Stocks finished Friday slightly lower as June OPEX passed. This week, we head into the quarter’s end, closing out the year’s first half. It should be a fairly uneventful week with little on the macro front, and the PCE report is not due until Friday. Fed speakers will be around, but it appears to be a fairly light calendar. The Treasury will also auction off the 2-year, 5-year, and 7-year notes in the 1 PM time slots this week.

The PCE report has become a relatively non-event inflation report, as most people deduce its outcomes from the CPI and PPI prices. Even so, Fed speakers over the past couple of weeks have increasingly noted the need for several months of inflation data to feel comfortable with cutting rates.

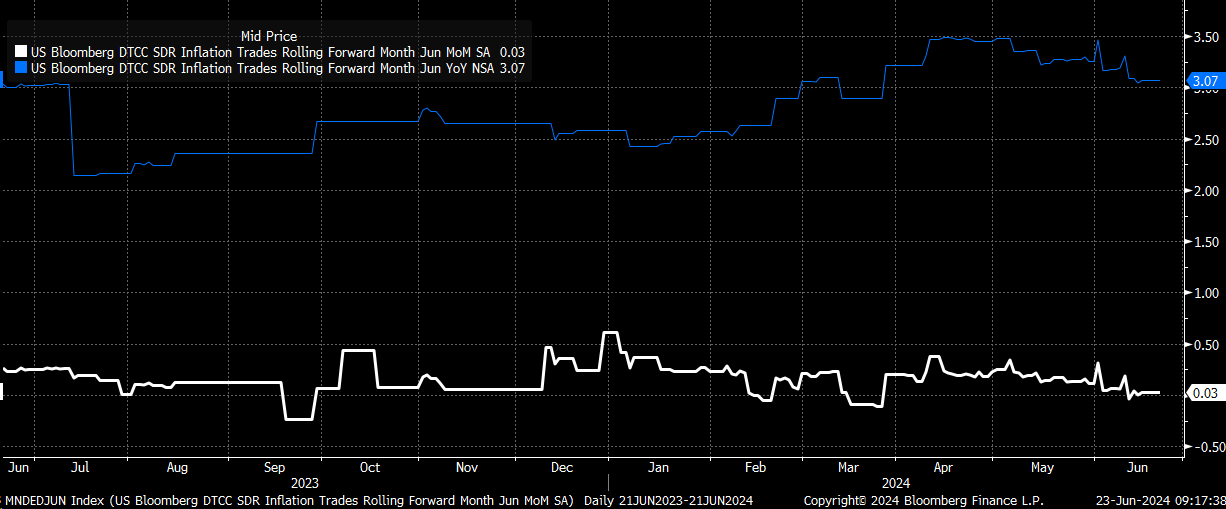

The odd thing about inflation is that it appears to have just suddenly vanished based on swap pricing. The June swaps are now pricing in CPI, rising by just 0.03% month-over-month and by 3.1% year-over-year. I’m not exactly sure how inflation can vanish as it has from the economy unless the economy is seeing a significant slowdown that now risks recession. It just doesn’t make much sense to me.

