- 2022's volatile market continues to offer opportunities

- Spotify's growth story is still on track

- The investment story is out of fashion, which makes it more interesting

The last time I wrote about the markets, I talked about bear market shopping. As often happens in the stock-analysis business, I looked a little silly. The title emphasizing a bear market bottom came in the week the market bottomed, at least so far for this year. As the saying goes, by the time it’s in the news, it’s in the price.

Still, I said there were more interesting buying opportunities than I had seen in a while. I think that holds up, even with the S&P 500 up 5+% since then (using Friday mid-day prices) and other indices up more. I’m still of the view that the U.S. economy is not going off a cliff, even as Europe and other markets are more challenged. I don’t have a much more sophisticated macro view than that—will we hit a recession technically or more deeply, will the Fed pivot or keep tightening, will inflation slow down? I can’t say. However, I think it’s still an opportune time to buy.

I organize the buying opportunities into four buckets:

- High-quality companies that have sold off and are now at a fair price. Say, Google NASDAQ:GOOG) (NASDAQ:GOOGL) at 21-22x free cash flow.

- Companies caught in an industry with a severe but likely temporary downturn, i.e., COVID-hangover companies that have seen their stocks dive this year. Google and advertisers could fall into this bucket, but a company like Zoom Video Communications Inc (NASDAQ:ZM) is a better example.

- Companies that are over-earning and that the market is pricing in a meaningful pullback--but where the pullback may be overestimated. Most of the names I mentioned in the last article—housing-related stocks and specifically Williams-Sonoma Inc (NYSE:WSM) typify this category.

- Special situations; market stress tends to widen merger arbitrage spreads and create more opportunities for people who can dive in on this sort of work.

There’s some overlap, of course, and you may like other types of companies, but those are my stand-out groups.

I’m going to write about an example stock from each group over the next few weeks. I own stocks in each category, though for these articles, I’m going to analyze companies I haven’t bought into yet, to see whether there’s still an opportunity.

Let’s start with a company between bucket one (high quality) and bucket two (localized recession).

Spotify: The Audio Leader, But Not Yet A Profit Factory

Spotify Technology (NYSE:SPOT) feels like—and sounds like—a high-quality company. It is the market leader for streaming music, the leader in podcast listening, and a leading consumer brand. Spotify has a founder-CEO (Daniel Ek), positive free cash flow on a last twelve months basis since mid-2019, and has only raised capital since coming public (including its IPO, which was a direct listing) by selling convertible notes with 0% interest at the peak of the meme stock bubble in February 2021—which is just smart corporate finance.

The company’s stated aim at their recent investor day is to become people’s homes for audio and listening. It wouldn’t be surprising to see the company gain leadership in audiobooks now that they bought Findaway. The presentation left space for unknown future categories that Spotify might add to its ‘audio platform.’

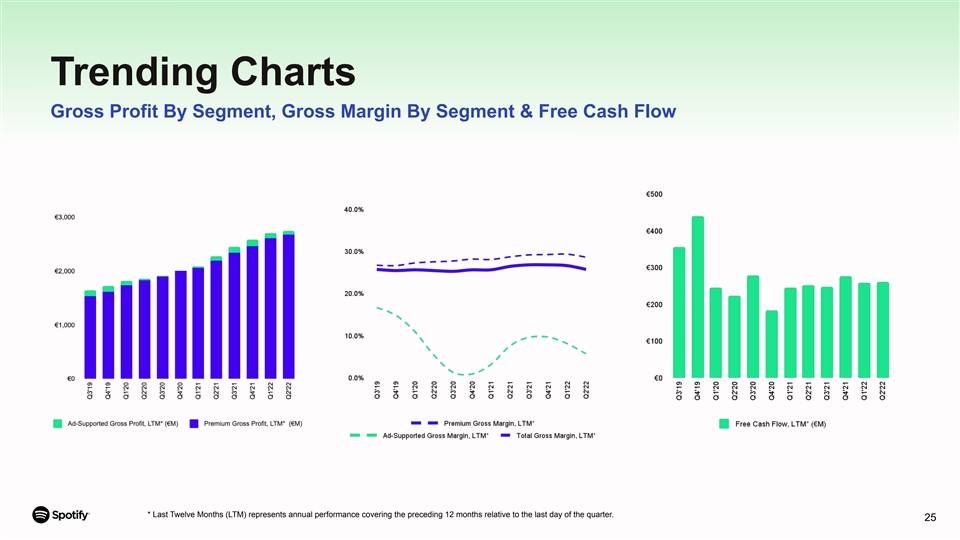

Source: Spotify's Q2 Presentation

At the same time, Spotify doesn’t actually make money. Gross margins are stuck in the mid-high 20s, a result of the company relying on a commodity–-licensed music—controlled by an oligopoly of music labels. The free cash flow is an artifact of share-based compensation, negative working capital from their payment timing, and the fact that acquisitions are a high cost below the free cash flow line.

Spotify argues it is investing in growth, especially in podcasts and its marketplace vertical--working directly with artists, in part creating an end-around from labels or at least a new profit center with them—and that core gross margins are growing. Still, the core music business will never be a huge gross margin business, and it will take a long time for that music business not to be core.

