This post was written exclusively for Investing.com

You do not buy a quality long/short fund for thrills and spills. Robinhood gunslingers would likely find the JP Morgan Opportunistic Equity Long/Short Fund (JOELX) boring. Someone of a different bent would call it sane.

In the best of markets, there are some company’s shares that deserve to be sold, or even shorted. In the worst of markets, there are those that are begging to be bought.

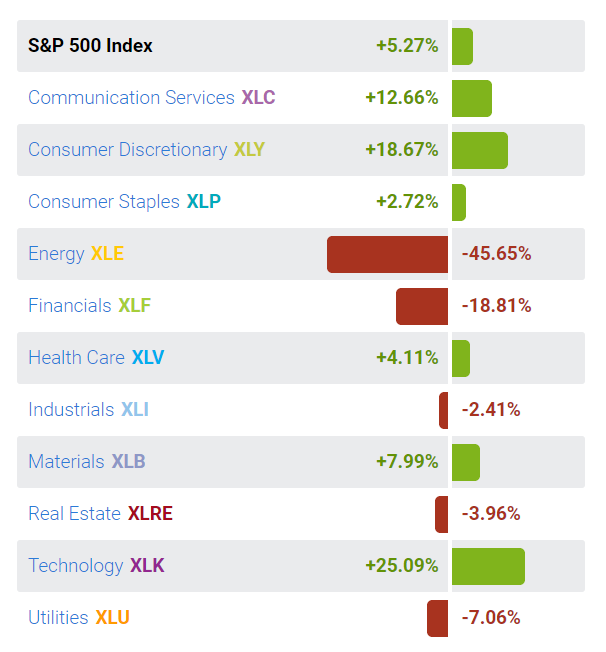

The same is true of sector rotation. It is here that the very best of the long/short funds thrive and rise above the rest. They do not necessarily have to short shares to do so. Let us say, for example, that a long/short fund decides to buy all sectors of the S&P except, say, Energy and Financials.

In 2020, relative to the S&P 500, which is comprised of 11 sectors, including energy and financials, if a fund had zero holdings in Energy and Financials and placed their funds equally in the other 9 sectors, they would have far outperformed the benchmark S&P.

The S&P is up 5.27% this year. But just take a look at one example of what the worst-performing component has done:

One—that’s “1”—energy company is up for the year. You don’t *even* want to look at page 2 of this chart!

I use this example because “short-selling” scares some people away from the get-go. You don’t have to short; you just have to play the right sectors and “effectively” short losing sectors.

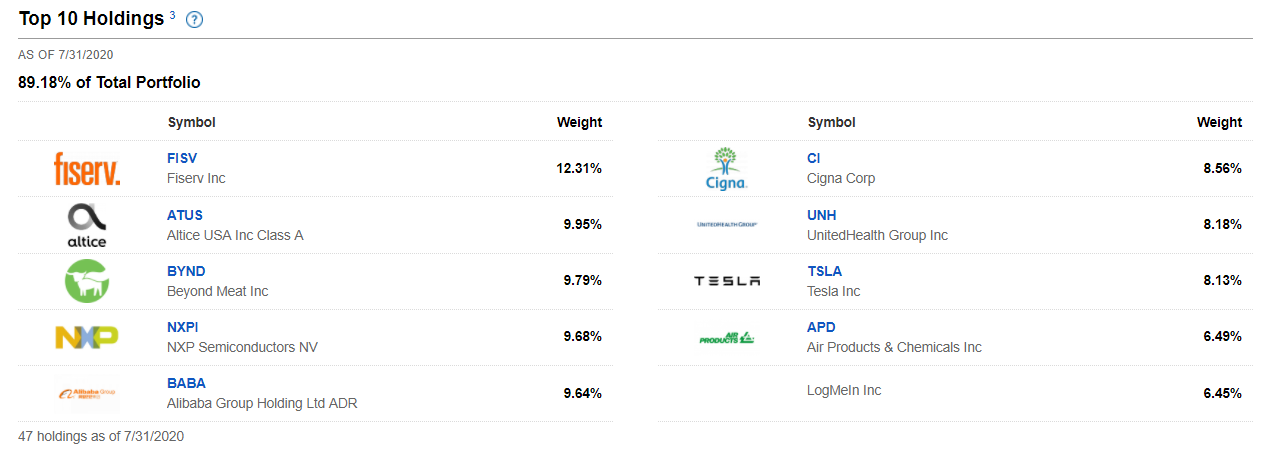

Here are the Top 10 holdings for JOELX: Fiserv Inc (NASDAQ:FISV), Altice USA (NYSE:ATUS), Beyond Meat (NASDAQ:BYND), NXP Semiconductors (NASDAQ:NXPI), Alibaba (NYSE:BABA), Cigna (NYSE:CI), UnitedHealth Group (NYSE:UNH), Tesla (NASDAQ:TSLA), Air Products and Chemicals (NYSE:APD) and LogMeIn (NASDAQ:LOGM).

