- Warren Buffett is known as the Oracle of Omaha and is one of the most successful investors in history

- Buffett’s Berkshire Hathaway has consistently outperformed the S&P 500 in almost every year since 1965

- Using the InvestingPro stock screener, I will highlight five companies that are worth adding to your portfolio if you want to invest following Buffett’s advice

- Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

Warren Buffett offers several tips for investing, including identifying companies with a competitive advantage, investing in what you know, buying for the long-term, and not overpaying for a company. I presented an Investing.com webinar earlier this week in which I provided a complete breakdown of Buffett’s investing principles and what he looks for in a company before deciding to purchase shares.

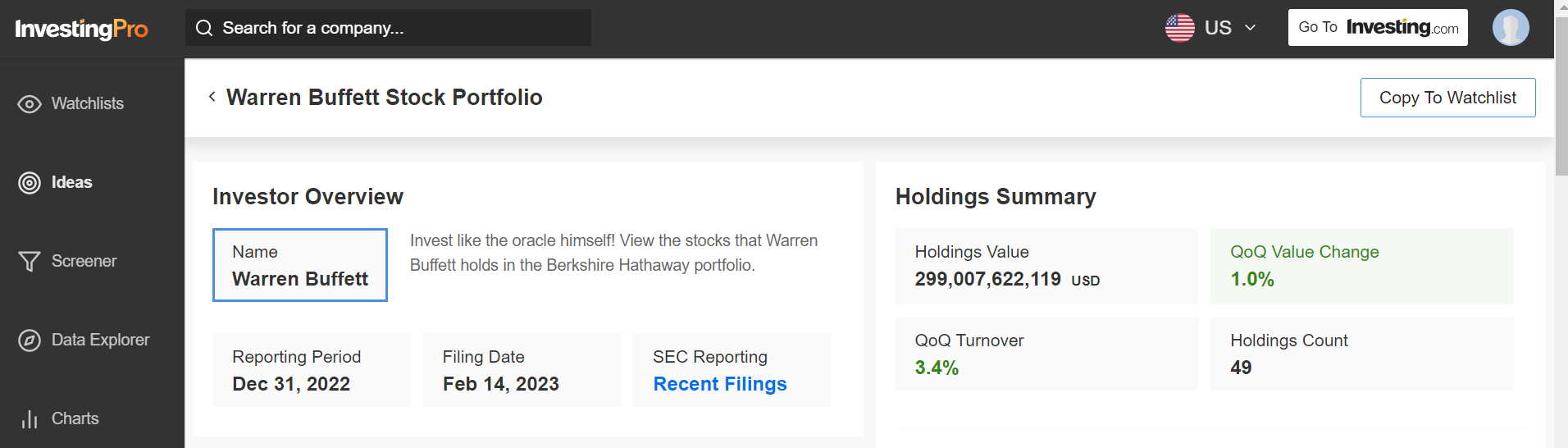

You can view all of the stocks in Buffett’s portfolio on InvestingPro. His five biggest holdings include, Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), Chevron (NYSE:CVX), Coca-Cola (NYSE:KO), and American Express (NYSE:AXP).

