DXY is up and away now and with twenty year highs in its sights:

The AUD held on but the pressure is mounting. JPY is a falling meteor until risk buckles:

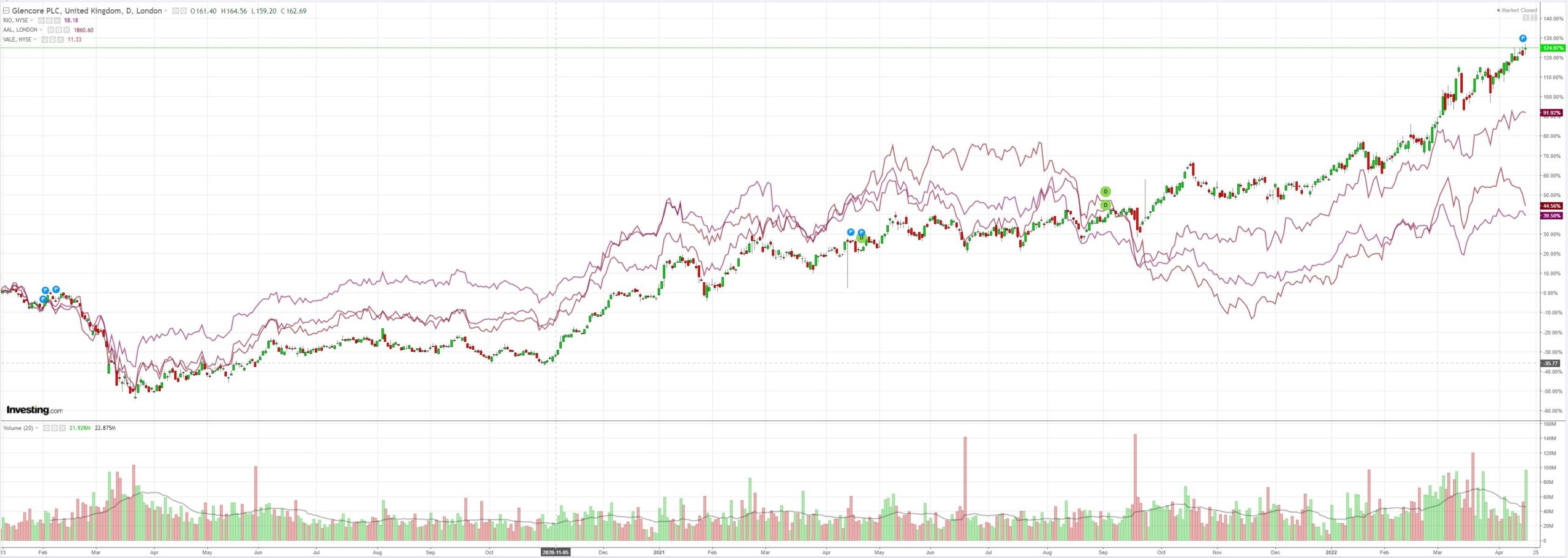

Commodities mostly fell:

EM stocks (NYSE:EEM) too:

