Investors will be laser-focused on inflation and the kickoff of third-quarter earnings in the week ahead.

The release of October's Consumer Price Index (CPI) report takes center stage, providing fresh insights into inflationary pressures.

Also on tap are updates on consumer sentiment and the minutes from the Federal Reserve's September meeting, both of which could offer clues about the Fed's next move on interest rates.

The CPI swaps indicate that September inflation could exceed expectations. They are pricing in a 0.2% month-over-month increase for headline CPI and a 2.4% year-over-year increase, surpassing estimates of 0.1% m/m and 2.3% y/y.

The real risk is shelter inflation, which could surge based on trends in Shiller Home Prices and a potential 12-month lag in the CPI Shelter Component.

Why Last Week's Unemployment Numbers Shocked Markets

Last week’s unemployment report was shocking. During a live session for paying members, I found myself staring at the Nonfarm Payrolls data, unable to respond, coming in at 254,000.

The highest analyst estimate was 220k, and the whisper number on Bloomberg was 152,000. What made it even odder was that both August and July figures were revised higher, along with wages.

We spent three months working under assumptions based on the data, only for everything to unravel in seconds.

This makes me hesitate to shift from the “higher for longer” policy camp to the stagflation/recession camp. A 4% wage growth rate is inconsistent with 2% inflation but aligns with a 3% rate, assuming 1% productivity.

Wage Growth and Inflation

The data is inconsistent because the average workweek fell to 34.2 hours, a level not seen since the 2008 and 2020 recessions. It hit 34.2 hours three times in 2024. A drop below this level would raise concerns.

Aggregate Weekly Payroll Growth

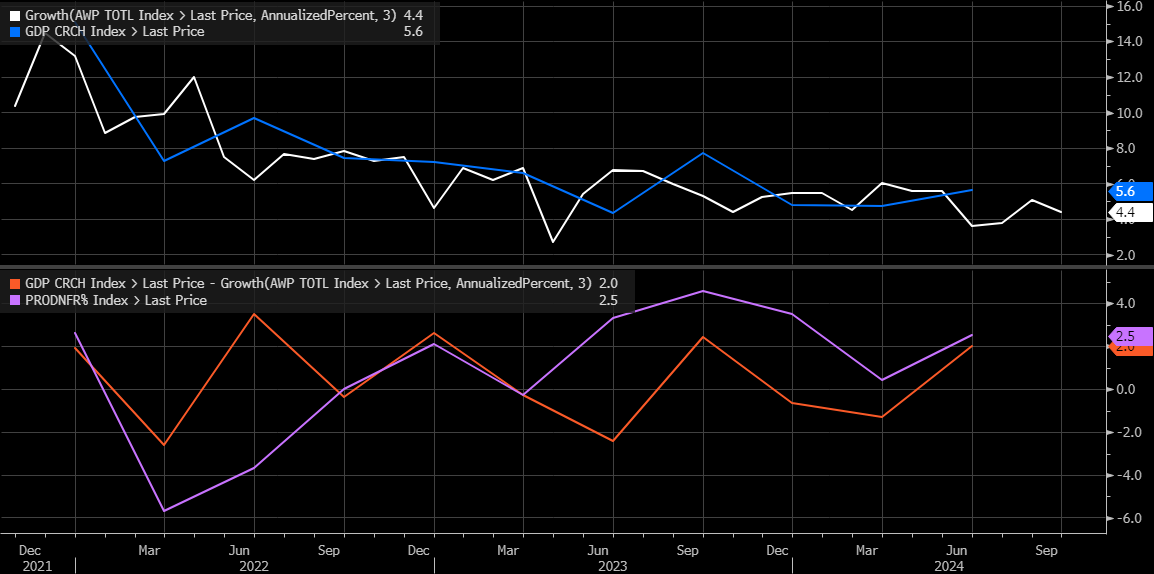

We saw the Index of Aggregate Weekly Payroll growth slow to just 4.9% year-over-year, near the lower end for this business cycle.

This suggests that nominal GDP growth for this quarter may have slowed as well, as the two tend to track closely over time.

The Aggregate Weekly Payroll 3-month annualized change reached about 4.4% in September, higher than June’s 3.6%.

Nominal GDP growth in 2Q was 5.6%, and the Atlanta Fed’s model estimates the same for this quarter. If payroll growth is rising while GDP remains steady, this indicates higher labor costs and reduced productivity, potentially fueling inflation.

Currency Market Impact: USD/CAD and USD/CHF

A hotter-than-expected CPI would strengthen the US dollar, particularly against the Canadian dollar (USD/CAD), which has already weakened. However, unless USD/CAD breaks 1.36, it’s unlikely to severely impact equity markets.

The other currency to watch is USD/CHF, which seems to have formed a diamond bottom pattern, indicating a potential return to 0.87 or 0.88.

Historically, this has impacted Apple’s stock price due to the Swiss National Bank’s significant $10 billion stake in Apple (NASDAQ:AAPL).

This movement also affects Microsoft (NASDAQ:MSFT) in a similar manner.

S&P 500 Technical Analysis

The S&P 500 remains in a secondary rising wedge pattern, and despite Friday’s unusual price action, this structure remains intact. Liquidity in the market is weak, and the top of the book hasn’t improved, leaving bid/ask spreads wide and gamma levels neutral. Should sellers step in, the market could be poised for a significant move downward. However, I’ve been wrong before and could be wrong again.