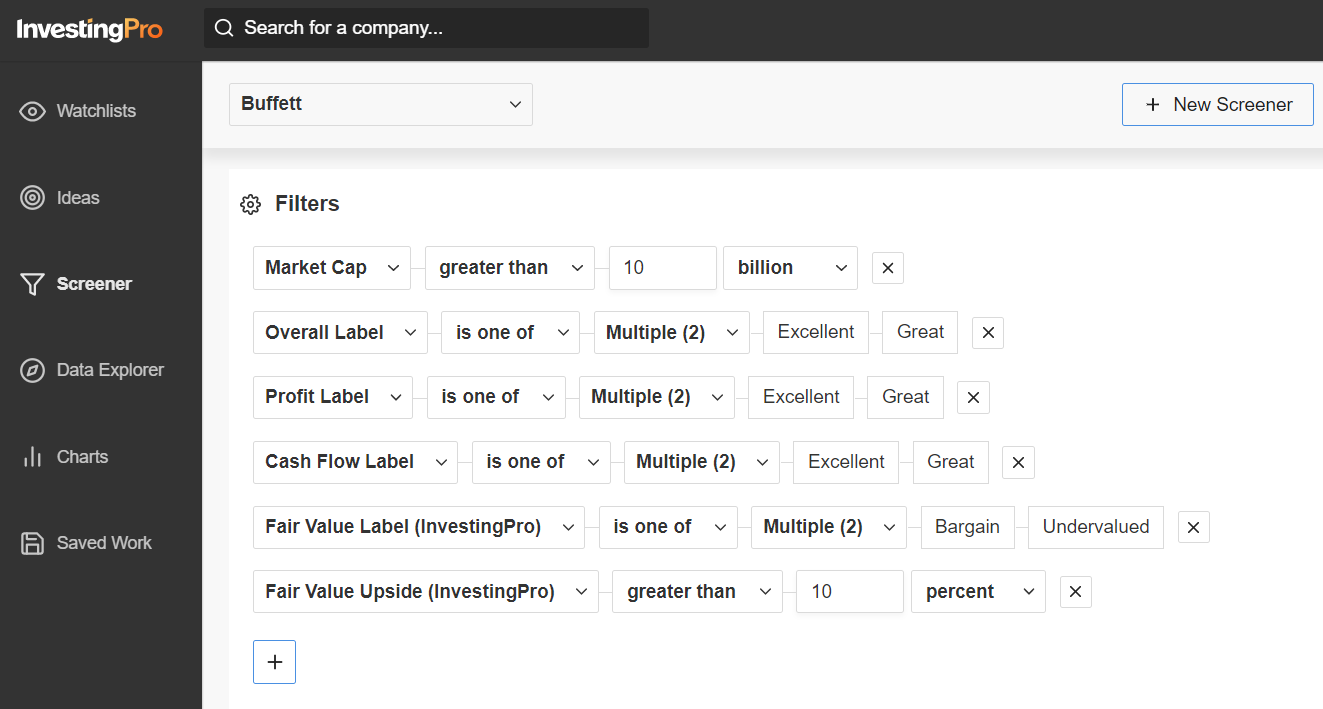

As such, using the InvestingPro stock screener, I ran a methodical approach to filter down the 7,500-plus stocks that are listed on the NYSE and Nasdaq into a small watchlist of established companies that have strong growth, solid profitability, healthy cash flows, and an attractive valuation.

My focus was on stocks with a market cap of $10 billion and above.

I then scanned for companies whose InvestingPro Financial Health label was either ‘Great’ or ‘Excellent’. The InvestingPro Financial Health benchmark is an advanced stock ranking system that considers over 100 metrics pertaining to the company's growth, profitability, cash flow, and valuation, and then compares companies against each other. The best-performing companies on these metrics are the healthiest.

