We may be toiling in the post-truth age, but I stubbornly remain stuck in old-school habits and favor hard data over the rising preference in some circles for creatively reframing facts.

Case in point: claims about US energy production, which became a hot-button issue at Wednesday’s Republican primary debate. If you accepted the candidates’ assertions it was easy to assume that America’s energy output has slumped sharply during the Biden administration. Former Vice President Mike Pence promoted this idea by arguing:

“One of the signature accomplishments of our administration was in just a few short years we achieved energy independence,” Pence said. “But on day one, Joe Biden declared a war on energy.”

He added:

“We’re going to open up federal lands, we’re going to unleash American energy, we’re going to have an all-of-the-above-energy strategy.”

The not-so-subtle implication: a radical U-turn is needed to reverse the dramatic decline in US energy production. The reality, however, is quite different when adopting the quaint idea of looking at the actual numbers, based on data from the US EIA.

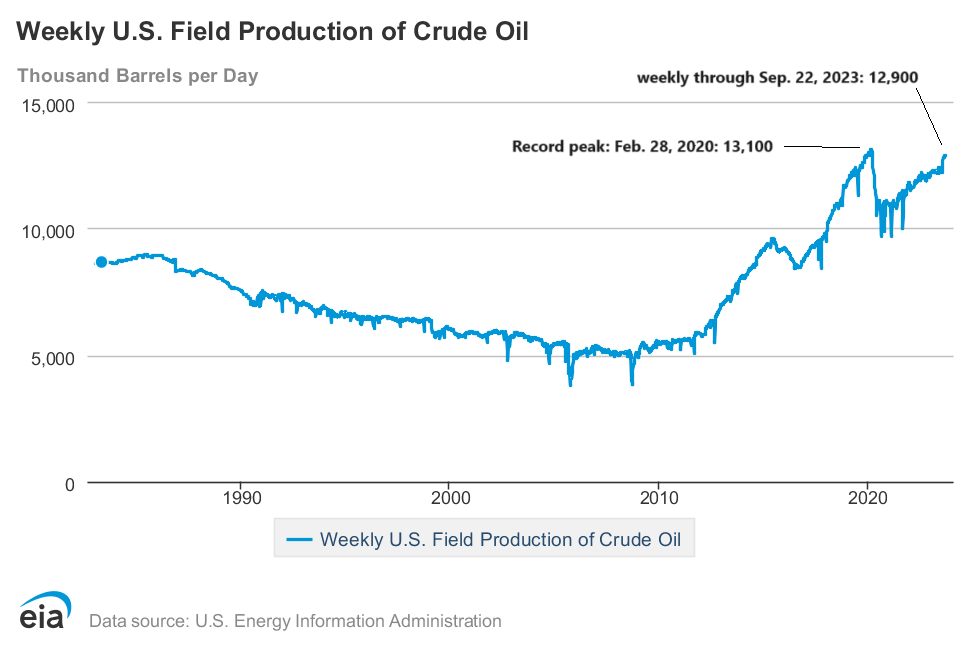

Weekly production of crude oil through Sep. 22, 2023, rose to 12.9 million barrels a day. For those of you keeping score at home, that translates to an 18% increase since Biden was inaugurated on Jan. 20, 2021, which marks a sharp rebound from the falloff during the pandemic.

The latest output level is still below the record peak of 13.1 million barrels for the week through Feb. 2020, but only slightly. If the recent trend persists, a new record high is likely before the year ends.

One can argue that the current recovery in output isn’t sufficient and that the administration could be even more aggressive in favoring what some might term a “drill, baby, drill” policy. But to suggest that America has abandoned its capacity to be energy-independent via domestic production requires an extreme bout of intellectual acrobatics that ignores the numbers in search of an alternative narrative.

In fact, there’s a strong argument to make that the Biden administration, for all its talk of pursuing a green energy policy, is moving too slow to curtail, much less reverse, US fossil fuel output. The numbers certainly provide support for that argument. But in the current realm of GOP politics, there’s no appetite to argue that view, to put it mildly.

In the post-game analysis/debate at Wednesday’s GOP talk fest, for example, California Democratic Gov. Gavin Newsom highlighted the rise in US energy to Fox News host and Republican stalwart Sean Hannity, who claimed “We were energy independent, and now we’re not.” Newsom correctly responded that “we’re more energy independent today — that’s a fact, look it up.” We did, and Newsom’s right, as the chart above indicates.

But Hannity persisted and falsely said that “Joe Biden has unilaterally disarmed [US energy production].” The facts suggest otherwise. Fortunately, facts are stubborn things, at least for those interested in understanding reality.