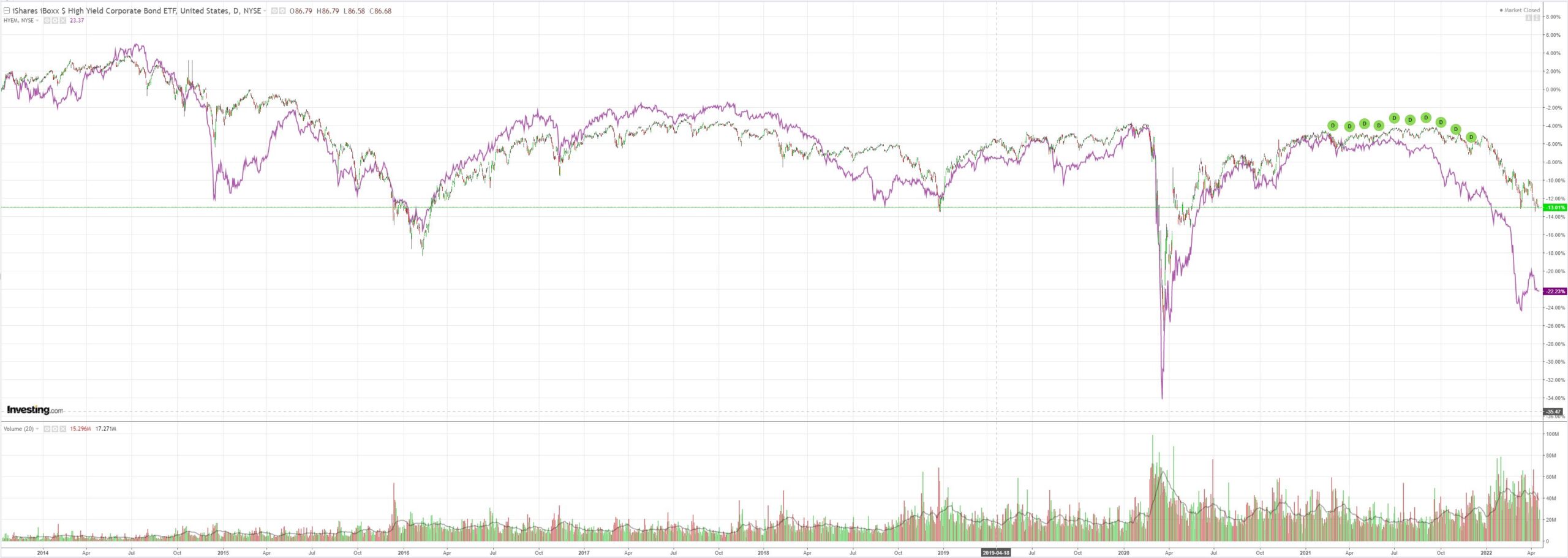

Junk (NYSE:HYG) is at the brink again:

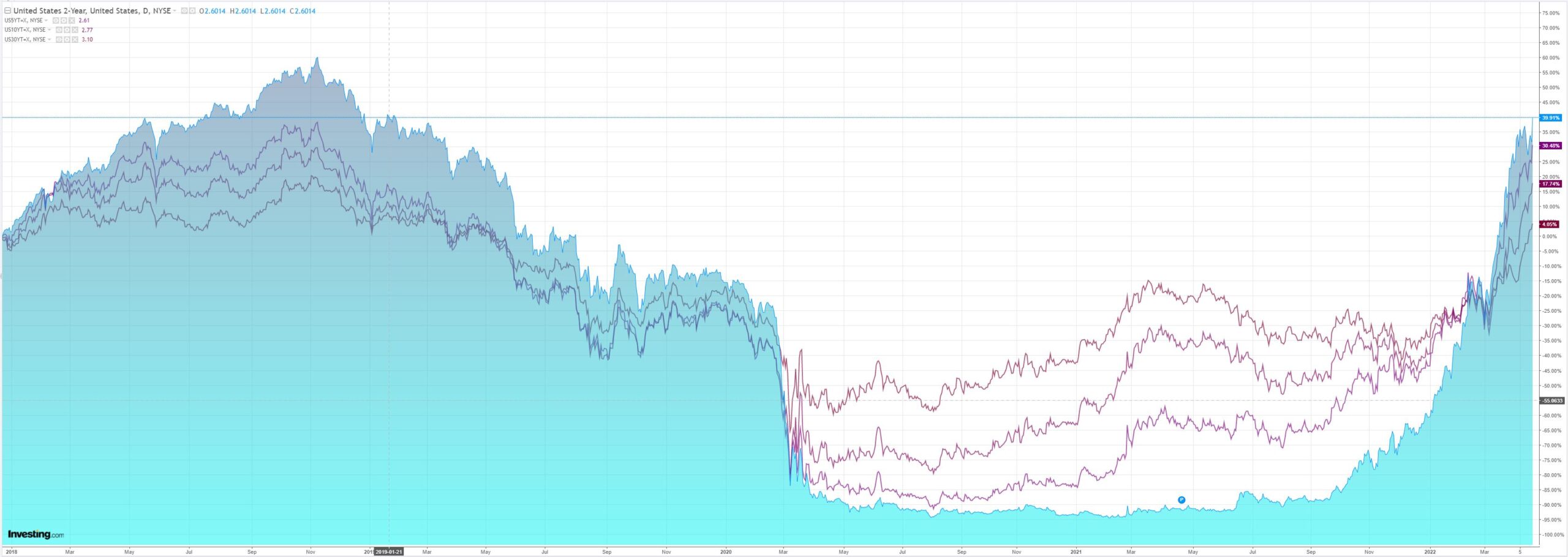

As the curve resumed flattening:

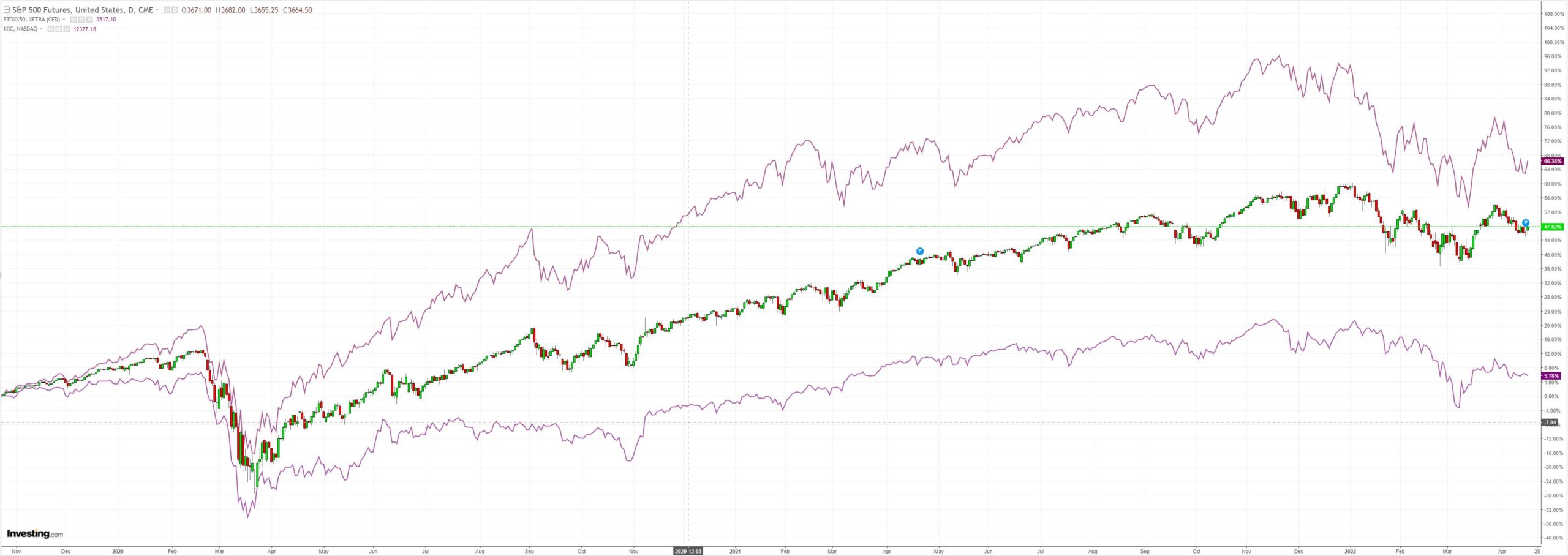

Stocks rallied just because!

Westpac has the data:

Event Wrap

US building starts and permits in March were again strong. Starts rose to 1.793m (est. 1.740m, prior revised to 1.788m from 1.768m). while permits rose to 1.873m (est. 1.82mn, prior revised to 1.865m from 1.859m).

FOMC member Evans thought the Fed will probably raise rates above neutral, and sees the target rate up in the 2.25% to 2.50% area by the end of the year. He added that “short-term neutral is actually lower, and by the time we get to 2.5%, it’s actually contractionary for a variety of reasons”.

IMF cut its world growth projections, noting the outlook has “worsened significantly” following the Russian invasion of Ukraine and subsequent sanctions, while rising inflation is also forcing central bank normalisation that will further weigh on growth. China’s zero-covid stance is also hindering. Its global GDP forecast for 2022 is now 3.6%, down from 4.4% in January. The outlook for 2023 was lowered to 3.6% from 3.8% previously.

Event Outlook

Aust: The March Westpac-MI Leading Index will likely ‘pop’ higher as last year’s delta disruptions cycle out of the six-month measure; other positive updates around equities, commodities and dwelling approvals will also be included.

Eur: The trade balance should remain in deficit in February on account of elevated energy prices.

US: Weakness in supply is anticipated to weigh on existing home sales in March (market f/c: -4.0%). The Federal Reserve’s Beige book will provide a qualitative assessment of conditions across the 12 Fed districts. Meanwhile, the FOMC’s Daly, Evans and Bostic are all due to speak at different events.

DXY is the only game in town as US growth, inflation and yields all power ahead of everywhere else. JPM:

Having underperformed post CPI, the dollar came back with a vengeance post ECB and the price action continued over the holiday weekend. In a world of incrementally hawkish central banks, the ECB was a small disappointment as the tone definitely didn’t match expectations even though ultimately we are left with a wait for what will be key forecasts at the June meeting and potentially a possibility of a hike in July, not far from where we were= Thursday morning. Bullard talking about 75bp hikes certainly adds fuel to the fire although unclear he will have much support from the rest of the committee helping over the weekend to buoy the dollar further, usdjpy still underpinned by a belief the BOJ will not abandon its policy any time soon despite the language becoming more heightened on yen weakness, the BOJ next week will be very interesting.

The euro came under pressure during Lagarde’s presser, the disappointment of a failure to continue hawkish steps in consecutive meetings was enough to make new post invasion lows. The elongated nature of the conflict will continue to drag on the Eurozone economically whilst inflation starts to make the hawks on the council uncomfortable, a cocktail which isn’t great for the currency and with plenty of people having not caught the usdjpy up move well enough it feels positioning in the euro is inching higher as people don’t want to make the same mistake again. The COVID lows are the next major target in the 1.0630’s and above 1.09 and 1.0950/80 are the first keys to alleviating pressure on the topside.

The last update, on Thursday, I spoke about surprise/confusion around the USD sell off but normal service has resumed over the long weekend and we open to a firmly bid tone for the USD. The RBA mins reinforced the hawkish message at the meeting and it seems likely that they will set off on their hiking cycle before long. But the narrative for AUD is mixed as concerns over China are still rife. The bearish half of that story is better played via NZD, where the market seems fairly high conviction in the bearish local narrative (RBNZ hiking into a weakening economy), but doesn’t seem to have the position on as the narrative in March was that the USD was trading soft vs commodity ccys. I think we can distinguish between hard and soft commodity exporters.

I remain of the view that DXY is going to blast through twenty-year highs as the Fed kills the economic cycle in due course.

AUD will struggle against this gale.