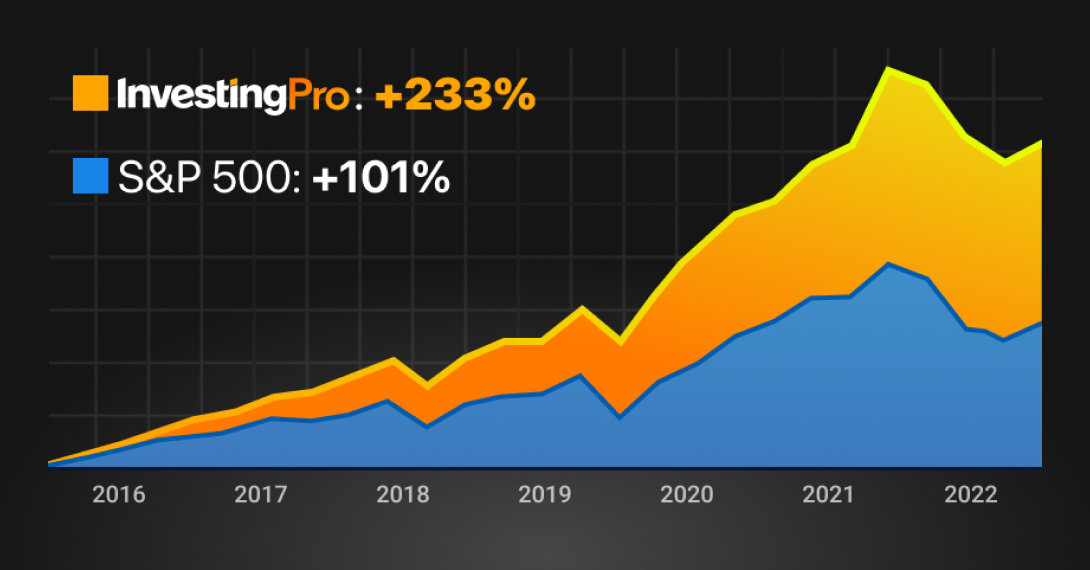

A backtest that the InvestingPro team ran on the S&P 500 since 2016 showed that companies with the highest health grades outperformed the broader market by a wide margin: 233% for the healthiest companies vs. 101% for the benchmark index through Q3 2022. That’s a 20.3% annualized return compared to 11.4% for the S&P 500 over the past seven years.

I then narrowed that down to companies with an InvestingPro Fair Value label of ‘Bargain’ or ‘Undervalued’. The grade is assigned based on the percentage upside when compared to the InvestingPro Fair Value estimate.

And those names with Fair Value upside of at least 10% made our watchlist. The estimate is determined according to several valuation models, including price-to-earnings ratios, price-to-sales ratios, and price-to-book multiples.

Once the criteria were applied, we were left with a total of 32 companies.