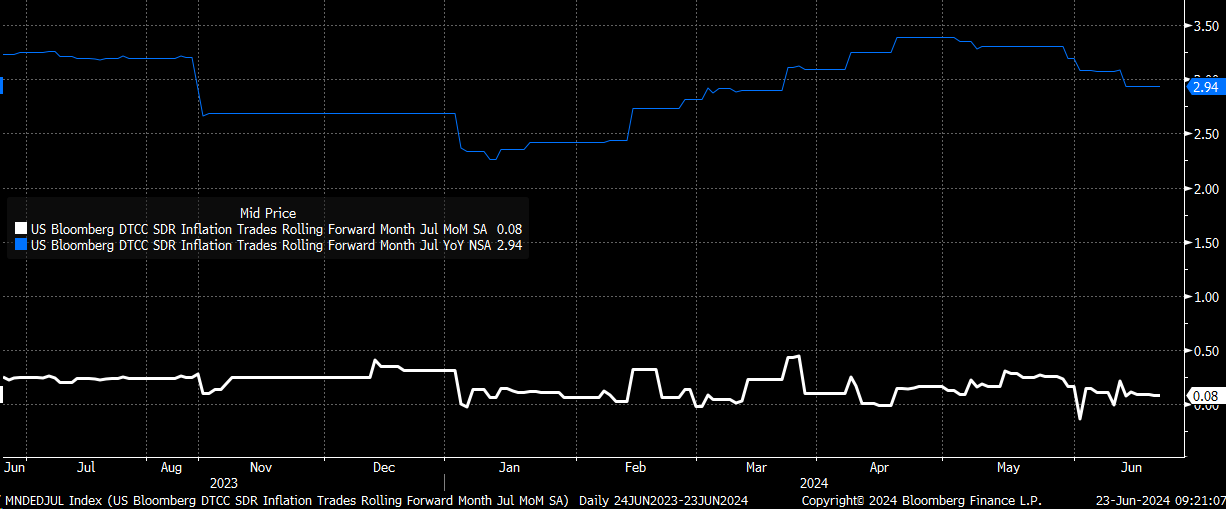

Even for July, inflation is expected to be non-existent, rising by just 0.1% month-over-month and by less than 3.0% year-over-year. So, either the markets are simply understating the risk to the inflation outlook for June and July, or something has materially changed in the economy over the past two months.

If inflation in May, June, and July has vanished, then growth has likely vanished, too, because it would suggest that nominal GDP growth has rolled over. Currently, GDPNow suggests that nominal growth is around 5.5%, which would be higher than the first quarter’s nominal growth of 4.3%. In the first quarter, real GDP was around 1.3%, with a 3% inflation rate.

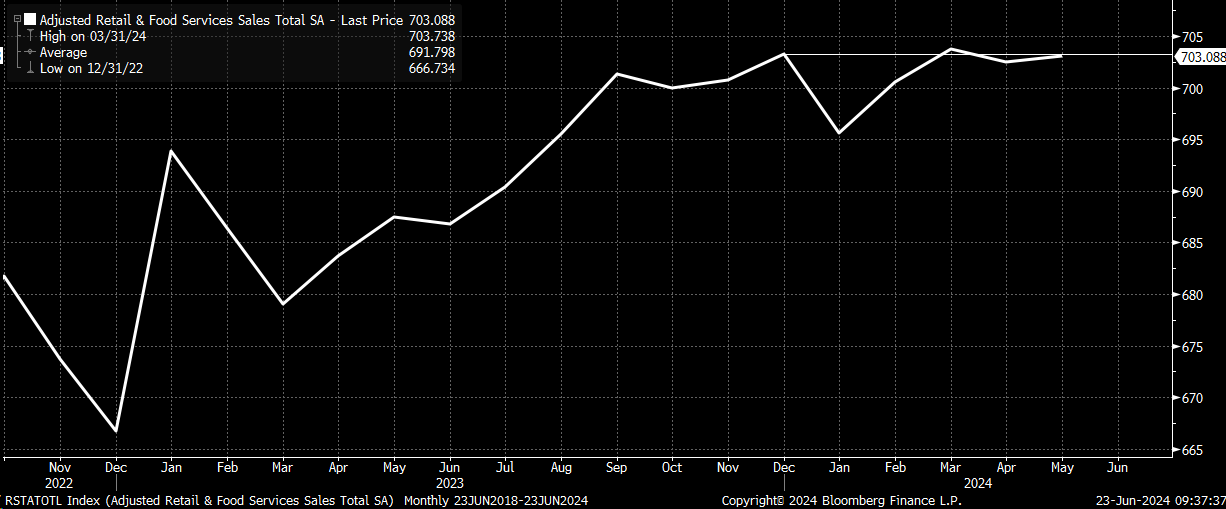

The retail sales data suggest that consumers are exhausted. April’s figures were revised to show a decline of 0.2% from an initial estimate of 0.0%, and May’s figures came in at a modest 0.1% increase, missing forecasts of 0.3%. Retail sales have plateaued since September. This suggests that the economy may be experiencing a significant slowdown, but it’s challenging to quantify this trend with only a couple of month’s worth of data. Additionally, this week’s data is unlikely to provide further clarity.

Something may have changed because we are seeing bank deposit growth. This could indicate that the money supply is starting to grow again, which may be slowing the velocity of money. As the velocity of money slows, inflation tends to come down. This phenomenon occurs because a slower velocity of money means that money is circulating less frequently in the economy, reducing upward pressure on prices.

2-Year Rates Indicate Fed Might Cut Rates Later This Year

Given this context, it is unsurprising to see rates moving somewhat lower over the last few weeks. The 2-year Treasury yield seems comfortable around the 4.75% region, reflecting current data and expectations that the Fed might cut rates later this year. A break below this support level would indicate that the market anticipates rate cuts by the Fed, while a move above 5% would suggest that the Fed might raise rates. The market is leaning towards expecting rate cuts.

The upcoming 2-year Treasury auction can provide significant insights into market sentiment. A strong auction would indicate nervousness among investors, suggesting they expect rates to head lower over the medium to long term.

