In investing, considering all available factors can be the difference between a loss and a profit. The September Effect is one of those factors that sits in the background noise of market signals. Sometimes, perception plays a role in market dynamics as expectations feed back into investor action. Whether real or not, how does the “month to avoid stock” play out this time?

What is the September Effect?

In the United States, the fiscal year ends on September 30. This is the time for preparing financial statements across the federal government and many organizations. In such a period, investors restructure assets to lock in tax losses and profits, which may lead to stock liquidations. It would then be no accident that this period coincides with the perceived September effect, later followed by the January effect.

As market anomalies, both effects manifest as downturns without apparent cause that can be easily quantified. Being neither predictive nor consistent, the September Effect is another vague signal that asset underperformance could be expected.

Jeremy Siegel of the Wharton School of Business Administration attempted to quantify the September Effect in the paper “September: A Month to Avoid Stocks”. The finance professor concluded that the Dow Jones industrial average dropped in 63 September's from 1890 to 1994, only to rise across 41 September's.

However, it cannot be conclusively stated that September is the worst-performing month. Moreover, in recent decades, the perceived effect is further waning in consistency. So much so that Siegel himself, in last Friday’s Behind the Markets podcast, is optimistic for this September.

Macro Factors that Defy September Expectations

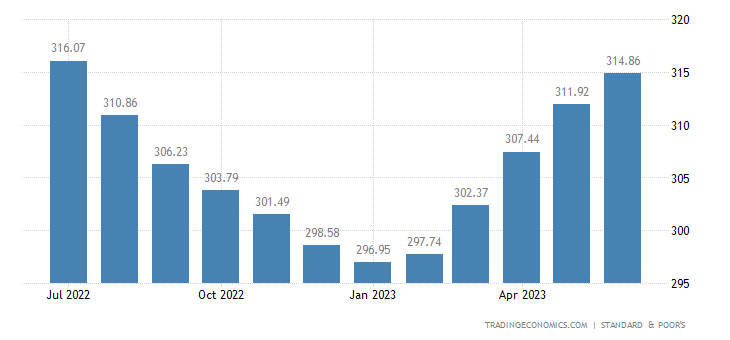

Otherwise known as the “Wizard of Wharton,” the retired professor cited several factors for a bullish outlook. One of the indicators comes from resilient housing prices, which are certainly more resilient than expected.

This may seem unusual given that mortgage rates surpassed 7%, but most housing market has rates locked in under 5%. In turn, houses are locked in, keeping the supply lower than demand for the time being. Siegel believes investors are now treating both stocks and homes as inflation hedges.

Regarding the underlying dynamic between the Fed’s interest rates and inflation, Siegel noted that the inflation rate is now sufficiently low for the Fed to remain in standby mode.

“The likelihood that the Fed will raise in September is now almost nil, and in fact it puts the November increase in doubt”

This likelihood increases if the labor market continues to loosen up, a concurrent theme across all FOMC meetings since the hiking cycle began in March 2022. Inflation can only sustainably decrease if people have less money to pay for goods and services.

“The labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers.”

Jerome Powell at the annual Jackson Hole conference in August 2023

The latest JOLTS data for July shows a drop of 338,000 job openings; this signals the Fed to stay the course without more rate hikes. This would signal to the market that capital will not get even more expensive.

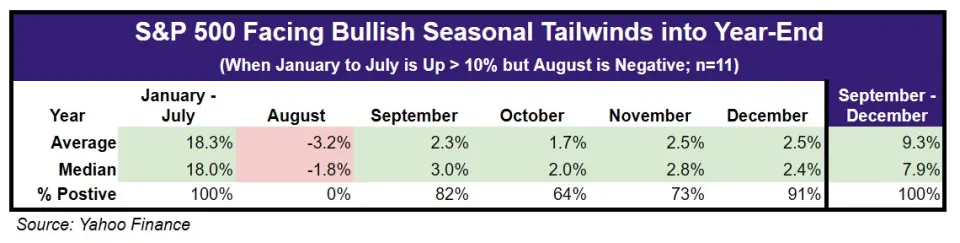

Tweaked Data Goes Against September Effect

If the September Effect is taken for granted, what if the trend considers this year’s paradigm precisely? The stock market went up until July, only to weaken in August. Accounting for 11 such historical instances, September doesn’t look that different from other months.

Apple is yet to surprise the market with its AI offering, presently under works as Ajax generative AI. This may be announced alongside the unveiling of new major Apple products on September 12th in Cupertino, California. Investors expect these to be Apple Watch Series 9 and iPhone 15 Pro/Max. The sentiment will likely spill over enough to countervail September Effect expectations if the market reception is positive.