This article was written exclusively for Investing.com

Market gyrations are only likely to grow worse in the weeks to come. Real rates are rising and the current earnings season is not going smoothly. So coupling this with the prospect of the Fed raising rates 4 or 5 times in 2022 is making investors very nervous.

The Fed's plan to tighten monetary policy while corporate earnings growth is slowing will make things very challenging for the stock market. It may not turn out to be the smooth sailing many investors and analysts initially projected. Ultimately, stocks are expensive on an index level for both the S&P 500 and NASDAQ, which means the froth will need to be taken out of the market via a lower PE ratio.

Rising Rates

On top of that, the higher real rates rise, the faster that multiple will compress. As noted last week, real rates on the 5-year TIP have increased dramatically, and as of this writing, they continue to rise. What makes matters worse is that the ECB may soon be in the game of raising interest too. Resulting in rates across Europe starting to increase, which will also help to boost rates in the US.

Uncertain Outlooks

Now, equities don't even have the comfort of stock earnings to lean on anymore, after Netflix (NASDAQ:NFLX), PayPal (NASDAQ:PYPL), and Meta Platforms (NASDAQ:FB) provided weak results and guidance. It resulted in those stocks falling more than 20%. At the same time, their guidance calls into question just how clear the outlook for 2022 and beyond really is for many sectors of the stock market.

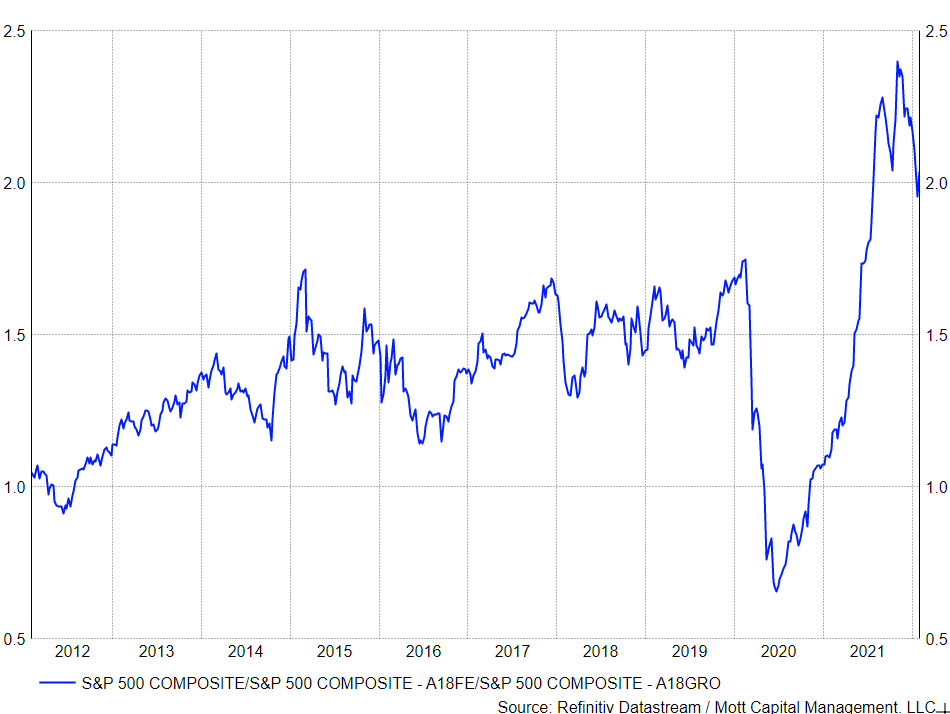

The outlook for stock more generally is weak, relatively speaking, when considering stock market valuations. Earnings growth over the next 18-months for the S&P 500 is forecast at just 9.6%, down from a peak of 28.1%. Additionally, the index is currently trading at 19.5 times earnings over that same period. The growth-adjusted PEG ratio is a stunning 2.02, well above the upper end of the historical range. It would suggest that the current PE ratios are too high, given the market's growth rate.

Don't Fight The Fed

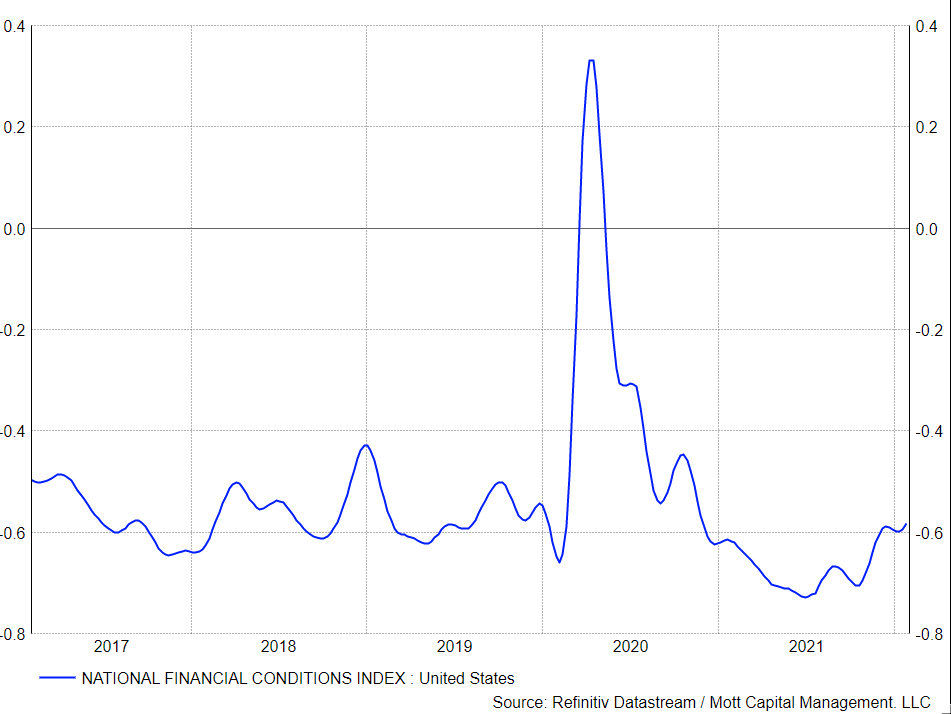

When real yields are profoundly negative, along with ultra-easy monetary policy and very accommodative financial conditions, the equity market could withstand that type of valuation. But that is now changing, with financial conditions tightening and the Fed looking to push real yields higher to combat high inflation rates.

When bringing all of this together, the equity market has two major issues ahead of it. The first is a Fed tightening monetary policy and rising rates. The second is a significant deceleration in earnings growth in 2022. On top of that, some of the companies that have been the lynchpin of the market over the past 24-months are now facing much uncertainty.

All of this will make the ride for 2022 more volatile than expected, as investors begin to digest the potential risk in the market during this revaluation period.