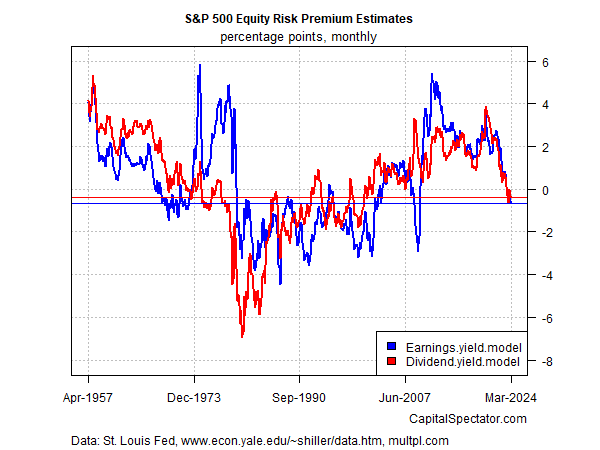

The roaring US stock market has delivered red-hot gains in recent history, but at the expense of future returns. That, at least, is one interpretation via earnings-yield and dividend-yield models that estimate the ex-ante equity risk premium (ERP). Based on a specific run of number crunching, this pair continues to estimate a negative ERP.

The pushback is that artificial intelligence (AI) and related technology innovations have changed the calculus. Maybe, but even wide-eyed optimists should consider the recent decline and fall of two flavors of estimating what stocks will deliver over the so-called risk-free rate in the years ahead. These forecasts aren’t destiny, but surely they’re relevant discussion points.

For this exercise, I’m running the numbers two ways: the earnings-yield model (EYM) and the dividend-yield model (DYM). The 10-year US Treasury yield is the “risk-free” rate. There are other choices, of course, and so results will vary, depending on your preferences. But this is an obvious way to start, if only as a baseline.

For EYM, I’m using the trailing S&P 500 earnings yield less the 10-year US Treasury yield. The formula for DYM draws on the frameworks of the Gordon Growth Model and Dividend Discount Model, which boils down to taking the current dividend yield and adding a growth estimate. There are several variations for estimating growth — let’s use the rolling 10-year growth rate for the US economy (based on real GDP). The assumption here is that the stock market’s dividends will grow in line with economic activity over the long run.

Running the numbers shows that both EYM and DYM are estimating the equity risk premium as modestly negative. In fact, the current estimates mark the first time we’re seeing a sub-zero equity risk premium in many years (except for a brief period for EYM during the 2008 financial crisis).

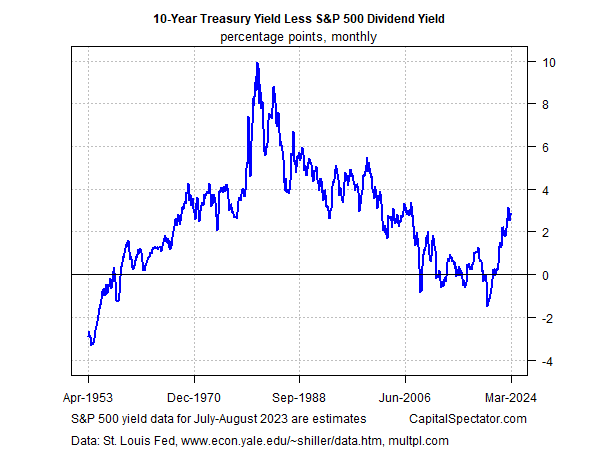

The result isn’t surprising when you consider that the 10-year yield continues to trade well above the S&P’s dividend yield, as shown by the second chart below. The key takeaway is that bonds continue to present a competitive alternative to stocks, which in turn has asset allocation implications.

There are caveats to consider, of course. Estimating risk premia for the long run may or may not be relevant in the near term, which tends to be dominated by trend. On the latter point, the bullish trend for the S&P 500 and other equity indices implies that stocks are still on track to deliver strong gains.

As always, the critical question is: When does the longer-run valuation outlook overtake the shorter-run trend factor? That, of course, is the question that every investor struggles with. Unfortunately, there are no easy, much less flawless, answers.

Nonetheless, from a calculated risk perspective, the case for incrementally adopting a defensive posture has a certain appeal, even if trend continues to make mincemeat of that decision.