The Hays Salary Guide 2023-24 found almost all employers plan to increase salaries in a bid to attract new employees and discourage top performers from seeking higher paying jobs in a tight labour market.

- Hays Salary Guide has revealed 95% of employers are looking to increase salaries in their next review.

- Allied health professionals, engineers, and accountants are among those to recieve increases of more than 7% - in line with inflation.

- Employees are gaining confidence with 65% planning to ask for a pay rise.

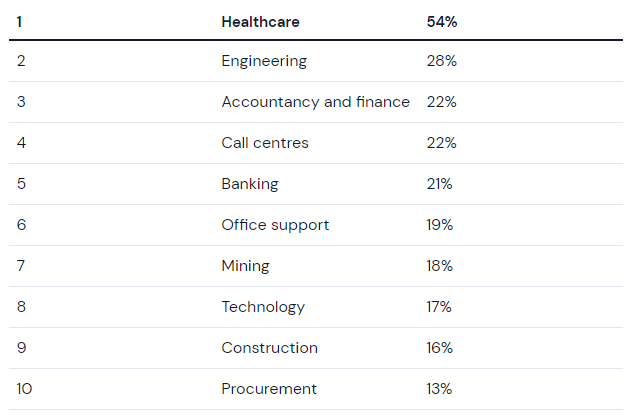

Allied health professionals, engineers, accountants, and people working in call centres are most likely to receive pay rises of 7% or higher.

Of the 14,000 respondents (consisting of 6,903 organisations and 7,392 professionals), 66% of employers plan to increase salaries by more than 3%- a significant step up from 37% last financial year.

Hays Asia Pacific CEO Matthew Dickason said demand for labour remains strong and skills shortages are forcing employers to push up salaries to retain staff.

“We’re calling this the year of the raise, where the promise of higher salaries reflects the intensity of the skills shortage in today’s job market,” Mr Dickason said.

“This year, both the number and value of increases will rise, continuing the upwards trajectory we first noted in last year's Salary Guide.

“Despite the increased salary boost, employer and employee expectations still fail to align. Only 28% of employees are satisfied with their current salary with most (71%) believing it doesn’t reflect their individual performance.”

Industries most likely to give an inflation-beating payrise

What’s driving salaries up?

According to Hays Salary Guide, there are four key factors motivating employers to increase salaries in their next review period.

- Competition amid a growing skills gap crisis

- Falling real wages

- Pay transparency

- ‘The great ask’

This financial year, 65% of professionals plan to ask for a pay rise, up from 58% last year and 45% the year prior.

Employees feel they have bargaining power as 52% believe they’d benefit financially from changing jobs while 64% said the skills shortage has made them more confident to speak up.

Should pay rises match inflation?

While almost four in five respondents say it’s reasonable to expect pay rises to keep up with inflation, most companies are either unwilling or unable to do so.

“Employers are sensitive to the hidden cost of falling real wages on employee engagement, mental health and wellbeing, morale and job satisfaction,” Mr Dickason said.

Instead, companies are increasingly relying on non-financial benefits to attract, reward, and retain staff.

However, Mr Dickason said the benefits companies are offering often differ to the perks employees want.

“While training, ongoing learning and development, and career progression opportunities are essential components of a successful benefits program, just 26% of employees are satisfied with their current benefits,” he said.

“They are now placing greater value on emotional salary - the intangible benefits that positively impact their emotional wellbeing and job satisfaction, like more than 20 days of annual leave.”

"The year of the raise: the workers set to land the biggest pay rises" was originally published on Savings.com.au and was republished with permission.