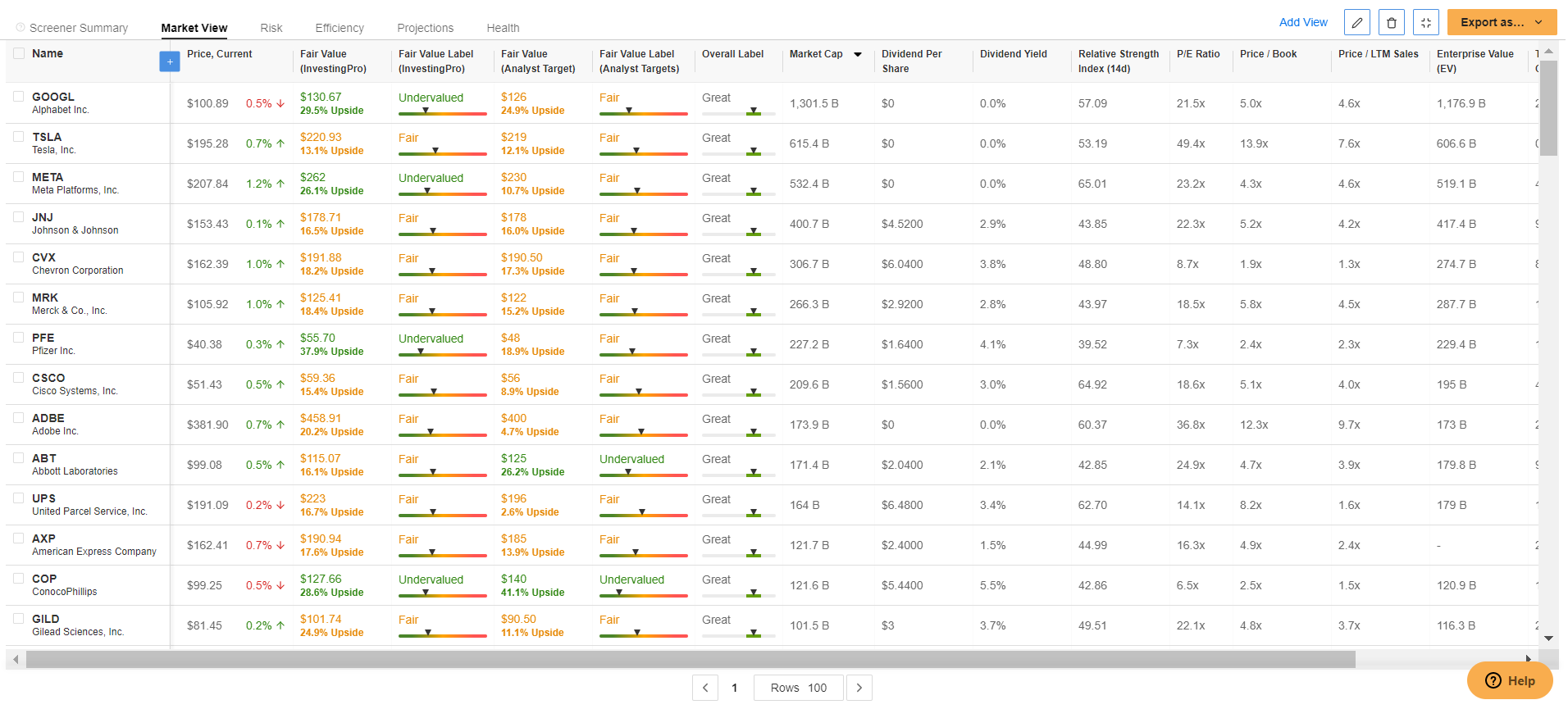

Source: InvestingPro

Here are five stocks to consider adding to your portfolio if you want to invest following Buffett’s advice.

