- This week’s CPI report may see another “peak” in CPI. That’s actually the good news

- The bad news is that due to easy comparisons, further peaks may be ahead – even in core inflation

- To date, Fed action has had no perceptible impact on lowering inflation

As I pointed out last week, market pricing suggests great confidence in financial markets that inflation will collapse back to the Fed’s target. Of course, market prices do not technically reflect risk-neutral expectations as much as they reflect where risk clears. However, since most market participants (certainly, anyone who is naturally long stocks and bonds and has real liabilities) are inherently short inflation risk, one would think that market prices should clear higher than arm’s length expectations.

It is hard to believe that’s the case, but in any event, I think it’s fair to say that markets are being generous about the inflation outlook as we advance. This week will see another real-time test of the thesis that inflation pressures are contained or that they aren’t running away from us.

The CPI report on Wednesday will supposedly mark the peak of y/y headline inflation… haven’t we heard that before?

The consensus estimate is for 1.1% m/m in headline inflation and +0.6% m/m in core inflation, bringing the y/y figures to 8.8% and 5.8%, respectively. The interbank market for the monthly print is actually slightly higher than that. The core number seems to be well past its peak—it was 6.0% y/y as of last month, and the peak in March was 6.47%.

I think the consensus for core CPI of 0.6% seems reasonable, given that Primary and Owners’ Equivalent Rent will still be strong. For all the hand-wringing about how home prices and rents are overdone, there is no sign of serious weakness in pricing in these markets. As Bill McBride points out in his CalculatedRisk newsletter, the apartment vacancy rate declined in Q2. There may be moderation on the horizon, but it is too early for that. We’ve also heard many predictions about the coming collapse in new and used car prices back to their old levels. That’s not going to happen, but the rate of change will slow. Still, that’s not a serious drag to this number yet. As I said, I think 0.6% on core seems reasonable.

On the other hand, the headline number of +1.1% m/m, or +1.2% if you use the interbank market, seems a little high. Gasoline was up roughly 10% m/m in June over May, which means roughly 25-35bps of premium over core. If I made monthly point forecasts, something around 0.9% or 1.0% on the headline would be my forecast.

I know that 1.1% and 0.6% sound like bad news. Unfortunately, that was the good news.

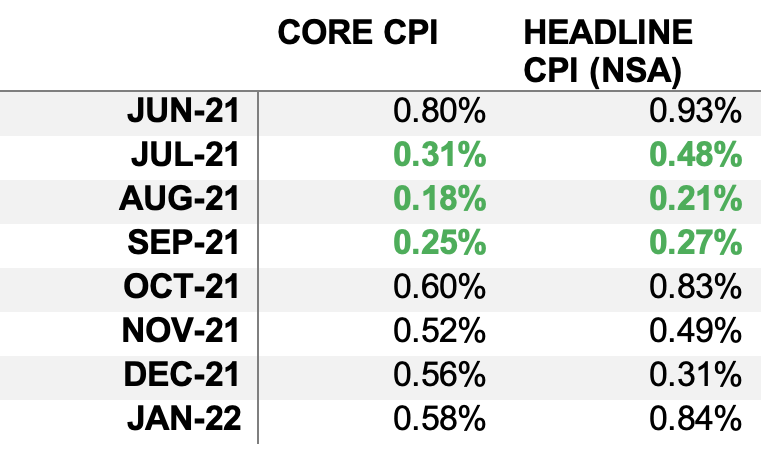

The bad news is that the favorable comparisons to 2021, which led to predictions of an inflation peak in the first place, are now behind us for a while. Here are the ‘comps’ for the next few months, starting with this month:

