Realized volatility increased sharply yesterday, as expected, given that the S&P 500 gained over 1%. 10-, 20-, and 30-day volatility rose on the day. Additionally, the implied volatility unwind for S&P 500 components will start today when two of the Mag 7 stocks report results.

Alphabet (NASDAQ:GOOGL) and Tesla (NASDAQ:TSLA) will see their implied volatility plunge on Wednesday once earnings events pass, which will play into the volatility dispersion trade that has been rotating through the market. This should help push implied correlations higher over the next few weeks, as companies report.

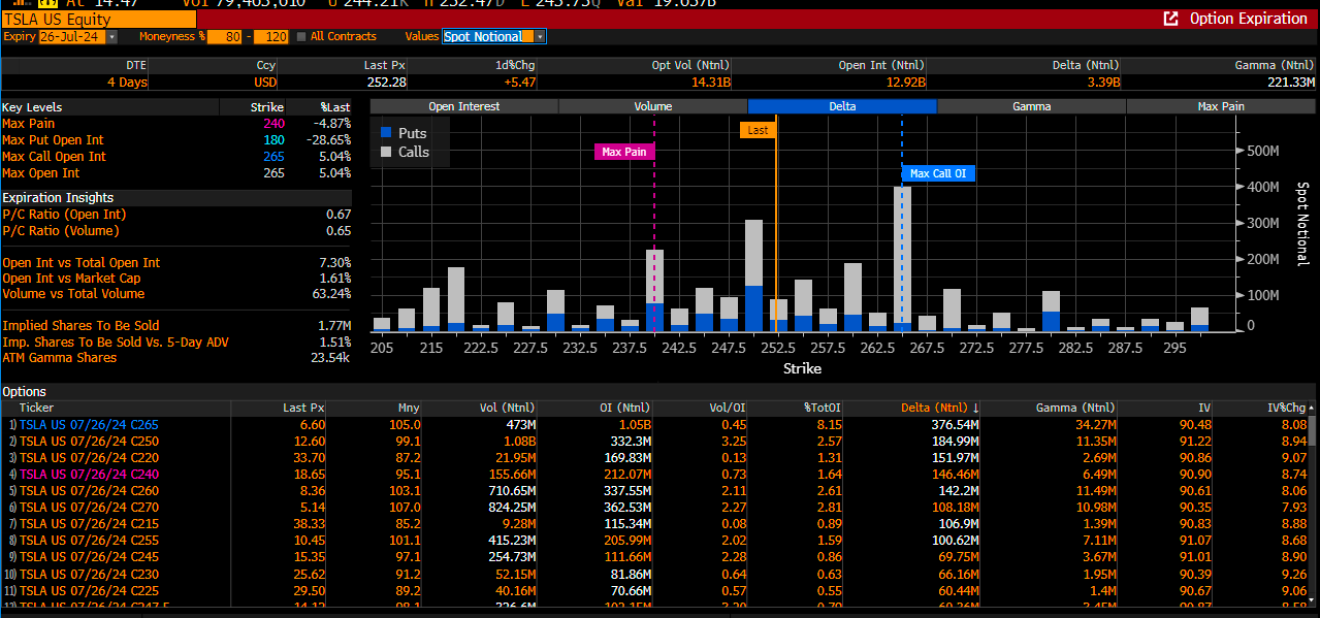

Tesla: Market Overly Bullish?

For Tesla, IV is pretty high, at over 90%, with a lot more notional value on the call side of the equation for this Friday’s expiration date. That may not favor Tesla after it reports results, with call IV and premiums getting crushed. Last quarter the market was too bearish on Tesla, this quarter, it seems the market is too bullish.

(BLOOMBERG)

I think that after yesterday, things in the market will change, with volatility expanding. Earnings season is ramping up today, and GDP later in the week could create more uncertainty. At this point, the biggest question is the state of the economy and whether or not corporate earnings will hold up as expected or continue to stagnate as they have for the last 18 months, around $240 to $242 per share.

The entire equity market rally was ultimately driven by multiple expansion based on earnings growth “expectations.” But if the earnings growth doesn’t materialize, then the multiple expansion probably wasn’t warranted, creating a re-rating of risk. Second-quarter earnings come beyond the year’s mid-point, and I imagine the third-quarter guidance will break the stalemate in the 2024 earnings estimates one way or another.