DXY popped and dropped again last night:

AUD is a raging short squeeze:

As Oil goes about filling gap:

Base metals roared too:

Big miners (LON:GLEN) were firm:

EM stocks (NYSE:EEM) were weak:

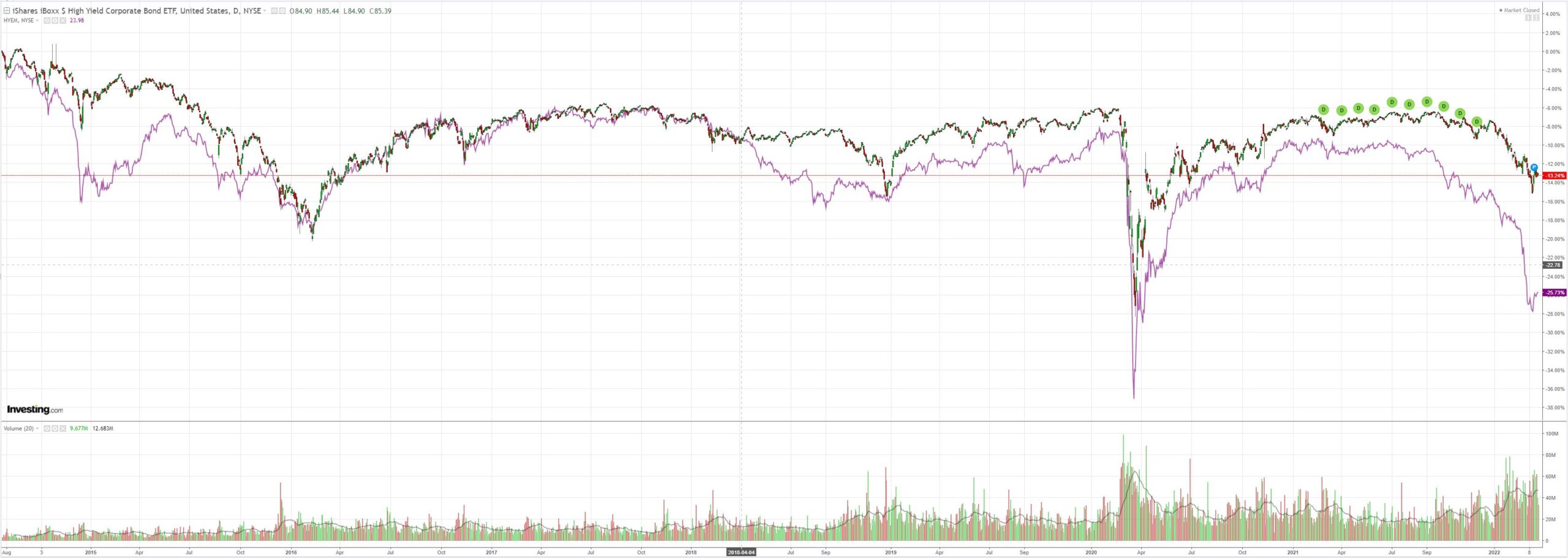

Junk (NYSE:HYG) was mixed:

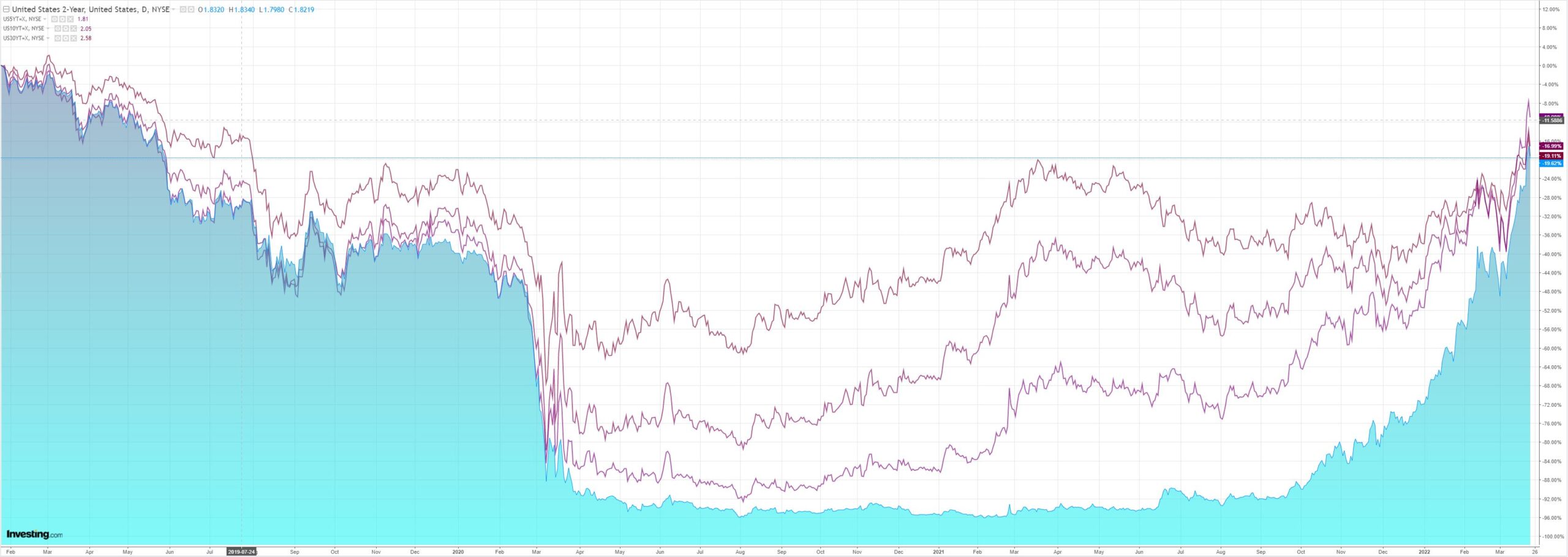

Treasuries rose:

Stocks fell:

Westpac has the wrap:

Event Wrap

US new home sales in Feb. fell 2.0% (est. +1.1%, prior revised from -4.5% to -8.4%).

FOMC member Mester favoured some 50bp hikes this year, front loading a move to 2.5% rate by year end. She said the economy has excess demand and doubts rate hikes will cause a recession. She added that unwinding the balance sheet will help reduce distortions in the yield curve.

Eurozone EC consumer confidence disappointed at -18.9 (est. -12.9, prior -8.8) – the lowest since May 2020.

Event Outlook

NZ: The surge in job opportunities is a positive for the Q1 Westpac-MM employment confidence survey but subdued earnings growth is a drag.

Japan: Weakness in the Nikkei services PMI may prolong in March as the sector continues to recover from omicron. The manufacturing PMI should meanwhile reflect a more positive outlook although supply issues remain.

Eur/UK: The relaxation of COVID-19 restrictions should continue support the Markit services PMI after the omicron outbreak (market f/c: 54.3 Europe; 58.0 UK). The manufacturing PMI is expected to signal robust growth even with headwinds surrounding the Russia-Ukraine conflict (market f/c: 56.0 Europe; 57.0 UK).

US: Despite the robust growth in the ex-transportation segment, volatility in durable goods orders will likely persist in February (market f/c: -0.6%). Initial jobless claims are expected to remain at a very low level (market f/c: 210k) and growth in the Markit manufacturing and services PMIs should continue to signal a robust pace of growth in March (market f/c: 56.6 and 56.0 respectively). The Kansas City Fed index is expected to reflect a strong manufacturing outlook for the region (market f/c: 26). The FOMC’s Bullard, Kashkari, Waller, Evans and Bostic are all due to speak at different events.