You’ll note their selection on the long side seems pretty astute given how these have performed and are currently performing:

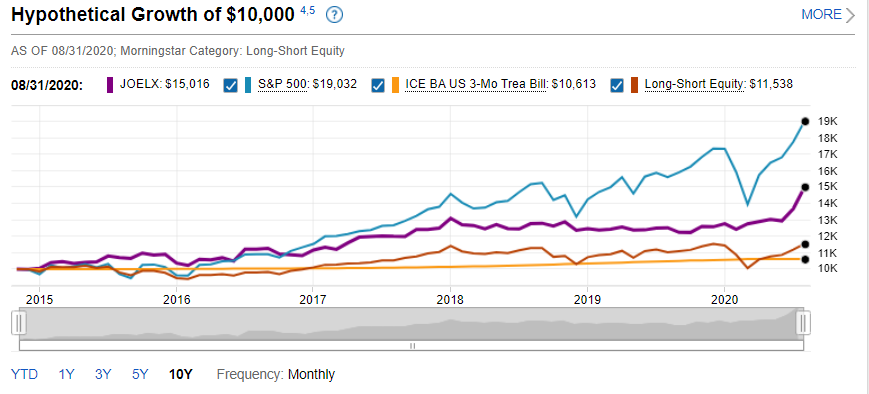

Now, I want to be certain we all understand that JOELX has been no match for the S&P over the past 10 years, but it has been solidly ahead of its long/short peers...

In fact, you will note that, while taking less risk than “the market” it underperformed the S&P by about the same amount as it out-performed its long/short peers!

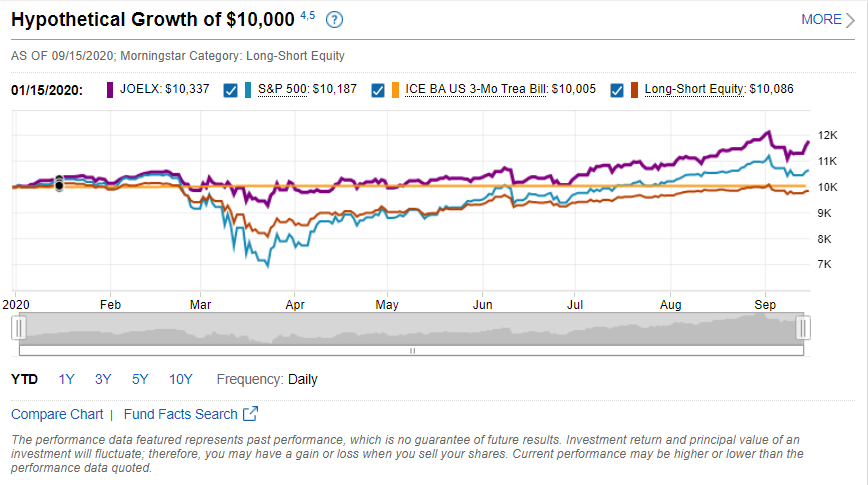

In the kind of market we may be in for in the coming months, with all the uncertainties of the election, the timetable for COVID-19 vaccine developments and treatment regimens, the ability of businesses to remain open or new businesses to form, I submit that a well-run fund that doesn’t swing at every ball but slowly and steadily advances might just be perfect for your due diligence.

Indeed, as well as the S&P 500 has done this year-to-date, take a look at the comparison with JOELX.

Portfolio management counts. By being opportunistic, the JP Morgan Opportunistic Equity Long/Short Fund never fell nearly as much as the S&P in March, giving its shareholders greater peace of mind, Even today, it's ahead of the S&P!

Disclosure: I own shares of JOELX, both personally in the model portfolio I maintain for clients. I own it for portfolio protection. In case there is another sudden downdraft it will be nice to have a steady performer that hugs the "mean" above.

Finally, as I must always note, unless you are a client of Stanford Wealth Management, I do not know your personal financial situation. Therefore, I offer my opinions above for your due diligence and not as advice to buy or sell specific securities.