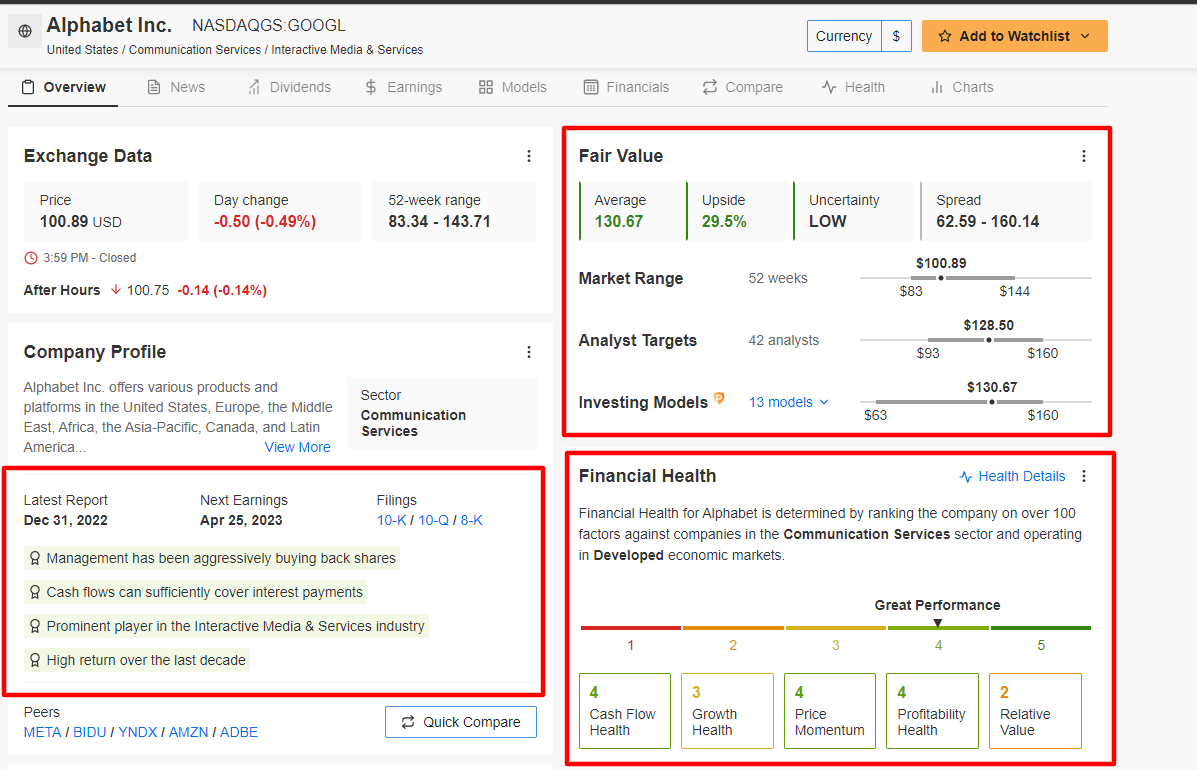

1. Alphabet

Google-parent Alphabet (NASDAQ:GOOGL) has what Warren Buffett calls a strong economic moat, which refers to companies with competitive advantages that protect them from rivals and enable them to earn outsized profits over time.

The online search giant, which is widely considered the leader in the digital adverting space, is one of the most dominant and profitable companies in the Internet media and services industry.

The Mountain View, California-based tech behemoth sports a near-perfect InvestingPro Financial Health score of 4/5 thanks to its dependently profitable business model and robust free cash flow.

Source: InvestingPro

Indeed, GOOGL stock could see an increase of around 30% in the next 12 months, according to the InvestingPro model, bringing it closer to its fair value of $130.67 per share.

Buffett has admitted in the past that he should have had better insight into Google after not buying the stock years ago because it was outside his circle of competence.

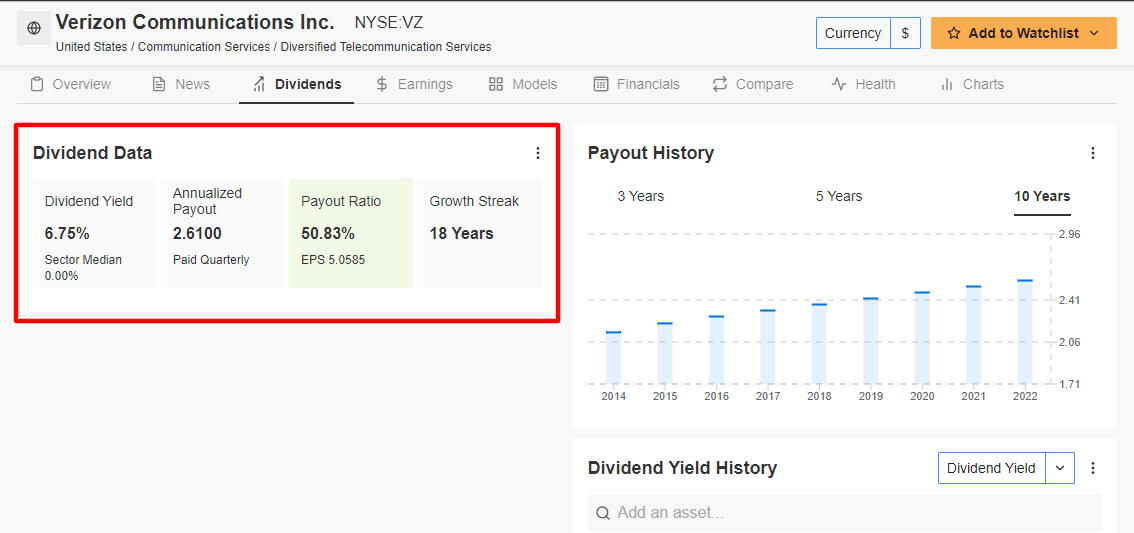

2. Verizon

Verizon Communications (NYSE:VZ) is the largest wireless carrier in the U.S., ahead of AT&T (NYSE:T) and T-Mobile (NASDAQ:TMUS), with 143.3 million subscribers as of the end of Q4 2022.

The telecommunications conglomerate is one of the top 15 highest-yielding stocks in the S&P 500. Not only do shares currently offer a market-beating yield of 6.78%, but the telecom giant has increased its annual dividend for 18 years in a row, a testament to strong execution across the company and its enormous cash pile.

