It is becoming increasingly clear that someone is offside; it’s just a matter of who. I know talking about credit spreads and implied correlations, and the Mexican peso is not en vogue or as hot as Nvidia (NASDAQ:NVDA). But we are here to do the work that nobody is talking about and not state the obvious.

The following six things give a good sense that something is changing in the risk sphere currently. Maybe it is only temporary, maybe it is not. However, it is a clear sign that the tone of the underlying market is somewhat shifting:

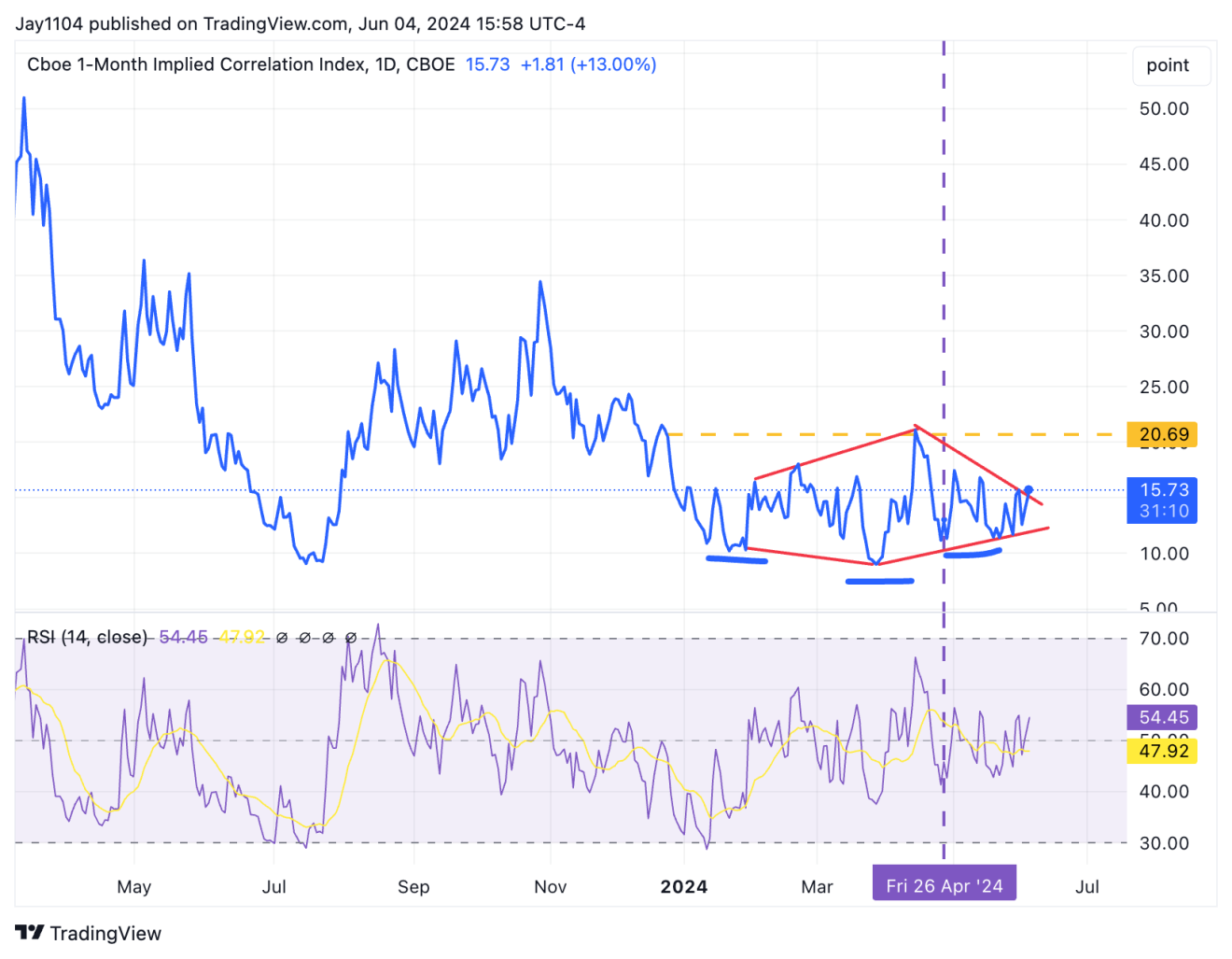

1. Implied Correlation Spikes

In the last couple of days, the 1-month implied correlation index has moved higher to around 16.

