- Don't miss out on tech's hot streak, but consider diversifying.

- This piece will discuss 4 strong stocks beyond the tech sector.

- Beat the market with these undervalued picks in healthcare, consumer staples, and more.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

The stock market is currently riding a wave powered by large-cap tech stocks, but history tells us rotations and economic cycles are inevitable.

To stay ahead of the curve, here are 4 alternative stocks with strong fundamentals and growth potential outside the tech sector:

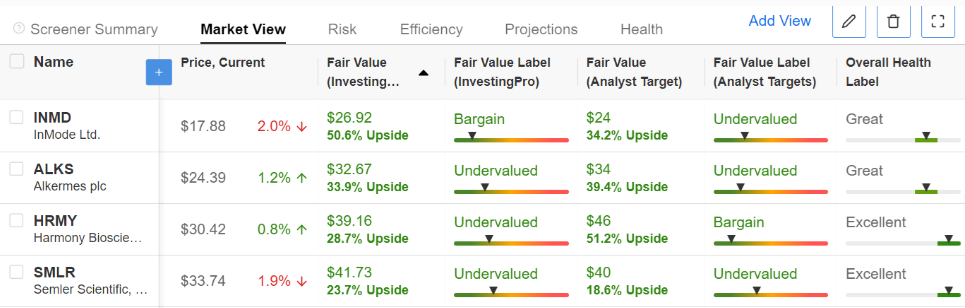

Source: InvestingPro

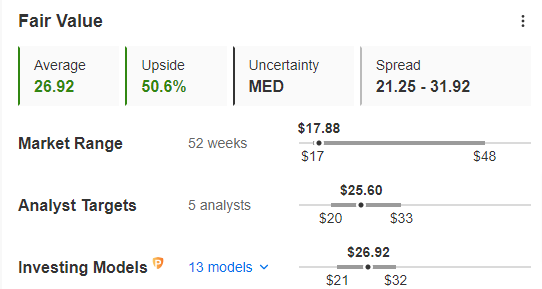

1. InMode

InMode (NASDAQ:INMD) manufactures minimally invasive aesthetic medical products.

The company boasts "excellent" overall health and bullish potential exceeding 50% from its current price.

Source: InvestingPro

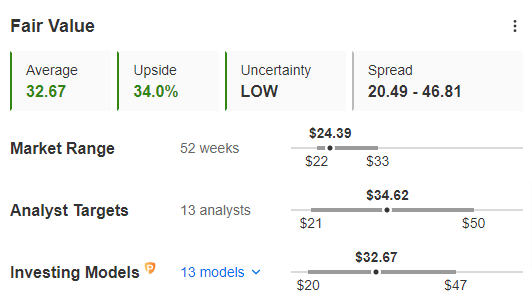

2. Alkermes

Similar to InMode, Alkermes (NASDAQ:ALKS) has an "excellent" health label and significant upside potential of around 34%.

Source: InvestingPro

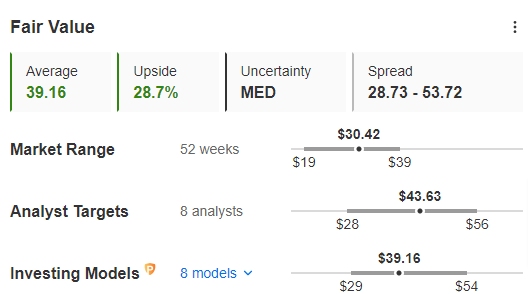

3. Harmony Biosciences Holdings

Harmony Biosciences Holdings (NASDAQ:HRMY) also holds an "excellent" label, suggesting strong financial health and a decent upside potential of 28.7%.

Source: InvestingPro

4. Semler Scientific

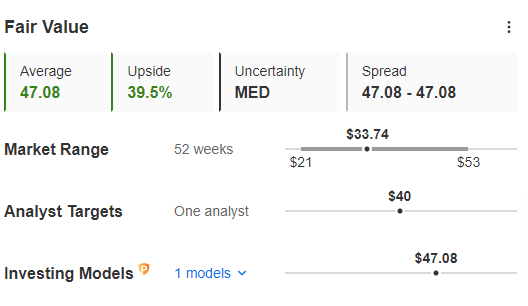

Semler Scientific (NASDAQ:SMLR) rounds out the list with a solid overall health rating.

