As the final weeks of the trading year come into focus, American shares remain the odds-on favorite to dominate 2024 performance for the major asset classes.

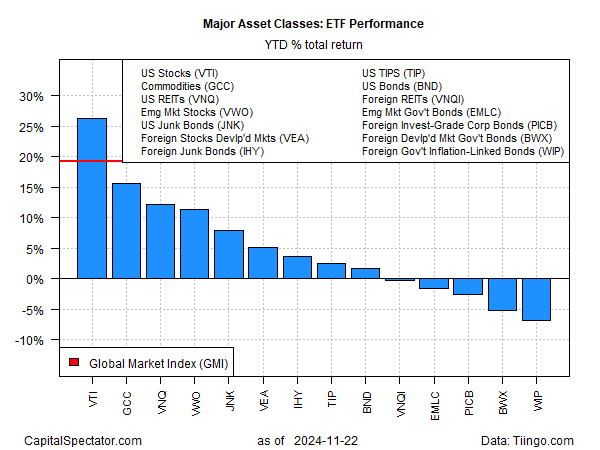

Using a set of ETF proxies through Friday’s close (Nov. 22) highlights a wide gap in US stocks over the rest of the field.

Vanguard Total US Stock Market ETF (NYSE:VTI) is up more than 26% year to date. The next-best return: commodities (GCC), with a strong but relatively distant 15.5%.

Several varieties of foreign bonds are this year’s losers, led by inflation-indexed government securities ex-US via WIP, which has shed 6.8% in 2024.

The election of Donald Trump is widely considered a bullish factor for US stocks and the source of the post-election rally that boosted the already solid year-to-date rally for shares prior to Nov. 5.

Some analysts see an enduring uptrend for stocks for the near term. “The rally in the S&P 500 should continue to broaden as the percent of S&P 500 companies with positive 12-month percent changes in forward earnings continues to rise,” predict Ed Yardeni and Eric Wallerstein at Yardeni Research.

The forecast for long-suffering small-cap stocks has turned brighter, too, according to analysts at BNP Paribas Asset Management:

“The outlook for US small-capitalization stocks looks better now than it has for several years. The main reasons include the US interest rate cutting cycle (small caps tend to benefit); attractive valuations; and continued reshoring and merger & acquisition trends.”

What could go wrong? There may be an inflation cost associated with a red-hot US stock market, advises Skanda Amarnath, executive director of Employ America. “Either stocks have to correct or the Fed’s going to be in a position where they’re forced to slow down their cuts and be a little hawkish,” he says. “If the equity market corrects more sharply this month, then a lot of things get a lot easier.”

The reasoning is that higher stock prices will contribute to firmer price pressure in a component of the personal consumption expenditures price index – so-called PCE inflation – that influences Federal Reserve policy decisions.

There’s also a concern that the Trump 2.0 policy agenda – higher tariffs, lower taxes and fewer regulations – could support higher inflation too.

The October report on PCE inflation (part of the personal spending and income data) is scheduled for Wednesday, Nov. 27. Economists are looking for headline and core PCE inflation to edge higher in year-over-year terms.

Markets may take comfort in the Trump’s pick for Treasury Secretary, reasons Kit Juckes, chief FX strategist at Societe Generale. Writing in a note to clients today:

“The nomination of Scott Bessent to be US Treasury Secretary has been a catalyst for lower bond yields, higher equity indices and a weaker dollar this morning. His nomination was greeted positively by markets worried about the size of the U.S. budget deficit and the inflationary impact of tariffs. Whether he can help get the U.S. to 3% GDP growth and a 3% budget deficit time will tell, but for now, he has changed the market mood, if nothing else.”