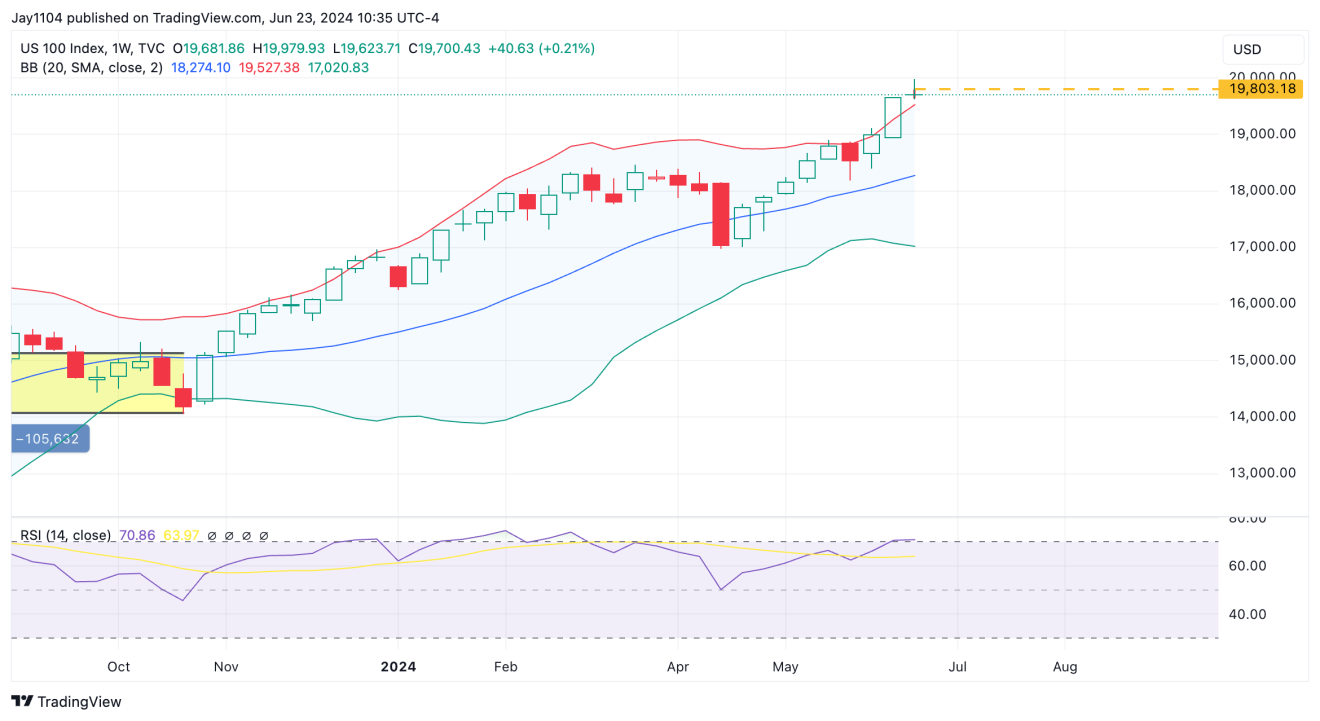

Nasdaq Remains Overbought

Meanwhile, the NASDAQ closed one full bar above the upper Bollinger band this past week, with an RSI above 70, indicating a pretty overbought condition. If the market is to pull back, then this week seems as good as any, especially given that we are now past OPEX. Gamma levels will be greatly reduced, allowing for prices to swing in a much larger trading range, given that the pinning we see around options expiration has now passed.

S&P 500: Pullback on the Horizon

On the weekly chart, the S&P 500 is trading above its upper Bollinger band and has an RSI of nearly 74. The index is overbought, and based on current conditions, this week a pullback seems possible.

We also saw the index trade within range following Thursday’s bearish turn lower, and given that it is not uncommon for the trend lower to continue, the symmetrical triangle from Friday also suggests a consolidation period and perhaps another leg lower to start the week.

Nvidia to Test Support at $125

Nvidia (NASDAQ:NVDA) had a large amount of gamma built up around $125 on Friday, helping to support the stock, but that appears to be gone now. This means the stock can more easily break support at $125 when we start this week, with the next major level of support not coming until $120, where there is a gap to be filled.

Meta Nearing the Bottom of Its Trading Channel

Meta Platforms (NASDAQ:META) has filled the post-earnings gap and is now nearing the bottom of its trading channel. Momentum has clearly shifted from positive to negative over the longer term, and a break of the uptrend could confirm an overall shift in Meta’s shares, pointing to a lower trajectory.

XLE Consolidating Despite Positive Trends

Despite some positive trends, the XLE has been consolidating more recently. If the XLE is in a bull flag, which it appears to be, then a move higher in the near term seems possible. However, it would likely need to get over $92 to see that downtrend break. Conversely, a drop below $88 would be bearish, suggesting lower prices.