Stock market today: S&P 500 slides on economic worries; Tesla hits closing record

Last week, Friday picked up on Thursday's gains to push back on the support break. There hasn't been a challenge on earlier bull flags resistance, but we will likely see how much resistance there is at these levels early this week.

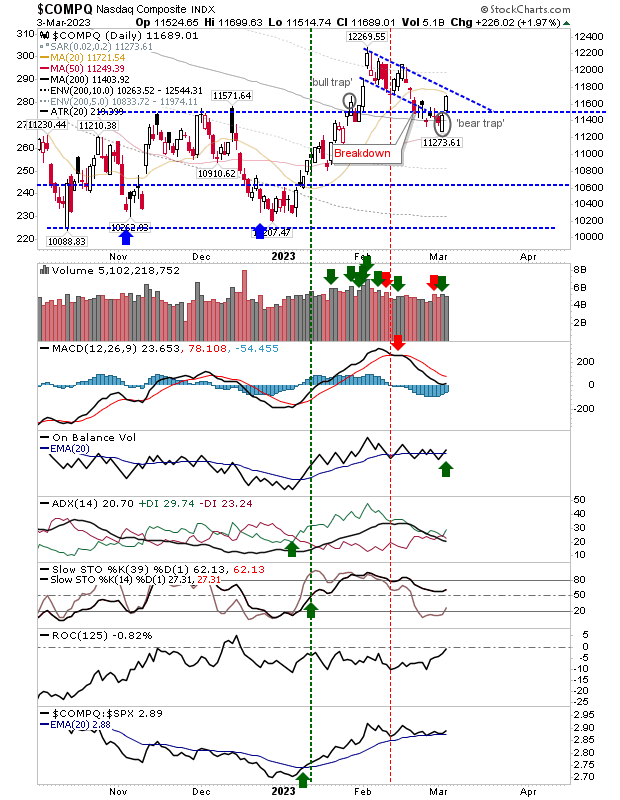

NASDAQ

In the case of the NASDAQ Composite, a successful test of the 200-day MA came with a new On-Balance-Volume 'buy' trigger. However, there is no pending MACD trigger 'buy,' so it will take a few more days of positivity to drive this. The index is clinging to its outperformance against the S&P 500.

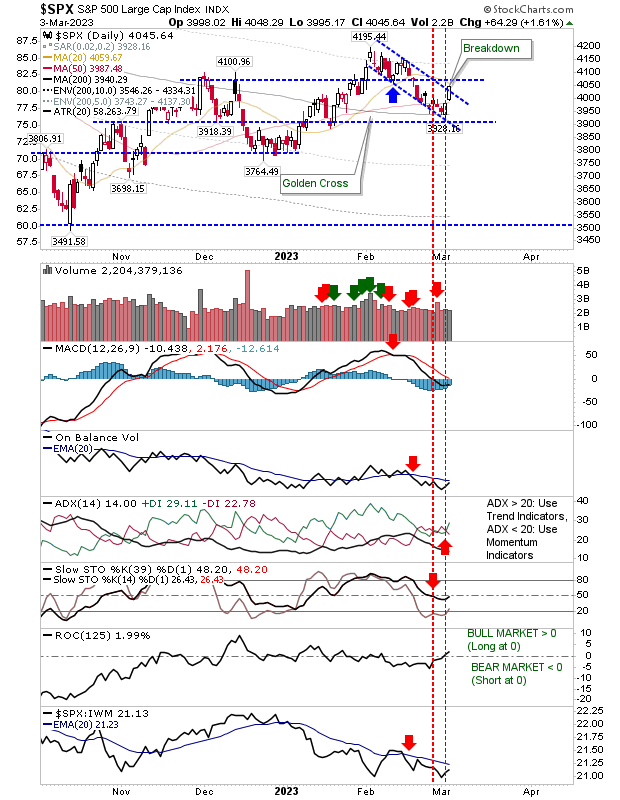

S&P 500

The S&P 500 did manage to clear resistance of its bull trap, but not the double top from November/December. Technicals are net negative, including an underperformance relative to the Russell 2000 (NYSE:IWM).

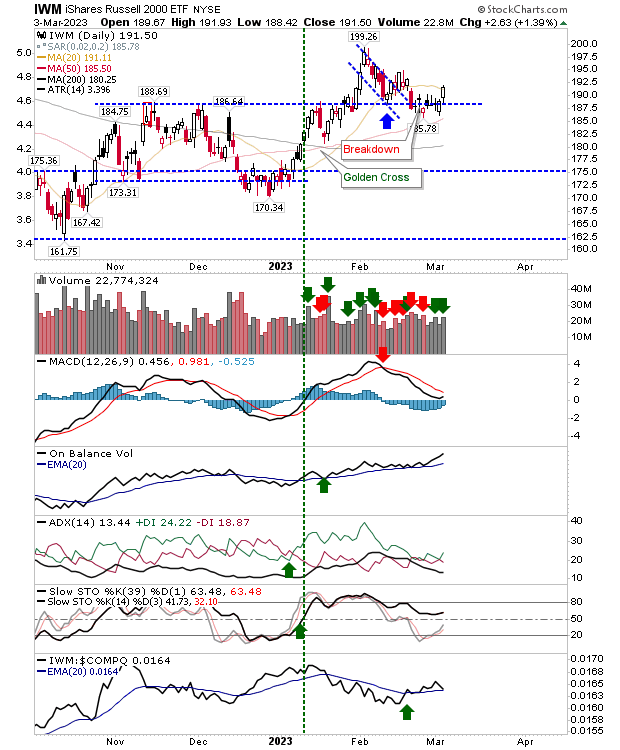

Russell 2000

The Russell 2000 returned to its 50-day MA after a series of days trading at a level previously associated with the November/December swing highs. Technicals are mostly positive, but the MACD remains negative. The index is outperforming the Nasdaq.

We need to see more from the indexes as Friday's gains managed to stall the market decline. The moving averages are proving to be critical support, but they need to be launch points for rallies, not support which is constantly tested. We have seen the positive MA test in the S&P 500 and Nasdaq, but now we need to see the push-off.