Source: InvestingPro

At a price point under $40, VZ comes at an extreme discount according to the quantitative models in InvestingPro, which point to upside of 18.2% in Verizon’s shares from current levels over the next 12 months.

Buffett’s Berkshire initiated a position in Verizon in the past, purchasing 159 million shares in the fourth quarter of 2020. The Oracle of Omaha has since completely exited his position in the company.

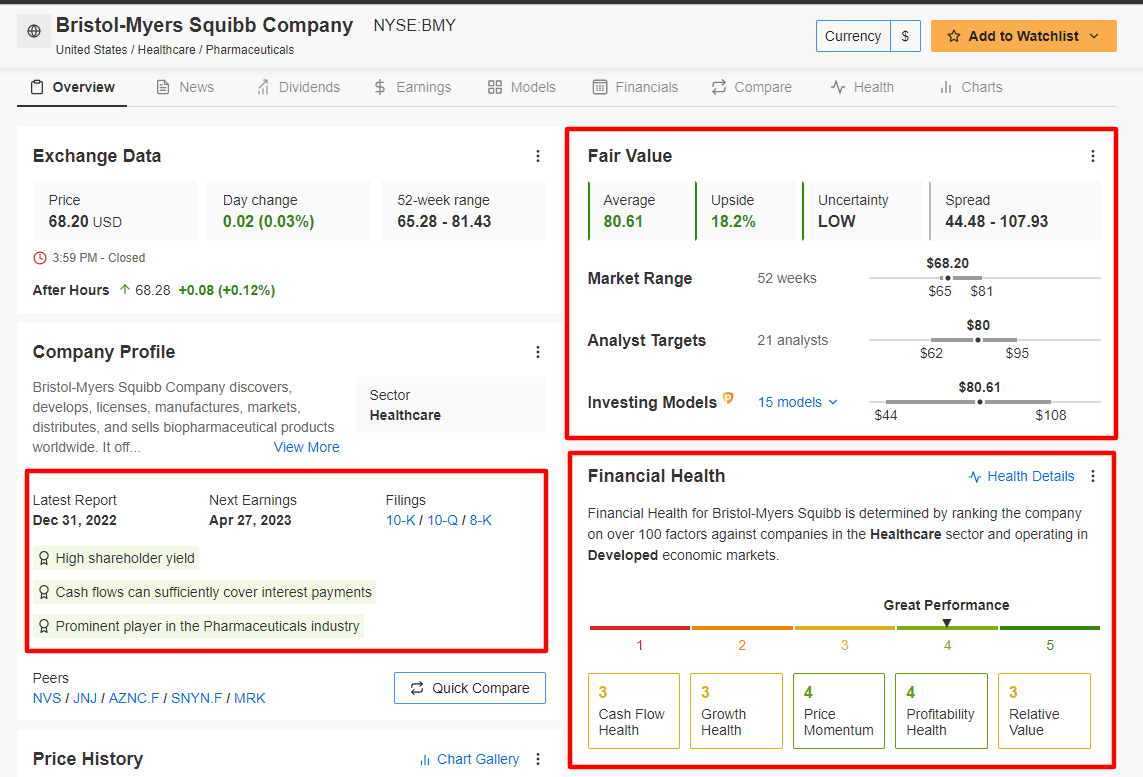

3. Bristol-Myers Squibb

Bristol-Myers Squibb (NYSE:BMY), which is one of the world’s largest pharmaceutical companies, checks off many of the boxes Warren Buffett looks for in a stock.

The New York City-based drug manufacturer currently owns several blockbuster drugs, each with over $1 billion in revenue, including its oncology, immunology, cardiovascular, and fibrosis drugs.

The pharma giant is a quality dividend stock. BMY currently offers a quarterly payout of $0.57 per share, which implies an annualized dividend of $2.28 at a yield of 3.34%.

