- Amazon and Apple are set to report earnings today

- Both stocks have rallied more than 50% this year, flirting with overbought territory

- Can an upside surprise spark a rally?

Today marks the highly anticipated release of quarterly reports from Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN), the last two major U.S. companies to report for this earnings season.

The two tech giants proudly hold their place among the famous Big Tech group, often referred to as the old FAANGs.

To get a comprehensive overview of their performance, we'll turn to InvestingPro for valuable insights and analysis.

Apple

Let's begin with Apple, the trillion-dollar company with a staggering market capitalization of over $3 trillion. The tech titan has shown impressive and steady growth since the beginning of the year, boasting a remarkable gain of more than 50%.

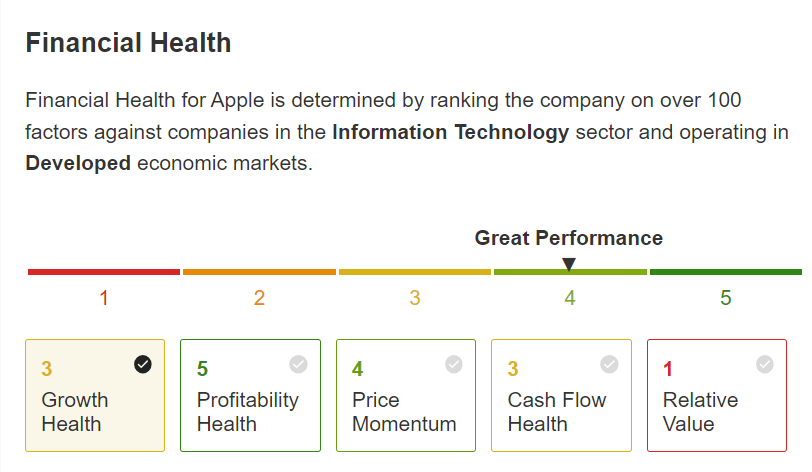

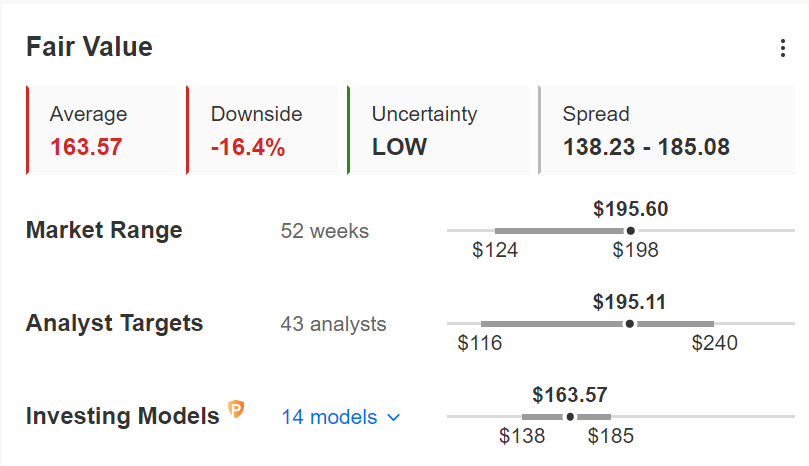

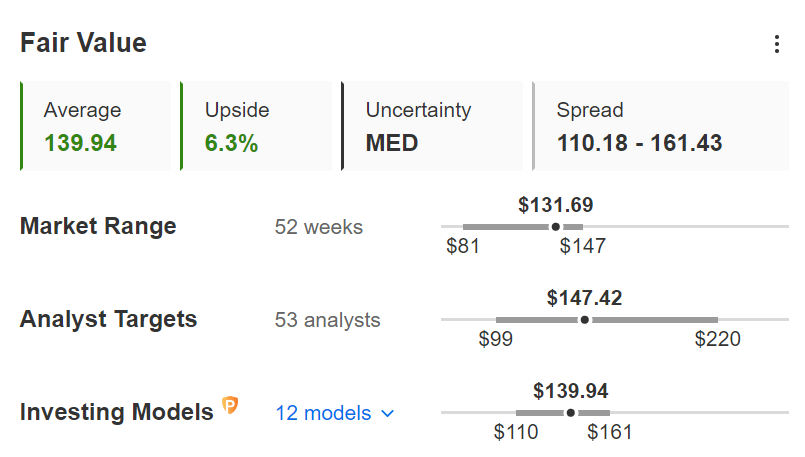

As of today, Apple is in very good financial health, as indicated by a strong rating of 4 out of 5 on InvestingPro. However, it's essential to note that the substantial spike in prices has led to the stock becoming relatively expensive, leaving little room for any margin of safety.

As of today, Apple is in very good financial health, as indicated by a strong rating of 4 out of 5 on InvestingPro. However, it's essential to note that the substantial spike in prices has led to the stock becoming relatively expensive, leaving little room for any margin of safety.

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

In regards to the upcoming quarterly earnings report, analysts are expecting Apple's EPS to be at 1.19, which aligns with the same period in 2022. However, there might be a slight dip in Apple's revenues, with expectations at 81.8 billion, just below the 83 billion recorded for the same period in 2022.

