- TSMC's market leadership continues, driven by strong AI-driven demand despite geopolitical challenges.

- The semiconductor giant’s Q4 results highlight its dominant role in powering the AI revolution.

- Meanwhile, technicals signal that TSMC’s stock may be poised for a rebound.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

The AI revolution is reshaping industries, and Taiwan Semiconductor Manufacturing (NYSE:TSM) stands at the heart of this transformation.

As the global leader in advanced semiconductor manufacturing, the Taiwanese giant has captured the spotlight in both tech innovation and geopolitics.

With a commanding share of nearly 60% of the global chip market and a critical role in enabling AI breakthroughs, TSMC’s ascent reflects its unmatched strategic importance.

Yet, this growth story isn’t without its challenges. As U.S. export restrictions on high-tech chips tighten and geopolitical tensions with China simmer, investors are scrutinizing TSMC’s resilience.

Despite these headwinds, the company continues to defy expectations as the latest earnings report showed.

Another Beat: TSMC Posts Impressive Q4 Results

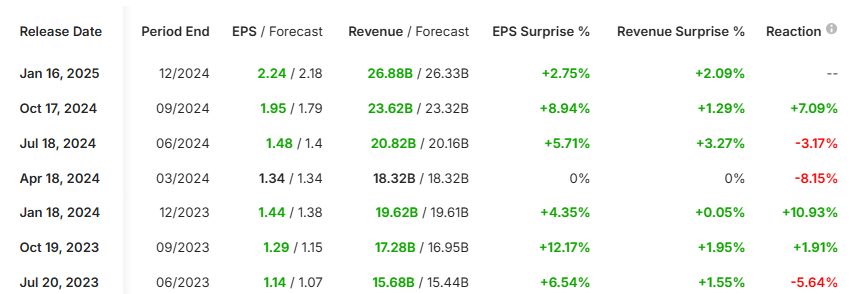

TSMC has done it again. For the fifth time in six quarters, the company exceeded market expectations, reinforcing its reputation for operational excellence. Year-over-year, revenue surged by an impressive 38.8%, while earnings per share jumped 57%.

The revenue breakdown highlights the dominance of its advanced manufacturing processes.

The 5-nanometer wafer accounted for 57% of total sales, followed by the 3-nanometer wafer at 26% and the 7-nanometer wafer at 14%. With such strong results, market sentiment could drive a renewed demand impulse as trading unfolds.

TSMC Could Continue to Power the AI Boom Despite Tariff Uncertainty

As the backbone of the AI revolution, TSMC plays a pivotal role in manufacturing chips for industry leaders like Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), and Advanced Micro Devices (NASDAQ:AMD).

The company produces roughly 90% of the world’s most advanced semiconductors, enabling cutting-edge technologies in artificial intelligence, cloud computing, and autonomous vehicles.

While proposed U.S. tariffs on Taiwan-made chips loom, Taiwan’s central bank governor downplayed the likelihood of implementation.

Even if enacted, TSMC’s strong partnerships with U.S. tech giants, which account for about 65% of its revenue, position the company to weather such challenges.

Major players like Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT) rely on TSMC for custom AI chips, while Tesla (NASDAQ:TSLA) depends on its innovations to power electric vehicles.

Navigating the Geopolitical Headwinds

Recent U.S. restrictions on advanced semiconductor exports have further heightened the stakes for TSMC. Dividing countries into tiers of access, these measures target China as part of a broader geopolitical strategy.

In response, TSMC is bolstering its ties with the U.S., including plans for a $30 billion facility in Arizona to manufacture 2-nanometer chips. These moves aim to mitigate risks from rising tensions between Washington and Beijing.

The specter of a potential military conflict remains TSMC’s most significant challenge, threatening its operations and Taiwan’s critical role in the global tech supply chain.

Technical Outlook: Is TSMC’s Correction Over?

TSMC’s stock appears poised for its next upward move. After defending a key demand zone near $200 per share, supported by an upward trendline, the stock shows signs of resuming its broader rally.

A close above this level could signal further gains, with the next target at all-time highs.

However, a break below $200 would shift the outlook, with the next support level near $190. For investors looking to capitalize on the AI boom, this correction offers a potential entry point at more attractive valuations.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.