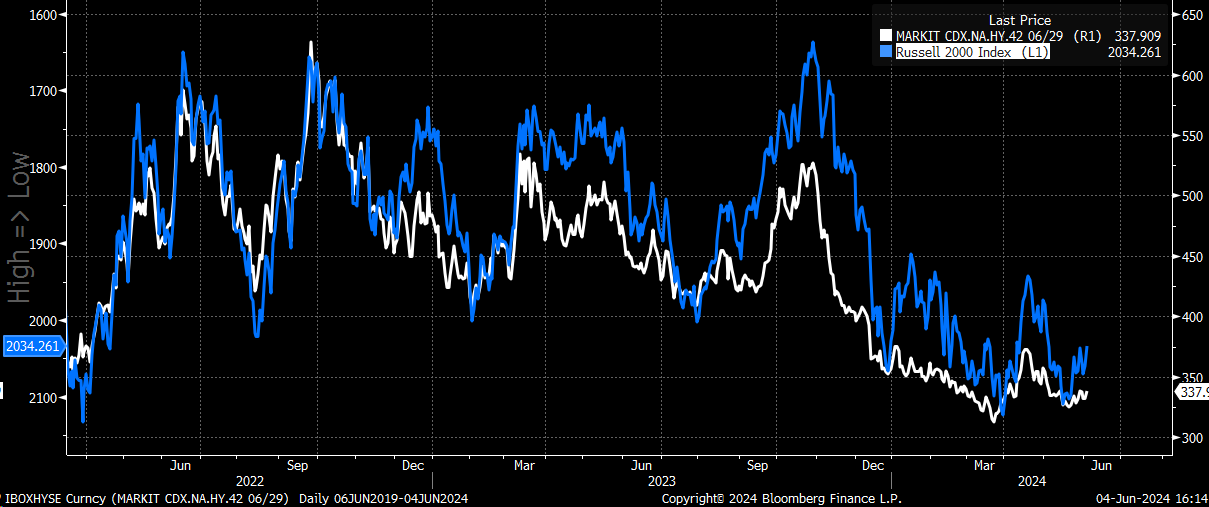

2. High-Yield Spread Rises

Meanwhile, the CDX high yield spread index is slowly moving higher.

3. USD/MXN Volatile

There has been a sizeable move in the USD/MXN following the election.

4. USD/CAD Stalls Ahead of BoC

We will watch the Bank of Canada today, where it is expected to cut rates. If the BOC doesn’t cut rates, it would probably come as a surprise, as the market has the odds around 80% they do cut rates.

It could explain why the USD/CAD has stalled recently. What does seem clear is that whatever happens, the stalemate is likely to end. The announcement comes at 9:45 AM ET, so if the US equity market starts doing some weird stuff around that time, look to the USD/CAD and take 5 minutes to read the announcement.

5. Russell 2000 Moves Lower

For the most part, the movements you see in Russell 2000, which are more economically sensitive, reflect some of these changes in risk. The Russell, for the most part, trades with the changes in credit spreads.

6. Housing Index Tumbles

Also, despite declining 10-year rates yesterday, the PHLX Housing index was hit hard, falling by around 1.9%. It is getting close to a big region of support that needs to hold, or a break lower is likely coming.

The “sudden” mood change might be because some cracks are forming in the economy, which suggests a slowing. Now, is it a major slowing, at least to this point? No.

But it is indeed not the pace of growth we saw in the second half of 2023. First-quarter growth was notably slower, and the ISM manufacturing report also points to slower growth.

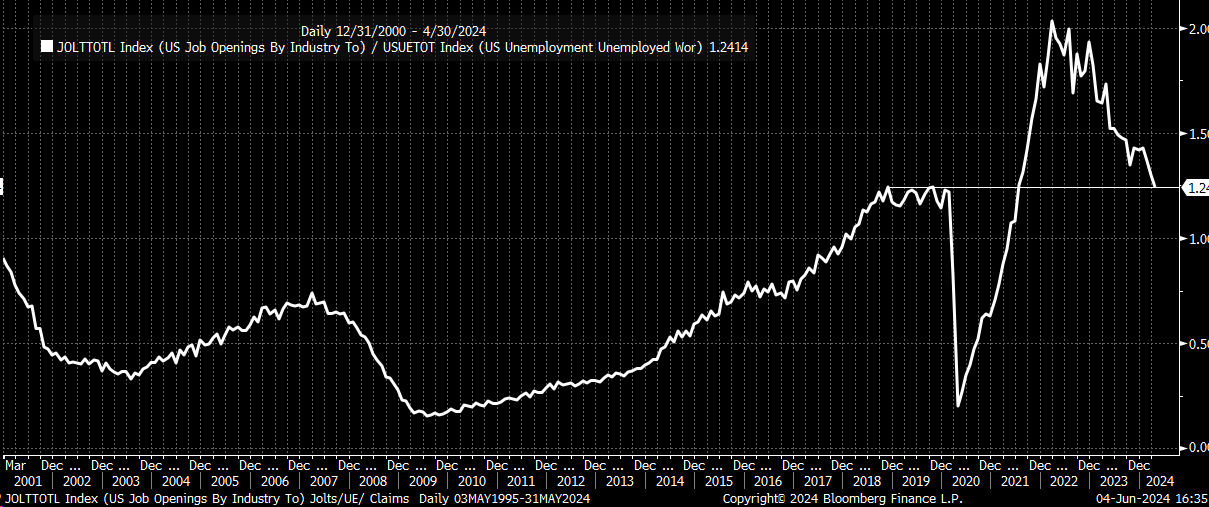

The JOLTS data yesterday fell more than expected, and now the ratio of job openings to unemployed workers has fallen back to pre-pandemic levels.

It probably puts a little more importance on today’s ISM services number and, of course, the job report on Friday. The March employment report wasn’t the strongest, but it wasn’t horrible, and Friday’s job data is expected at 185k, which is a solid number.

Again, we are more likely heading towards a stagflation-like environment for now. In my view, this is sluggish growth and a 3.5ish % inflation, at least until we have clear evidence of a change in trend. I think that overall market risk was probably mispriced, and too much emphasis was placed on the “golden path” or whatever it’s called.

Again, these are just some things we can continue to watch to help us understand the broader stock market tone through cross-asset movement.