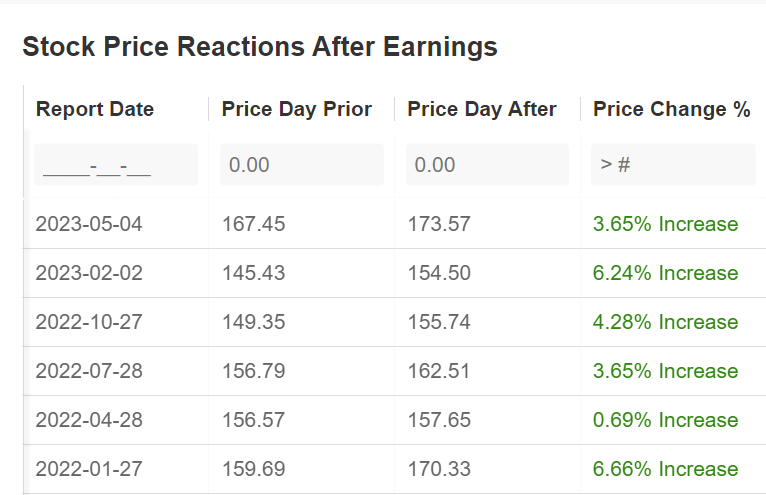

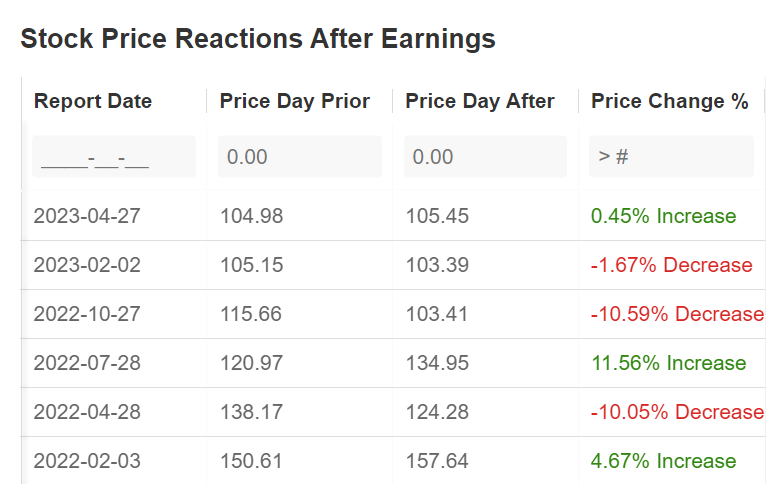

It's worth noting that throughout 2022 and 2023, Apple has consistently exceeded analysts' estimates, leading to positive market reactions after each earnings release.

Source: InvestingPro

Source: InvestingPro

Fitch's downgrade of the U.S. credit rating, however, may hinder the quarterly reports' ability to provide substantial help during this time of market weakness unless they deliver exceptional numbers.

As of today, the market has already factored in an optimal scenario, making it difficult for companies to surprise investors and drive significant gains in stock prices.

Amazon

Amazon is also a trillion-dollar company, boasting a market capitalization of over $1 trillion. Like Apple, Amazon has exhibited consistent and stable growth since the beginning of the year, leading to impressive gains of more than 50%.

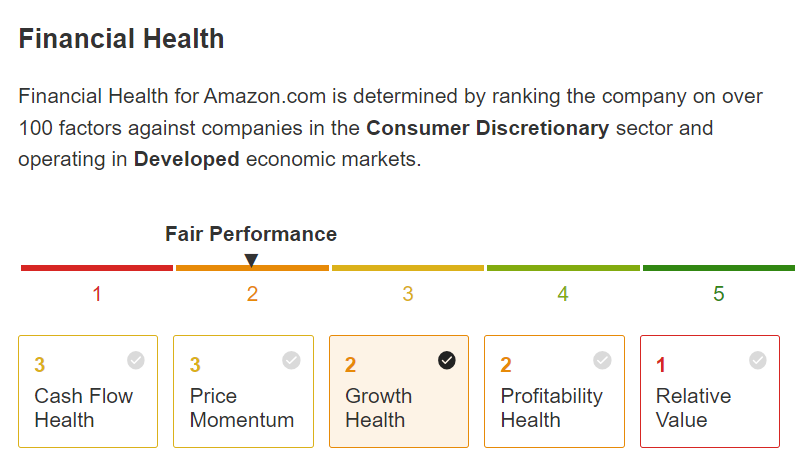

As of today, Amazon's stock health appears to be in a less favorable condition compared to Apple, with a rating of 2 out of 5 based on InvestingPRO data. The company is experiencing sluggish growth, and certain balance sheet indicators raise concerns about potential future earnings growth rates.

As of today, Amazon's stock health appears to be in a less favorable condition compared to Apple, with a rating of 2 out of 5 based on InvestingPRO data. The company is experiencing sluggish growth, and certain balance sheet indicators raise concerns about potential future earnings growth rates.

Regarding valuations, Amazon's current prices are in line with its market value, but like Apple, there are no significant discounts available. While the valuations are slightly more favorable than Apple's, they still do not provide sufficient profit potential for investors who buy now.

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

In the upcoming quarterly earnings report, analysts expect Amazon to post an EPS of $0.34, indicating a significant improvement over the loss reported in the same period of 2022. Additionally, the company is projected to report revenues of $131 billion, which is slightly higher than the $121 billion recorded in the same period last year.

Looking back at 2022 and 2023, Amazon's quarterly earnings releases have resulted in mixed feedback from the market. As the next report approaches, much will depend not only on the actual figures but also on the company's forward guidance.

Source: InvestingPro

Source: InvestingPro

*** Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."