Source: InvestingPro

Analysts agree that these stocks are discounted relative to their fair value today. Some of these stocks have yet to fully capitalize on the recent bull market, while others are restructuring or recovering from recent challenges.

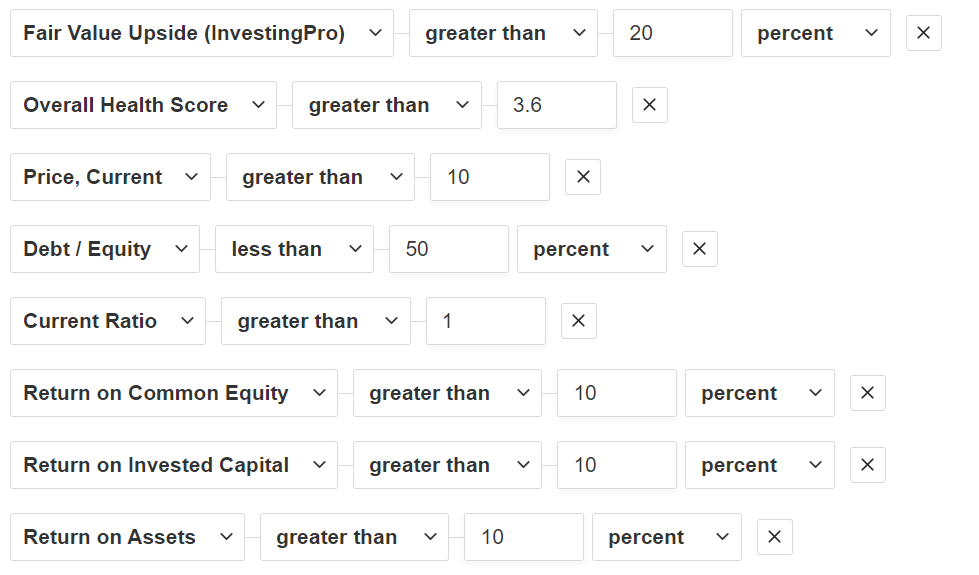

If you have an InvestingPro+ subscription, you can explore the full list by applying specific filters.

Source: InvestingPro

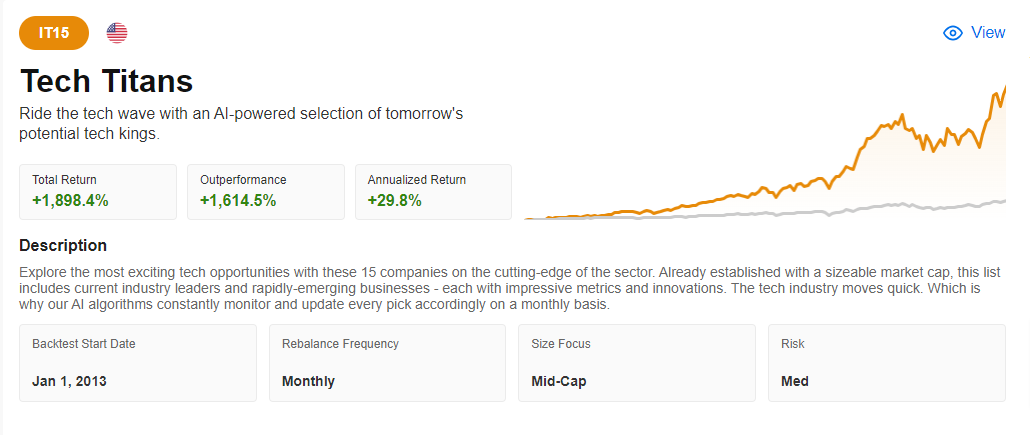

For those focused on momentum, the AI-managed Tech Giants strategy by ProPicks InvestingPro is positioned to benefit from the next phase of the AI rally. Backtests since January 2013 show a remarkable performance of nearly 1900%.

Source: InvestingPro

Beyond Tech Giants: Broader Thematic Portfolios

ProPicks offers 5 additional thematic portfolios with attractive historical returns:

- Beat the S&P 500: 1,095%

- Dominate the Dow: 647.8%

- Top Value: 932.7%

- Midcap Movers: 579.7%

- Best of Buffett: 373.2%

So what are you waiting for?

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.