Canadian Club:

In yesterday’s Daily Market Update, we took a look at trading the Bank of Canada interest rate decision in the wake of elections, which saw the Liberal’s Justin Trudeau sweep to victory.

Our thinking was that with a new government coming in with a mandate of implementing a wide range of fiscal stimulus measures, Poloz and the Bank of Canada may have some of the work done for them in the coming months and that cutting rates again might not be the ideal situation to play for.

“CAD Overnight Rate on hold at 0.50% as expected”

So while the BoC left interest rates unchanged, they did however cut their economic forecast for GDP over the next 2 years.

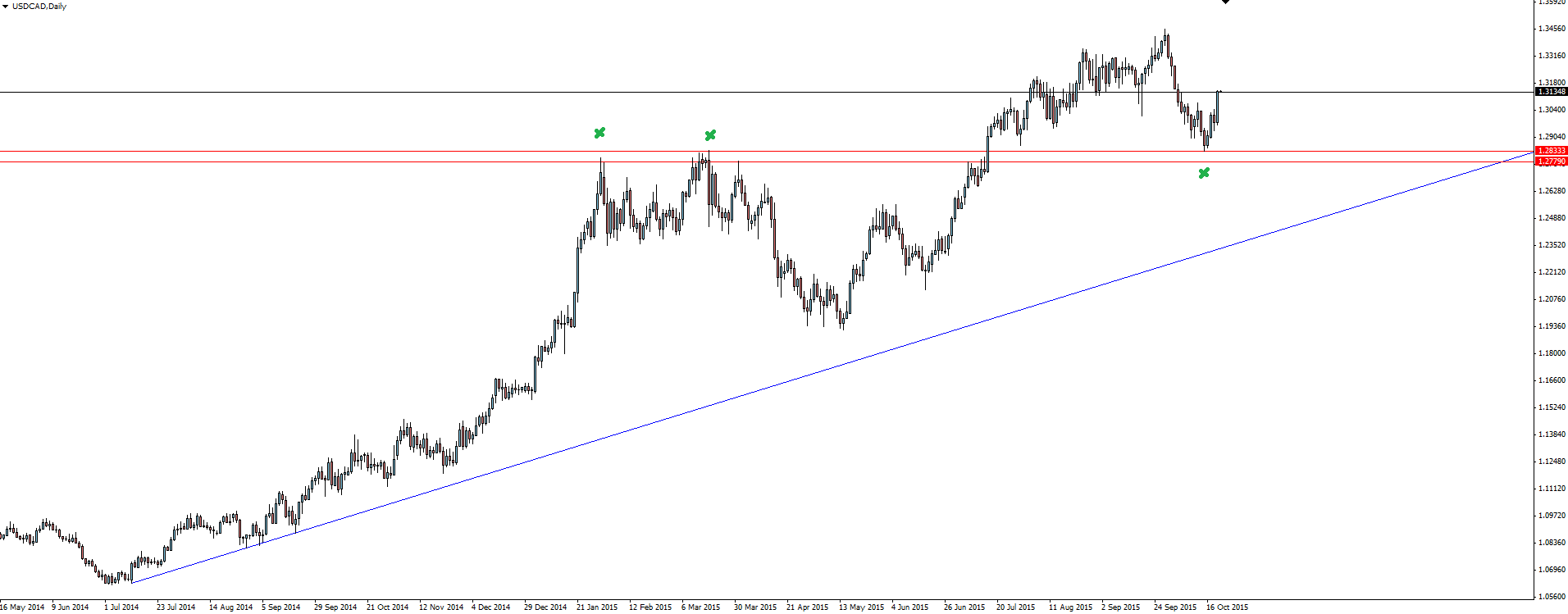

USD/CAD Daily:

Click on chart to see a larger view.

The dovish tone accompanying the downgrades in the BoC Monetary Policy Report gave the Canadian dollar a slap and caused USD/CAD to continue to rip out of the support/resistance zone we have been watching.

“Lower prices for oil and other commodities since the summer have further lowered Canada’s terms of trade and are dampening business investment and exports in the resource sector.”