Not surprisingly, BMY stock is substantially undervalued at the moment according to the quantitative models in InvestingPro and could see an upside of roughly 18% over the next 12 months to its fair value of $80.61/share.

Source: InvestingPro

Like Verizon, Bristol-Myers Squibb is another previous holding in Berkshire’s portfolio. Buffett loaded up on shares of BMY in 2020 before selling his stake in the drugmaker in 2022 as part of an overall trend in moving away from pharma stocks.

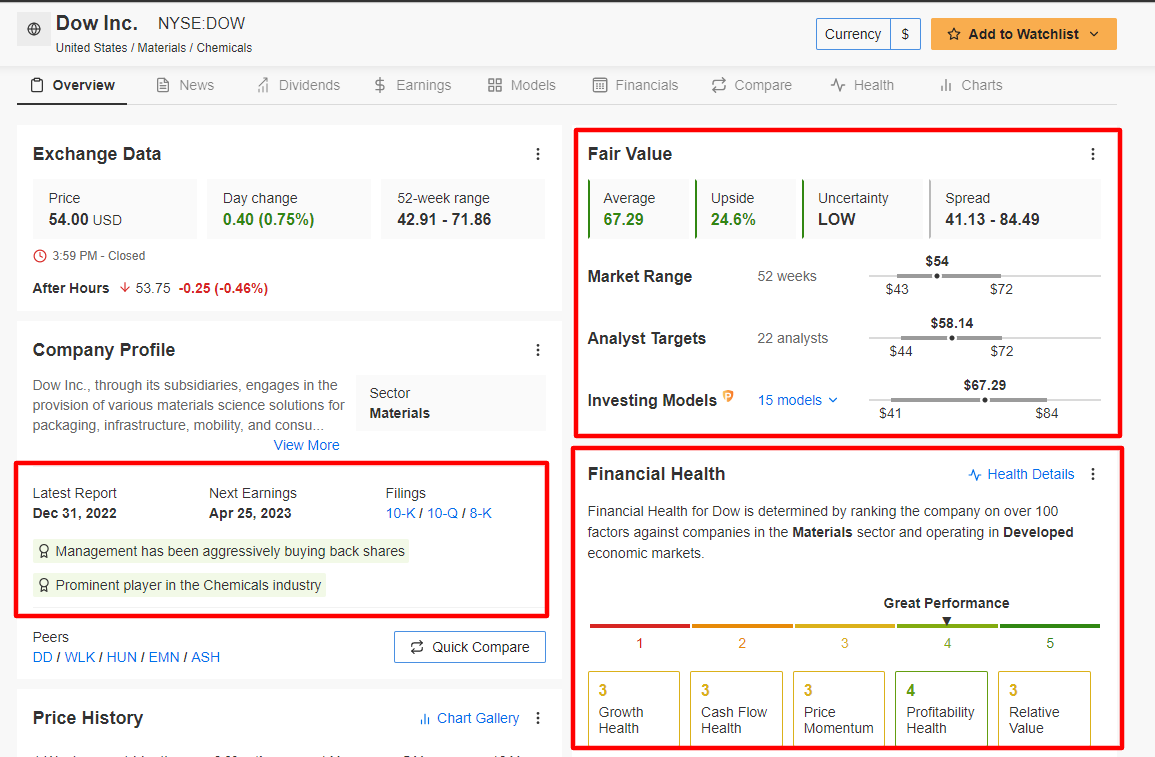

4. Dow Inc

Dow Inc (NYSE:DOW) is among the three largest chemical producers in the world, with operations in more than 160 countries. Between its pristine balance sheet, enormous cash pile, strong dividend, and attractive valuation, Dow checks most of the marks on Warren Buffett’s list.

The global chemicals giant has proven over time that it can successfully navigate through uncertain economic environments and still provide investors with solid payouts thanks to its diverse business and rock-solid fundamentals.

Source: InvestingPro

Dow currently offers an annualized dividend of $2.80 per share at a yield of 5.19%, one of the highest in the basic materials sector.