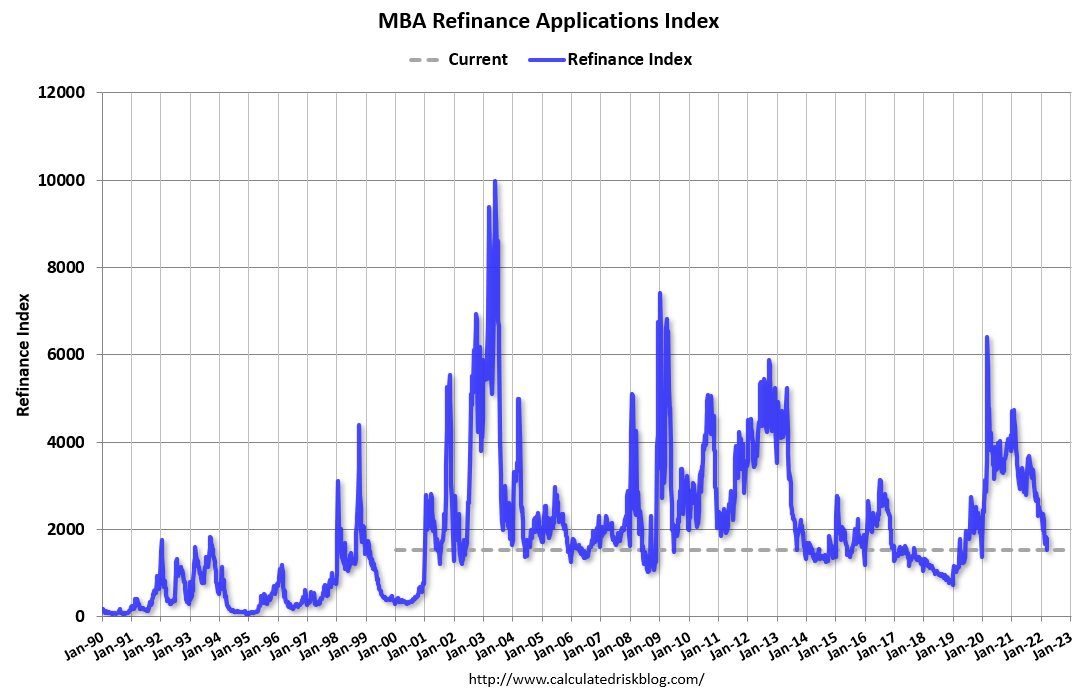

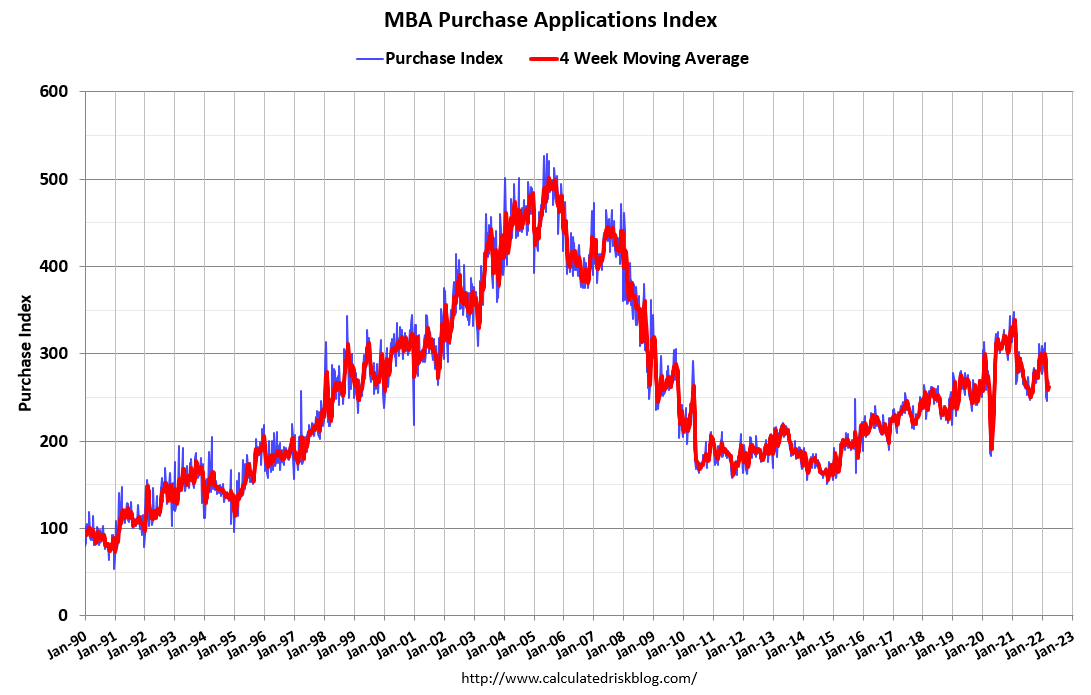

The US property market is turning south as rates skyrocket:

Rising inventory and falling prices are ahead. I’m not expecting a bust but a correction is on the cards. More to the point, Fed tightening is ahead of where the cash rate actually is given Treasury yields jackknifed in advance.

Volume growth in US consumer goods activity is steadily falling away and will continue to do so. This will land on China in due course via supply chains, which has no domestic offset as its property market crashes. Europe will follow.

But all of that is over the crest. Right now we’re still in the Ukraine commodities blowoff and AUD is the number one global forex proxy.

To the moon and then back again!