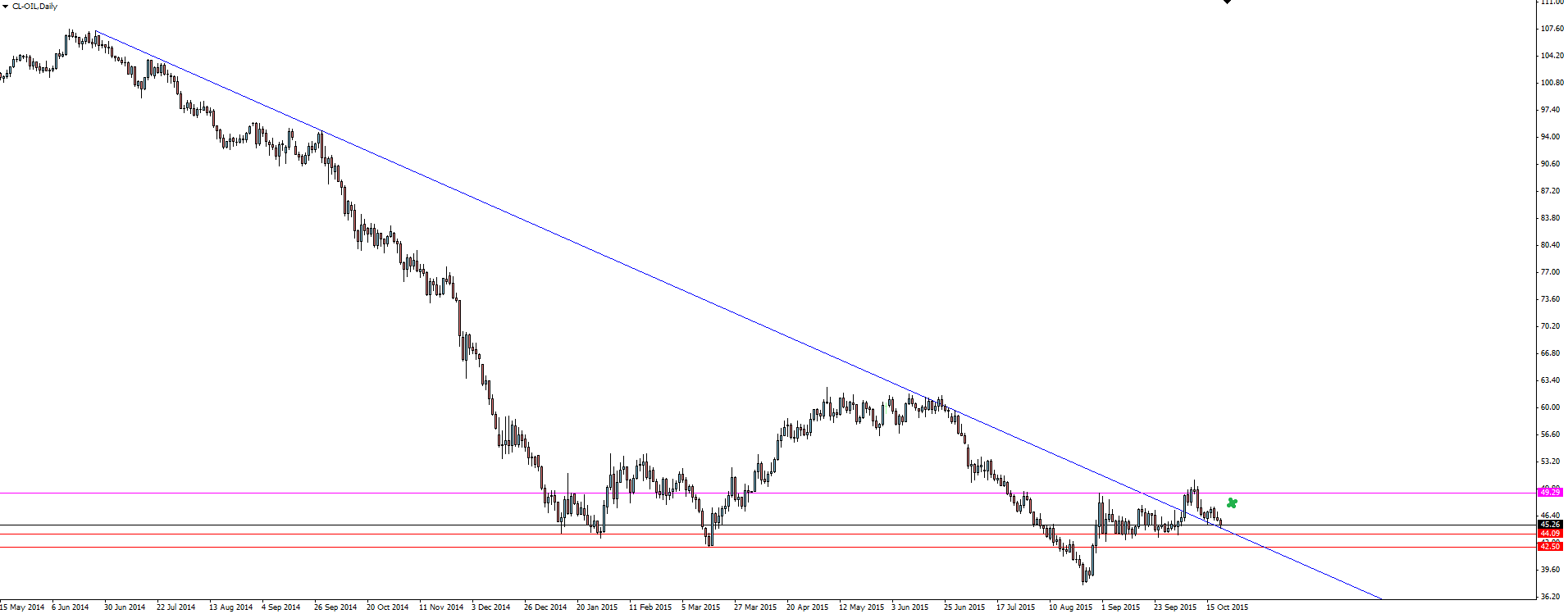

Oil Daily:

Click on chart to see a larger view.

With the price of oil continuing to tumble, the largely reliant Canadian export economy has naturally taken a hit. Poloz warned that the effects of this ‘two stream economy’ wont be going away any time soon, and that we need to be patient in letting past interest rate cuts trickle through the economy.

Trudeau’s honeymoon might not last long by the sound of it, so it will be interesting to watch what his government can do from a fiscal point of view to spur fresh growth.

Upcoming ECB Meeting

Tonight, we cap off the week’s major central bank event risk with an interest rate decision and press conference from our favourite central banker, Mr. Mario Draghi of the European Central Bank.

General consensus from the major surveyed banks is an expectation that the ECB will further ease policy in the near term. European QE is not finished yet!

