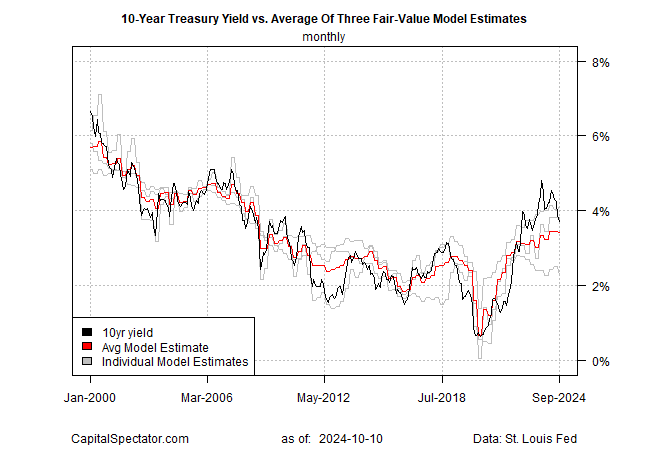

The market premium for the US 10-year yield over a “fair value” estimate calculated by CapitalSpectator.com continued to narrow in September.

The smaller spread extends a downside trend in recent months following a period of an extremely high market premium vs. the fair value, which is drawn from the average of three models.

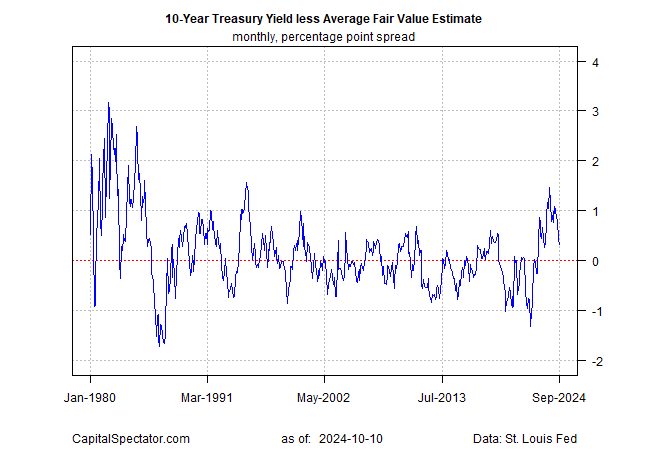

The current market yield premium slipped to 32 basis points last month. The decline brings the spread into what can be considered a relatively normal range after spiking to roughly 150 basis points in late 2023 – a three-decade high.

Although the surge in the market’s yield premium was unusually high in 2023, it wasn’t unprecedented. The model indicates that the market yield routinely bounces around fair value, posting both premiums and discounts, as the chart below shows.

To the extent that the market yield deviates widely from fair value, the extreme level of the spread offers an implied forecast on the assumption that a normalizing process will eventually return. That implied forecast has, once again, turned out to be useful in recent years.

In late-2023, for example, when the market premium was surging we wrote:

“Although the modeling shows that October’s spread isn’t unprecedented, history suggests such an extreme level doesn’t last long” and that “the process of normalizing has started.”

A year later, that forecast has held up well. Perhaps it was just luck, but a careful review of the model’s history, along with the underlying economic logic of the underlying analytics, suggests there’s a degree of value in estimating fair value and monitoring the spread vis-à-vis the market yield for context on deciding the likely directional bias in the near-term future.