There are complex trading strategies built around the yield curve, but analysts are finding a simple reason why the yield curve on US Treasuries is flattening. Investors are getting jittery about the presidential election in November.

The first debate between incumbent President Donald Trump and Democratic challenger Joe Biden on Tuesday, Sept. 29 has been preceded by a move into longer-term Treasuries. This has depressed the yield (bond yields move inversely to prices), and flattened the yield curve.

Election Uncertainty, Equity Headwinds To Pressure Long Bonds

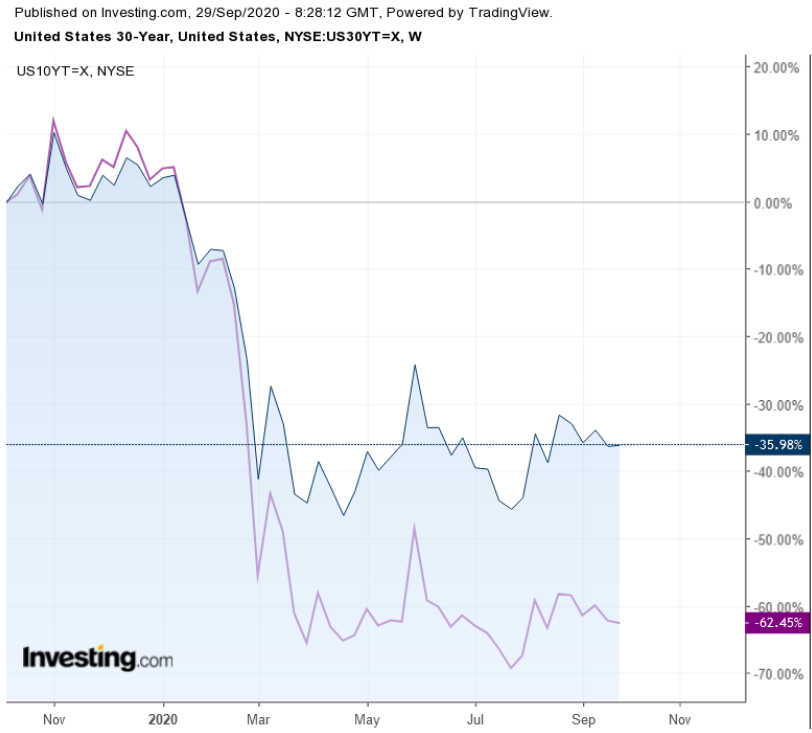

The spread between 10-year and 30-year bond yields is a narrow 76 basis points, not much of a premium for going out another 20 years.

The 10-year Treasury is yielding 0.66% and the 30-year, 1.42%.

The shift by the Federal Reserve to tolerate more inflation before tightening monetary policy should lead to a steeper yield curve. The chances for stronger economic growth and higher inflation over the longer term increase as the Fed policy pushes the next interest-rate hike nearer to the 10-year mark.

But that steepening yield curve is not happening as the election draws near. Polls give Biden a decisive lead nationally, but voters have learned from 2016 that these projections can be misleading. For whatever reason, pollsters misread Trump’s support in that election and there is little evidence they have improved their reliability.

Another lesson from 2016 is that national polls can’t really say what will happen in the swing states—those states that are not reliably captured by one party or the other and can decide the Electoral College vote regardless of the popular vote.

Hillary Clinton had 3 million extra votes in California and topped the national popular vote, but that didn’t save her as swing states Florida, Michigan, Wisconsin, and Pennsylvania all swerved to Trump, sometimes by narrow margins, giving him that Electoral College majority.

State polls are, as a rule, even more unreliable than national polls, so the whole procedure is fraught with uncertainty.

Analysts at ING recently concluded that other risks in favor of a flattening yield curve—such as the political stalemate over more fiscal aid and a rising number of COVID cases—might normally fade, but election uncertainty will keep the pressure on 30-year yields. Headwinds in the stock market may further encourage investors to pile into the 30-year Treasuries.

Just how sensitive bond investors are to elections was evident in the reaction last week to regional voting in Italy. The right-wing Northern League of Matteo Salvini had been rising in the polls ahead of the two-day vote on Sept. 20-21, and there was speculation the party would score a breakthrough in the leftist fiefdom of Tuscany.

But the League fell short, failing to win Tuscany as well as two other big regions, Campania and Apulia, which remained in the hands of the center-left. The result posed no threat to the national government in Rome and investors were relieved.

Yields on the 10-year Italian bond dropped nearly 10 basis points, dipping below 0.83% from 0.92% before results came out while the spread to German 10-year narrowed to about 135 bps, a range not seen since February.

In the United States, there is a barrage of negative news on both sides as the race for the White House enters its final stretch.

Republican senators released a detailed report on the millions of dollars of deals in Ukraine and China won by Hunter Biden while his father was vice president, creating a perception of a conflict of interest even though a bipartison panel of senators found no evidence of wrongdoing.

The New York Times finally got hold of some of Trump’s tax returns and reported that he had paid little or no federal income tax in the period before his election to the White House.

And now the campaign is overshadowed by the Republican effort to confirm a new Supreme Court justice to replace the late Ruth Bader Ginsburg before the election. If Trump’s nominee, appeals court judge Amy Coney Barrett, lives to 87 as Ginsburg did, the lifetime court appointment would enable her to affect American jurisprudence for nearly four decades.

Will the Republican gambit to cement a conservative majority in the court help or hurt them in the election? Opinions are divided on that score.

Investors, in short, have plenty of reasons to remain jittery.