Furthermore, the Stockholm, Sweden-based giant is facing a temporary downturn in several ways, though they are holding up better than many peers. Advertising is one of the hardest hit sectors in the 2022 market; Spotify has sold off at times in sympathy. In this vertical, though, Spotify is not overly reliant on ads—13% of total revenue in Q2, a record high for the company—and is also a share gainer, posting 31% last quarter. Then usage of pandemic-boosted products, like digital apps, has slowed in many cases.

Spotify is also seeing slowing growth rates, but in line with its historical trends, and claimed on its Investor Day that retention is improving. So that’s not really hitting Spotify.

The most significant localized recession risk Spotify is facing is investor enthusiasm for growth stocks, and perhaps in the podcast story. Spotify’s stock’s outperformance kicked into gear when the company announced an exclusive distribution deal with Joe Rogan, a leading podcaster. The stock more than doubled in the following eight months as a new narrative and strategy crystallized.

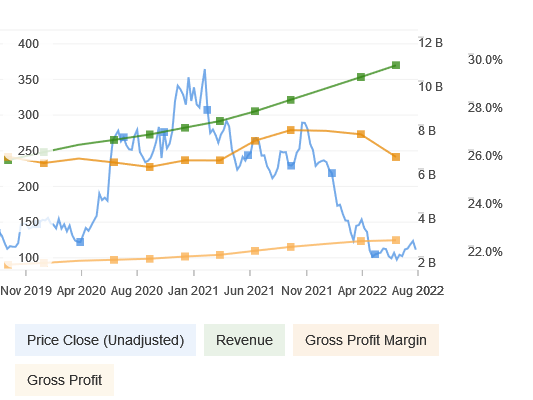

Since then, the stock has dropped as much as 70% from all-time highs and is now back at its 2019 range. As the company has grown revenue and gross profits, valuations are certainly more attractive now.

The outstanding question is if and when that growth will turn into real free cash flow, as the podcast story has proven not to be a quick fix or magic bullet.

Source: Investing Pro+

Promising Business Notes

Spotify’s core business trajectory hasn’t changed much, which is both a plus and a minus. This fell into the sexy growth-stock bucket and often gets compared to Netflix (NASDAQ:NFLX), but it won’t have a sudden House of Cards moment, as the Rogan experience has proven so far. At the same time, its COVID hangover is much milder, and while I, too, have no specific confidence they will achieve their 1 billion monthly active users target by 2030 (a 9-10% CAGR over that time), that CAGR is not crazy either given they are still in the mid-teens year over year.

The profitability story they told at the Investor Day makes sense, at least in the podcast vertical. I don’t think podcasts are a revolutionary medium, speaking as both a producer/host and listener of podcasts. Still, they can be modern radio with an added efficiency from knowing the listener better.

The strategic position Spotify is building feels like it should give them more opportunities. Recent news they are testing selling concert tickets to listeners is both inevitable and promising, as that’s a vertical Spotify would seem to have a natural foothold in. If Daniel Ek and co are not looking at Live Nation’s market cap and thinking they can’t take a chunk of that one way or another, I’d be surprised.

Spotify’s business also seems low-risk. Spotify controls its own destiny financially with positive free cash flow. Antitrust scrutiny on Apple (NASDAQ:AAPL) and Google should at least keep Spotify from being further limited in any way by those key partners, and Spotify seems to have figured out the relationship with music companies. And while Spotify is not beloved by the musicians they work with, neither are the labels, Live Nation, or giant corporations like Apple and Amazon (NASDAQ:AMZN).

The two drivers to Spotify’s business success will be maintaining its steady growth in market leadership as measured by MAUs and subscribers, consolidating its position as a leader, improving margins, and/or expanding to new verticals.

Sounding Out The Valuation

Buying Spotify shares here requires one or two things beyond conviction that Spotify can have that business success. First, belief that the pots Spotify is playing for are big enough to be worth it, and second, that we’re not paying too much right now to wait for Spotify's success.

What I’ve always gotten stuck with on Spotify is that the company’s total addressable market should be easy to measure, and it’s not all that exciting. Spotify’s TAM = the recorded music industry + the radio advertising industry (digital and legacy radio) + audiobooks, and that last is still a very new/unproven addition for Spotify. They’re locked into only a certain percentage of the recorded music industry given the role of labels; it’s hard to imagine the global radio industry is going to be that lucrative to a $19B or so enterprise company that was valued much more a few months ago. Spotify is probably expanding the recorded music industry's reach to a more casual and global audience, but there are limits to it.

The part that has most changed in the story, though, is that the entry price is more reasonable. At $19B in enterprise value, we’re getting a 1.6x 2022 estimated sales multiple, or a 6.6x 2022 gross profits multiple (assuming 25% gross margins), which allows us to adjust our thinking for Spotify’s structurally lower gross margins. That’s not a steal, per se, but it’s the lowest Spotify has been.

Spotify’s Song Could Be A Grower

If Spotify continues to scale as a financial model and as a business force, using its leadership with consumers to get into parallel business lines, I don’t think it’s hard to sketch out a robust growth trajectory. That investing style is out of favor in the post-pandemic market, as investors expect clearer and quicker profitability and payback, which makes Spotify sound a little better as a contrarian play.

I’m not quite buying it here, but if it sinks into double digits again, it may be hard to turn off that track.

Disclosure: I am long Zoom and have no positions in any other stocks mentioned, nor immediate plans to open positions in any other stocks mentioned.