Today's action finished with low-level losses. Candlesticks were bearish, but this wasn't surprising, given the tags on resistance. Overall, I'm still bullish on markets, but it may take a little longer before we see resistance breakouts.

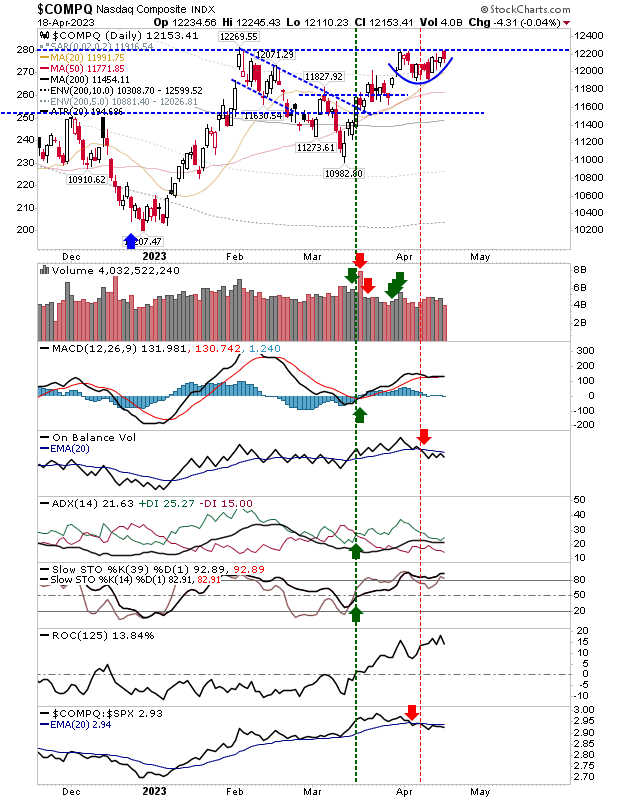

The Nasdaq started the day just below 12,250 resistance as it remains inside its mini-handle. On-Balance-Volume remains on a 'sell' trigger, and the index is still underperforming the S&P 500, but other technicals are positive. I would be looking for a breakout over the coming days.

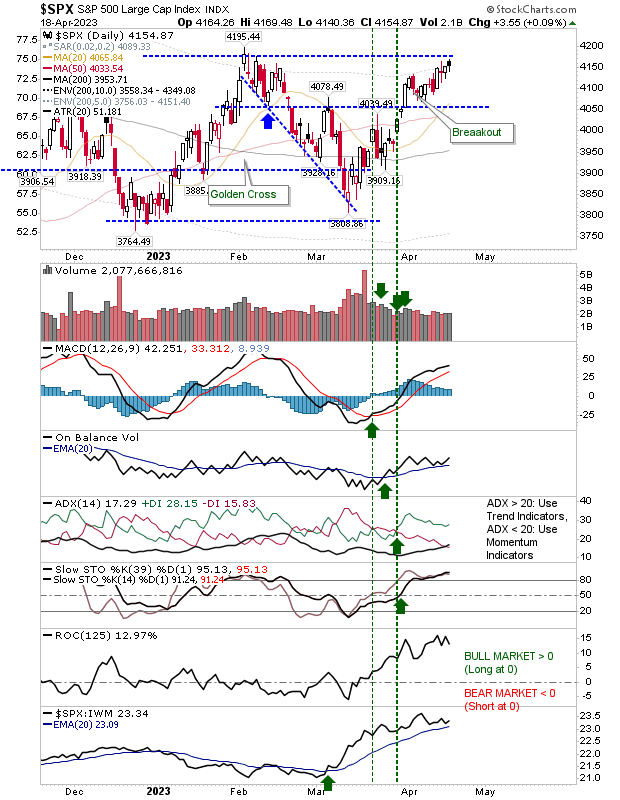

The S&P 500 closed the day with a bearish 'black' candlestick. At the end of a rally, the 'black' candlestick has a higher probability of acting as a reversal, so one must be cautious here because we have a strong possibility of some downside action in the coming days. Technicals are net positive, and the index continues outperforming Russell 2000.

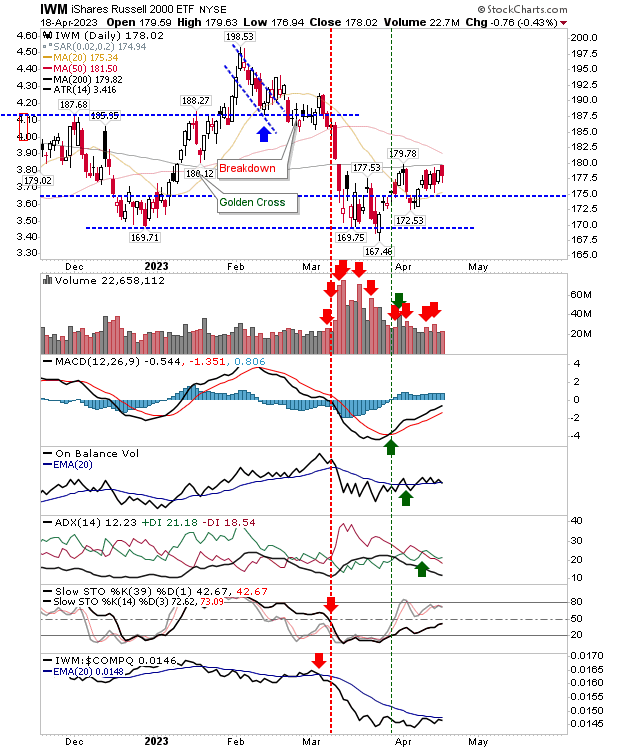

The Russell 2000 continues to be rebuffed by its 200-day MA. Technicals are still mixed, not helped by the MACD below the bullish zero line and stochastics below the 50 mid-line. Each on-balance-volume and the ADX are on the verge of fresh 'sell' triggers. While the long-suffering relative performance against Nasdaq is changing in favor of Small Cap stocks, it hasn't fully reversed.

While I remain positive on the Nasdaq breaking resistance, I find the Russell 2000 problematic. I wouldn't commit to the Nasdaq without the Russell 2000 surpassing its 200-day MA. The S&P is a bit of a "man-in-the-middle" and could go either way, but I don't see it as an index to watch now.