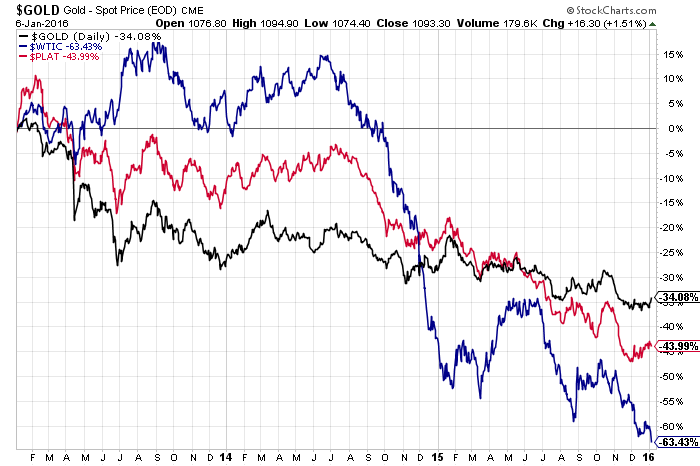

We can see from the 3-Year Daily comparison chart below that, for the most part, Gold, Platinum and WTI Crude Oil have traded in tandem, although Oil has seen far more volatile swings.

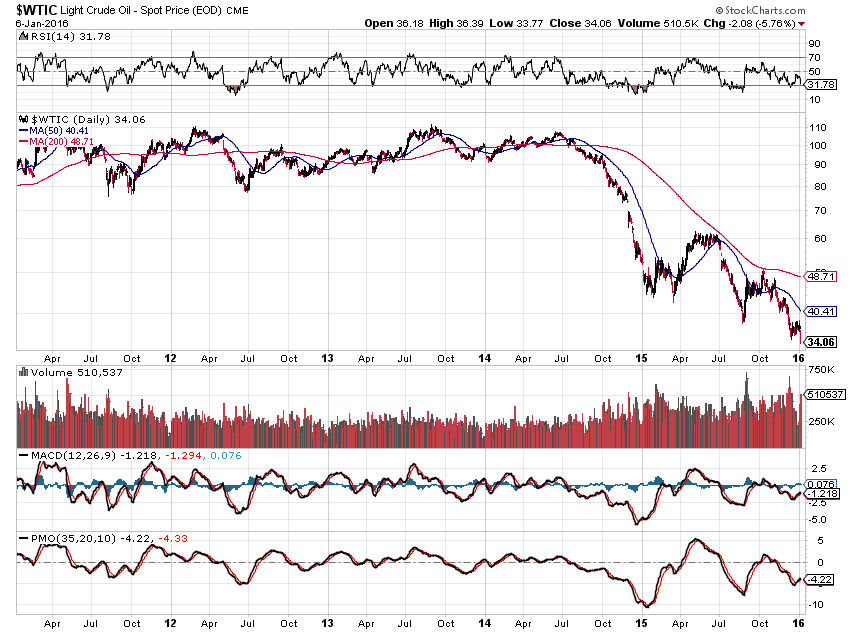

Since December of last year, Gold and Platinum have attempted to stabilize and rally from their 3-year lows while Oil's attempted rally was very short-lived, and price continues to plummet to new lows...we'll see if yesterday's (Wednesday's) volume spike signals capitulation, or not, as shown on the next chart (5-Year Daily).

Watch for bearish crossovers to occur on the MACD and PMO, along with a lower low on the RSI, to signal further weakness on Oil. Otherwise, we may see an attempt by buyers to step in soon.

If we see a such a rally, particularly if Oil breaks above its major resistance level of 45.00, we'll see whether any serious buying continues in Gold and Platinum, and, if so, whether it is sustainable...especially if Oil breaks and holds above 50.00.