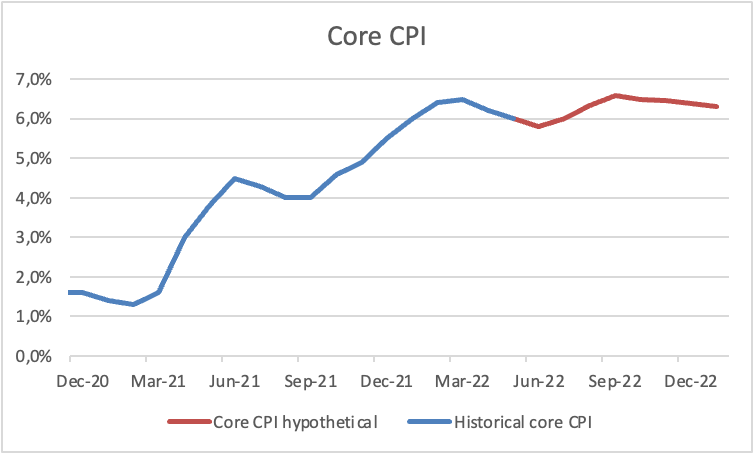

After this month’s print, the comparisons get very easy for a few months. Year-on-year resets for the next few months are about 8.45% for July, 8.37% for August, and 8.27% for September. That means the y/y figures for core and headline inflation could very easily reach new highs in the next three months. Headline inflation is already flirting with it, and unless gasoline continues to get pounded on the downside, we could get to 9% very easily. (N.b.: the derivatives market no longer thinks so. But just a few weeks ago, those were above 9%, and I think they’ve overreacted to the gasoline pullback.) The chart below shows where core CPI would be over the balance of this year if the monthly prints were 0.6% this month and 0.5% per month thereafter.

As I said, with rents doing what they are doing, this would not be an outlier outcome. The September core CPI would be at 6.6% under this scenario and would not decline appreciably after that.

Let me point out that this is consonant with what Median CPI has been saying. That index has been regularly hitting new m/m highs since January 2021. Last month, it was +0.58%, the highest since 1983. And unlike core or headline CPI, which occasionally jumps around because of some idiosyncratic element in a given month, this is far more unusual for Median CPI (see chart, source FRB Cleveland via Bloomberg). The point is that there is as yet no sign that inflation is about to decline to the comfort levels that the market is abruptly pricing once again.

Taking a Step Back…

I think there are two reasons that the market seems eager to discount a return to “the way it used to be” in inflation.

- We want to believe that the rate pain we are experiencing, as a result of aggressive Fed rate hikes and modestly declining liquidity, will have the intended effect. And, if possible, sooner rather than later and with less pain rather than more.

- Many people hold badly misinformed views about the cause of this inflation.

On the latter point, I have two illustrative anecdotes. The first is a personal anecdote: I met a fellow last week who (upon hearing that I was the Inflation Guy – evidently, I am not yet recognizable to the general public) made the statement that “this inflation is a commodity and wage inflation” with the point that it will naturally be over once the conflict in Ukraine winds down and the labor market adjusts. Now, this fellow works for a company that is involved in the financial markets and is relatively market-savvy. But his statement–which was made in the form of a statement of an obvious fact we can all agree on–is just not right.

We know it isn’t right because this inflation didn’t happen stochastically. Many observers predicted loudly that the attempt at MMT, drastically increasing non-wage transfers to consumers with money created by Fed balance sheet expansion, would have precisely the effect we have seen.

My supporting evidence goes beyond a casual conversation with someone met by chance. There was also this from a professional economist written in a guest essay in The Economist:

“A world in which the economy recovers so quickly that inflation emerges is better than one in which recovery drags on painfully for years.”

To repeat: the inflation was not due to “the economy recovering so quickly.” It was due to the fact that the economy “recovered” as a consequence of official policy action: by squirting more money to consumers than they would have had if there had been no COVID, by creating this money via QE, and by continuing this policy even when it was obvious that the crisis was over and that personal income was already outstripping potential GDP.

If we are to avoid this problem again, it is important that we not labor under the delusion that “no one could have seen this coming.” And as central banks move forward with policy actions intended to squelch inflation, it is important that we evaluate their actual progress. To date, there has been no evident progress in bringing down inflation, which admittedly should lag policy action. In my mind, the market is far ahead in thinking that success is assured and near at hand.

***

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs that may be mentioned from time to time in this column.