As could be expected, the average fair value for DOW stock on InvestingPro implies a nearly 25% upside from the current market value over the next 12 months.

5. Steel Dynamics

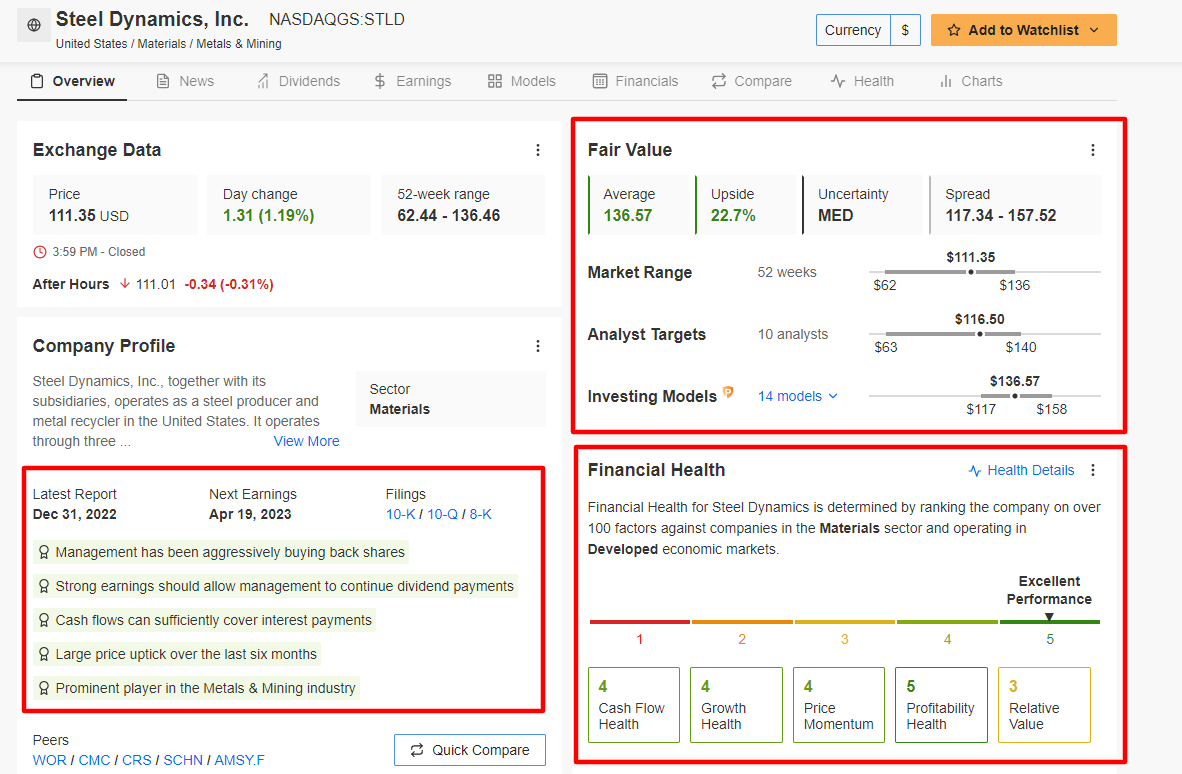

Steel Dynamics (NASDAQ:STLD) is an American steel producer based in Fort Wayne, Indiana. With a production capacity of 13 million tons of steel, the company is the third largest manufacturer of carbon steel products in the U.S., making it a leading player in its industry.

As InvestingPro points out, Steel Dynamics is in excellent financial health condition, thanks to strong profit and growth prospects, combined with its reasonable valuation. Pro calls out a few more key insights on the stock, with the share buyback and dividend payout points standing out the most.

Source: InvestingPro

In fact, Steel Dynamics has increased its annual dividend for 10 years in a row, proving that it can provide investors with higher dividend payouts regardless of the economic climate.

The quantitative models in InvestingPro point to a gain of 22.7% in STLD stock over the next 12 months, bringing shares closer to their fair value of $136.57.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.