Assessing US recession risk isn’t getting any easier, but when it comes to cutting through the noise, I continue to rely on combining models for the single-best tool in the toolkit. To paraphrase Churchill, this is usually the least-worst way to evaluate the odds that an NBER-defined downturn is near or has already started.

In practice, estimating this risk in real-time has been straightforward compared to current conditions. But as I’ve discussed in recent weeks, the task has become considerably more challenging. The reasons are probably linked to all the strange and one-off events related to the pandemic. Whatever the explanation, the economy remains resilient despite several indicators suggesting otherwise.

Consider, for instance, the Conference Board’s Leading Economic Index, which appeared to find a smoking gun in December. This benchmark plunged at the end of last year, prompting an analyst at the consultancy to “project a US recession is likely to start around the beginning of 2023 and last through mid-year.”

Similar estimates have been highlighted previously, driven by a pair of proprietary business-cycle indexes. But as explained last week, the subsequent performance of the US economy has been resilient. The quick takeaway: the slide in economic activity in last year’s fourth quarter stalled and to an extent, reversed in this year’s Q1. The onset of stability following a slide in the macro trend is unusual and has postponed formal recession conditions.

The debate is whether a downturn is still likely in the near term. Or has the worst passed, and the expansion remains on track to persist? Unclear, but what is conspicuous is that combining business-cycle models has proven its worth in recent months, a strategy that draws on a long line of research.

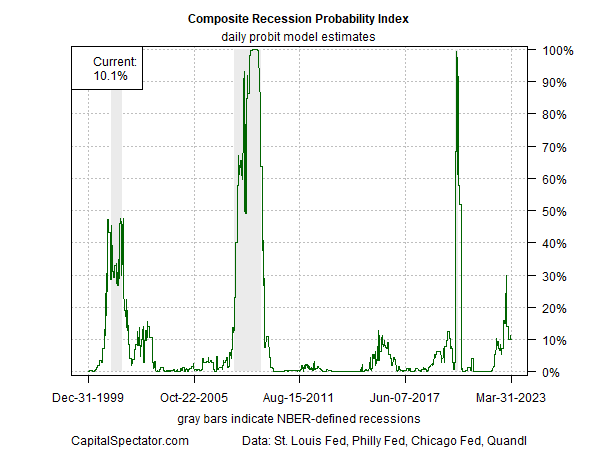

In the weekly updates of The US Business Cycle Risk Report, the first approximation for assessing the state of economic momentum is the Composite Recession Probability Index (CRPI), which aggregates five models: three are proprietary to the newsletter, plus the Chicago Fed National Activity Index and the Philly Fed’s ADS Index.

Each has its distinct set of pros and cons, making them complementary. The result, not surprisingly, is that when aggregating the data, the results provide a robust estimate of recession risk and – crucially – one that hasn’t been hoodwinked by the unusual macro signals swirling about lately. Although CRPI’s probability estimate of recession rose sharply to 30% recently, it’s since pulled back and currently reflects a low risk (as of Mar. 31).

Is CRPI infallible? No, but in the art/science of assessing recession risk, it’s probably on the short list of indicators that are as good as it gets for:

- Generating timely signals

- Having a high signal-to-noise ratio

That’s a high bar and one that’s difficult, if not impossible, for any one business-cycle model to reach. The logic is well documented over decades of research in various disciplines: combining complementary and relatively robust models tends to outperform single models.

There’s no guarantee that the ensemble approach to modeling will win every time. But measured through time, it’s likely to be the best of the lot. Recent history is merely the latest example.