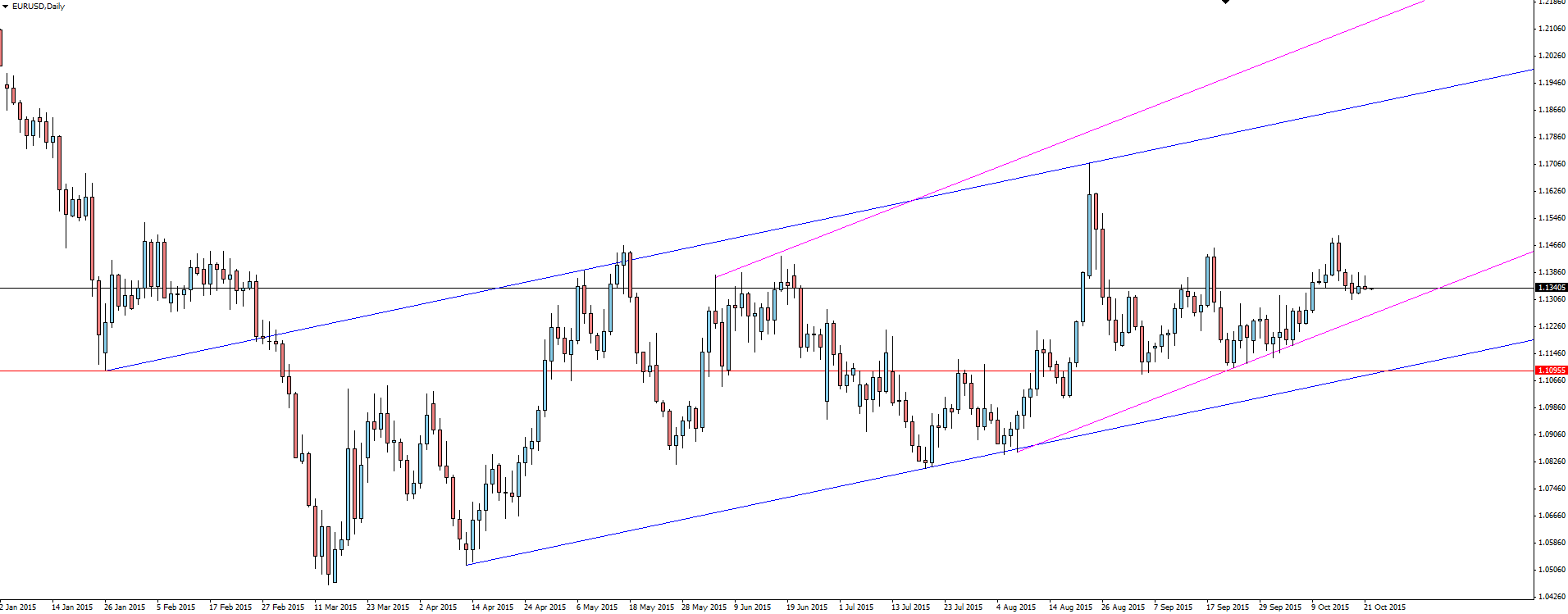

EUR/USD Daily:

Click on chart to see a larger view.

Just be aware that a dovish Draghi is the outcome that is most widely expected. This is always dangerous when it comes to trying to get on board a trade late and with price still in the middle of its longer term channels, just make sure you are managing your risk intelligently.

On the Calendar Thursday:

AUD NAB Quarterly Business Confidence

GBP Retail Sales m/m

EUR Minimum Bid Rate

CAD Core Retail Sales m/m

EUR ECB Press Conference

USD Unemployment Claims

Chart of the Day:

