The 2023-2024 NSW Budget, to be released tomorrow, will include an additional $100 million of support for eligible concession card holders amid soaring power bills.

- The 2023-2024 NSW Budget will offer extra energy bill relief for eligible low-income households, pensioners, self-funded retirees, and families

- Eligible households could receive energy rebates of up to $350 from mid-2024, with $250 available for families and seniors

- It comes as Aussie energy bills rose 6% in the month of July

- The upcoming NSW Budget will also see rebates on EVs scrapped and $260 million set aside to invest in EV infrastructure

That will see certain energy rebates increasing by as much as 39% from 1 July 2024.

“We understand many people are doing it tough,” NSW minister for energy and climate change Penny Sharpe said.

“This additional funding will make a material difference to some of the most vulnerable members of our community.”

The extra funding will see the Low Income Household Rebate and Medical Energy Rebate increase 23% to $350.

The Family Energy Rebate will also jump 39% to $250, while those in a partial rate who also receive the Low Income Household Rebate will see their assistance climb from $20 to $30.

Finally, the Seniors Energy Rebate will increase 25% to $250 and the Life Support Rebate will increase by 22% for each piece of equipment.

Right now, the Life Support Rebate offers an annual rebate of up to $1,343 for eligible households who use at-home life support equipment, such as home dialysis, ventilators and oxygen concentrators.

All that is on top of the $326 million to be handed out via NSW’s six energy rebates and its crisis support payment, Energy Accounts Payments Assistance (EAPA), in 2024-2025.

Not to mention, eligible NSW concession card holders were able to receive a one-off $500 energy bill rebate from July via the Federal Government’s Energy Bill Relief Fund, administered by state and territory governments.

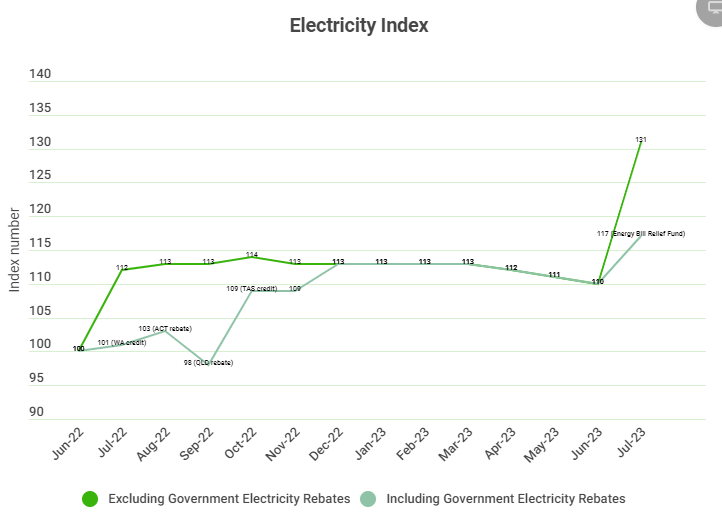

Energy prices across the nation soared 6% in July, the Australian Bureau of Statistics (ABS) found.

That figure would have been substantially higher – 19.2% – if not for Energy Bill Relief Fund rebates.

“The government is committed to keeping downward pressure on power prices at the same time as working to get more renewable energy into the grid, which will deliver cleaner and more affordable power,” Ms Sharpe said.

NSW EV rebate to be scrapped, $260m promised for EV infrastructure

NSW is also set to follow Victoria’s lead in scrapping rebates for the purchase of electric vehicles (EVs).

The state government currently offers rebates of up to $3,000, as well as stamp duty exemptions, for those buying new EVs or hydrogen fuel cell vehicles under certain price caps.

However, the Minns Government believes such rebates and exceptions risk driving up the cost of EVs.

“It’s important the scarce taxpayer dollars we have to transition to electric vehicles are being well spent,” NSW treasurer Daniel Mookhey said.

“Savings gained from cutting these costly exemptions and rebates will be reinvested, where it is needed, to deliver a more equitable and efficient EV roll out.”

The budget will include $260 million for EV infrastructure, providing more fast chargers on commuter routes, extra kerbside chargers near apartment blocks, grid capacity upgrades, and the creation of charging hubs able to support fleets.

The government hopes such projects will make EVs more accessible to people living in regional NSW, renters, apartment-dwellers, and people without access to home charging.

NSW residents who have already purchased or put down a deposit on an eligible EV will still be able to claim the rebate and/or stamp duty exemption.

Looking further ahead, a planned Road User Charge will kick off from mid-2027 or when battery EVs make up 30% of new light vehicle registrations in NSW, whichever occurs soonest.

It will apply to all zero- and low- emissions vehicles registered for the first time or transferred from 2024.

"Struggling NSW households promised $100m of additional energy bill relief" was originally published on Savings.com.au and was republished with permission.