The rout in the cable is set to continue despite some support being found. The economic data shows worrying signs for the UK economy, and the interest rate outlook will ensure the pound remains bearish.

The cable has been under pressure for several weeks and that led to (another) nine day losing streak. The streak petered out in unspectacular fashion as UK GDP returned a solid 0.7% q/q result as expected. The US Nonfarm Payrolls result was a big miss at 142k vs 202k exp, coupled with a downgrade of the previous result to 136k, saw momentum swing back in favour of the pound late in the week.

The pound has fallen out of favour with the markets in recent weeks as many see little chance of a rate rise this year from the Bank of England. Yesterday we saw the services PMI, representing 80% of the UK economy, fall to its lowest level in a year and a half. The PMI fell from 55.6 to 53.3 and will be a point of concern for the BoE. The fact that it encompasses somuch of the UK economy highlights the potential for a cooling of the economy. The retail sector is also looking a little shaky with core retail sales falling to 0.1% m/m, down from 0.4%.

Interest rates in the UK are unlikely to go anywhere any time soon. Inflation is stagnant at 0.0% y/y and the outlook is for low inflation for the rest of 2015 and deep into 2016. With that prospect, we can expect the Bank of England to hold rates at the historic low for the rest of 2015 at least. Keep an eye on the BoE this week as they are due to meet to discuss interest rates, but more importantly, give a monetary policy statement which will hopefully include their expectation for the medium term. The outlook for rates in the US is still uncertain, however, the rhetoric from the Fed is that a rate rise this year is still on the cards, hence the falling cable.

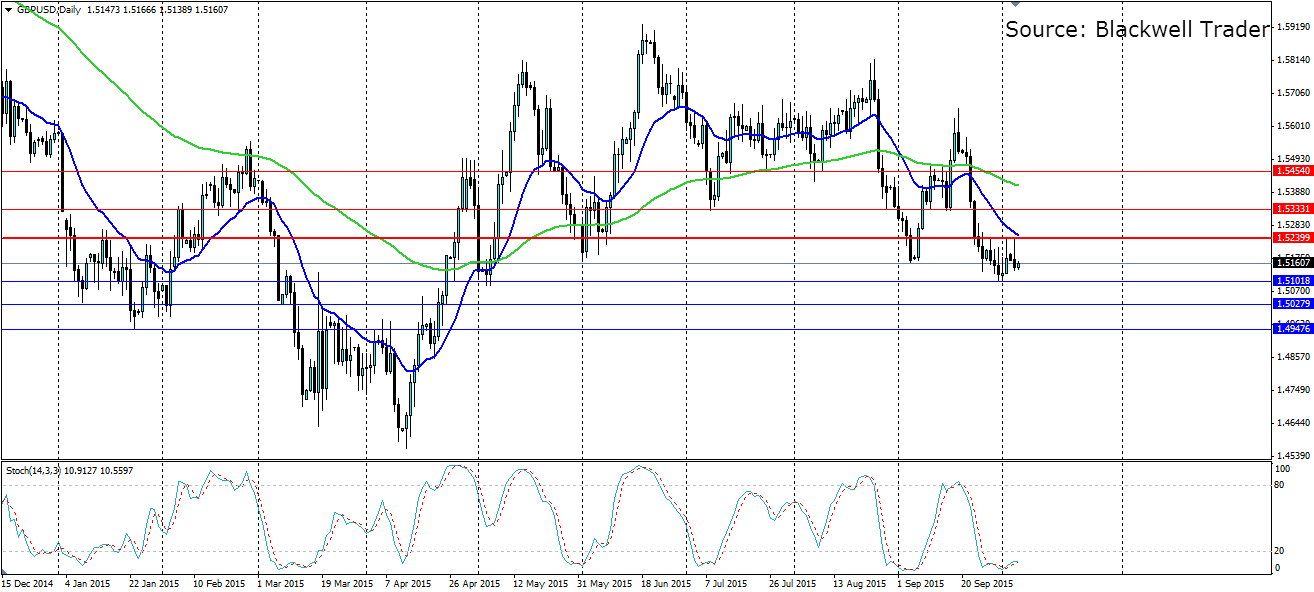

Technicals show the bearish sentiment the cable has been suffering from over the last two weeks. Support has been found at a previous swing point and this has led to some consolidation. In the short term we can expect the consolidation to continue, especially with such an oversold Stochastic Oscillator, but any dovishness from the BoE will heavily test the supports.

There is a solid level of resistance at 1.5239 forming the top of the current range that is proving tough to break. Any break above this important resistance level could lead to a swing in momentum towards the bullish side, but that is the unlikely of the two outcomes. If this level holds, we will likely see the recent lows extended lower. The support found at the previous swing candle is holding so far but will be tested, given the fundamentals. Look for support at 1.5101, 1.5027 and 1.4917 with resistance at 1.5239, 1.5333 and 1.5454.