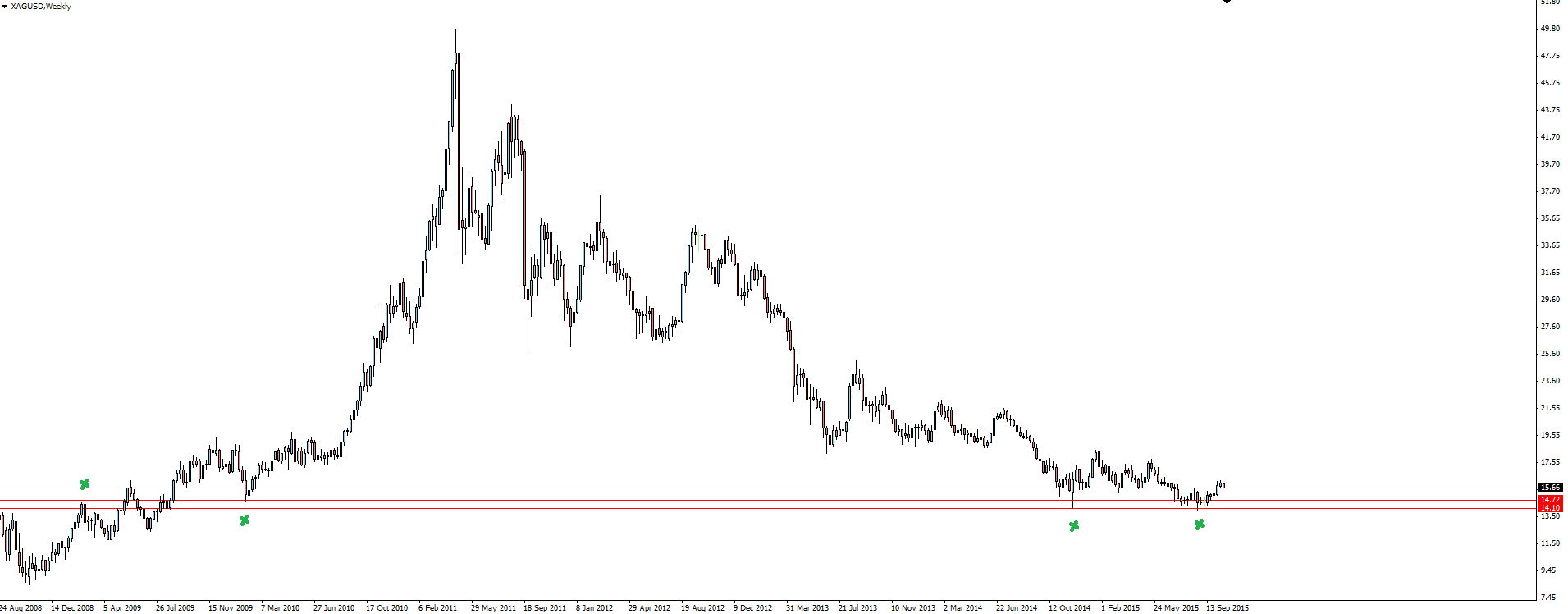

We spend a bit of time going over the gold chart and I often get asked what about silver? Silver trading respects major technical levels just as well, highlighted by one weekly support resistance zone that we are going to take a look at today.

Silver Weekly:

Click on chart to see a larger view.

The marked support resistance zone has been touched multiple times both on the way up and down. Price has most recently rallied out of the level, but is still in a huge bearish trend from the 2010 highs.

Your trading plan of attack here would be to decide if you want to go with the overall trend or if you want to use the weekly support level to manage your risk around, and play for a change of trend.

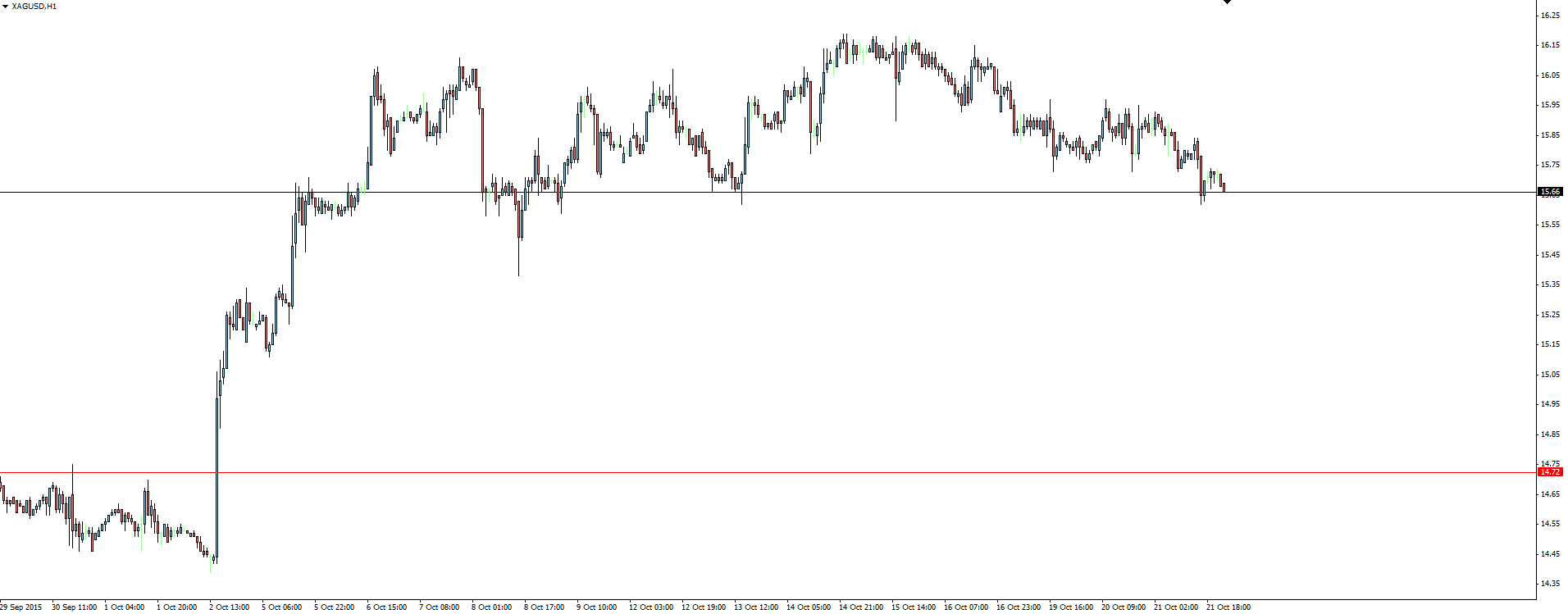

Silver Hourly:

I’ve included the hourly chart just so you can see the sort of pops that can come about while trading silver. The hourly chart shows the top of the support/resistance zone and then the huge, momentum rally that we got out of the level.

Is this your last chance to get long at these prices or are you going with the trend?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a no dealing desk forex trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.