2014, Monero has traded at a low of under $0.40 and a high of just below the $426 level. The low came in 2015, the high in early 2018, just after Bitcoin hit the $20,000 level for the first time.

Monero has been trending higher since hitting a low of $35.69 in mid-March 2020.

Solana: open infrastructure

Solana is a web-scale blockchain that provides fast, secure, scalable, decentralized apps and marketplaces. Solana uses a proof of stake consensus mechanism with a low entry barrier along with timestamped transactions that maximize efficiency. Solana’s website is solana.com.

On Mar. 30, Solana’s market cap was at the $5.170 billion level, with the token trading at $19.34. Solana was the twenty-second leading cryptocurrency.

Solana is a relative newcomer to the asset class. It has been trading since April 2020. The range has been from just over 50 cents to a high of $19.34 per token on Mar. 30, 2021. Solana has been trending higher since late December 2020, when the price started to rise from just below the $1.30 level.

With over 9000 tokens, liquidity is critical for success

Liquidity is crucial for survival in the cryptocurrency asset class. Only forty-one tokens, or under 0.46%, have market caps above the $3 billion market cap level. Fifty-five, or 0.61%, are above the $2 billion level.

Both Monero and Solana are top-tier digital currencies. While their current rankings are not guaranteeing success, they still stand a far better chance of survival than the thousands of other tokens floating around in cyberspace.

The number of new entrants continues to rise. The rankings move up and down daily. Eventually, liquidity will cull the herd as the asset class matures.

Trading or investing in cryptocurrencies requires study and a bit of luck. More knowledge will improve an investor's chances of success. One of the first things to look for is liquidity. The changes in market cap will tell you if a token has the potential to build critical mass or if it is falling off the market’s radar.