- Tesla faces mounting challenges, with disappointing sales and an NHTSA probe weighing on the stock.

- Analysts are lowering expectations as Q4 sales miss targets, raising concerns about further declines.

- Key support at $360 could determine Tesla’s next move, with earnings reports adding to the uncertainty.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Tesla (NASDAQ:TSLA) stock, stubbornly hovering near the $400 mark, faces mounting challenges as the company contends with disappointing sales and an investigation by the National Highway Traffic Safety Administration (NHTSA).

After a turbulent year, signs are emerging that Tesla could experience further declines. Amid the Q4 sales slump and scrutiny over its “Actually Smart Summon” feature, analysts are lowering their expectations, with Bank of America (NYSE:BAC) shifting its stance from "Buy" to "Neutral."

The key support level to watch? $360 per share. A breach of this level could signal a deeper decline.

Sales Disappointment and Mixed Market Reactions

Tesla’s quarterly sales figures for Q4 2024 fell short of expectations, with the company selling 495,570 vehicles—well below the anticipated 512,250. While these results may initially dampen investor optimism, the company's performance in China provides some reason for hope.

Tesla saw an 8.8% year-over-year sales increase in the competitive Chinese market, selling 657,000 cars in 2024. As Tesla looks ahead, two new models—one targeting the budget-conscious market—are expected to drive sales in the coming months.

Technological Advancements Could Pave the Way Forward

Beyond sales figures, Tesla’s future hinges on its technological innovations. The company continues to make strides in Full Self-Driving (FSD) capabilities, with ambitions to equip 23 million cars with this technology by 2030.

Another crucial development is the robotaxi service, which BofA analysts believe could be worth $800 billion globally. But not all the news is positive.

Tesla is under investigation by the NHTSA over the “Actually Smart Summon” feature, which remotely summons a car. While this probe could affect millions of vehicles, Tesla’s history suggests that software updates may be the ultimate resolution.

Fundamentals Suggest a Deeper Discount for Tesla

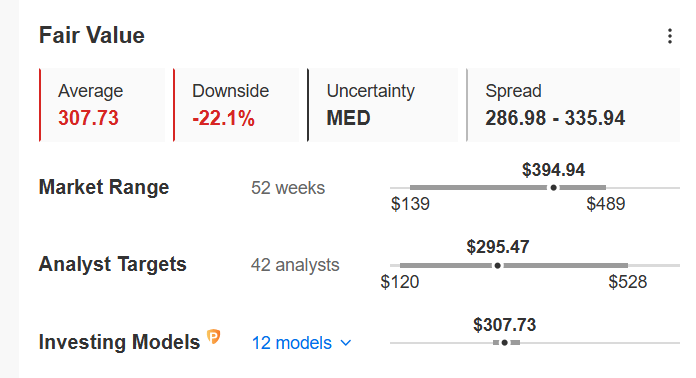

Tesla’s fundamental indicators continue to paint a bleak picture. InvestingPro’s fair value suggests the stock could be due for a more than 20% correction.

Source: InvestingPro

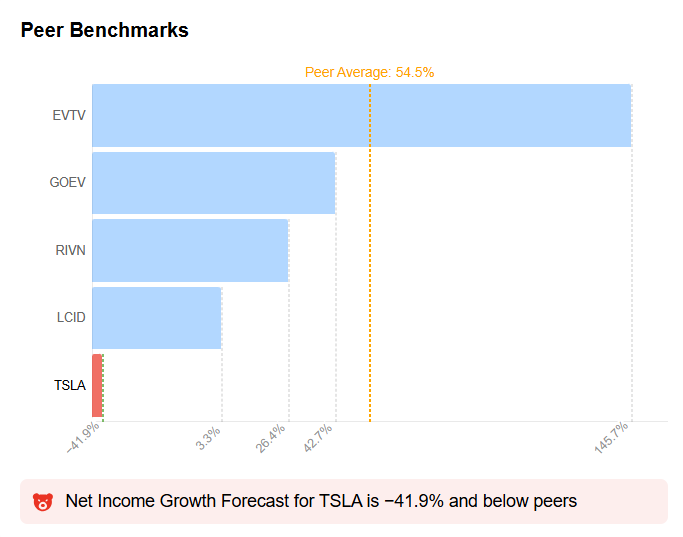

Adding to the concern is the projection of a possible decline in net income this year, exacerbated by intensifying competition. As the January 29 earnings report approaches, market watchers are bracing for more signals of a potential downturn.

Source: InvestingPro

Technical Breakdown: Watch for $360 Support

Tesla’s stock is currently moving within a correction pattern, having broken through its local uptrend line. The first major test will come at the $360 support level, which could determine whether the stock is headed for a deeper pullback.

A break below this level would open the door for further declines. However, if Tesla manages to rally above $420, it could signal a reversal and a potential breakout to higher levels.

Conclusion: Eyes on Key Levels and Earnings

As Tesla grapples with these challenges, traders and investors should focus on key technical levels, particularly $360, for clues about the stock’s next move. The upcoming earnings report will be a crucial catalyst in shaping Tesla’s near-term direction.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.