- US indexes stabilized, but weak buying pressure kept the S&P 500 and Nasdaq in a downtrend.

- Both indexes struggle to regain momentum as selling pressure persists.

- Key resistance and support levels set to decide how indexes end the week.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners.

The past week saw US stock indexes stabilizing after weeks of declines. This was supported by the Federal Reserve’s latest meeting, which brought no major policy changes, and stalled peace talks over Russia’s aggression against Ukraine.

However, since buyers showed little strength, both the S&P 500 and Nasdaq 100 continued to trend downward.

In Europe, stocks saw a small rebound in the second half of the week, but this did not change the overall upward trend. Still, sellers might push prices lower to test key support levels and see if buyers step in.

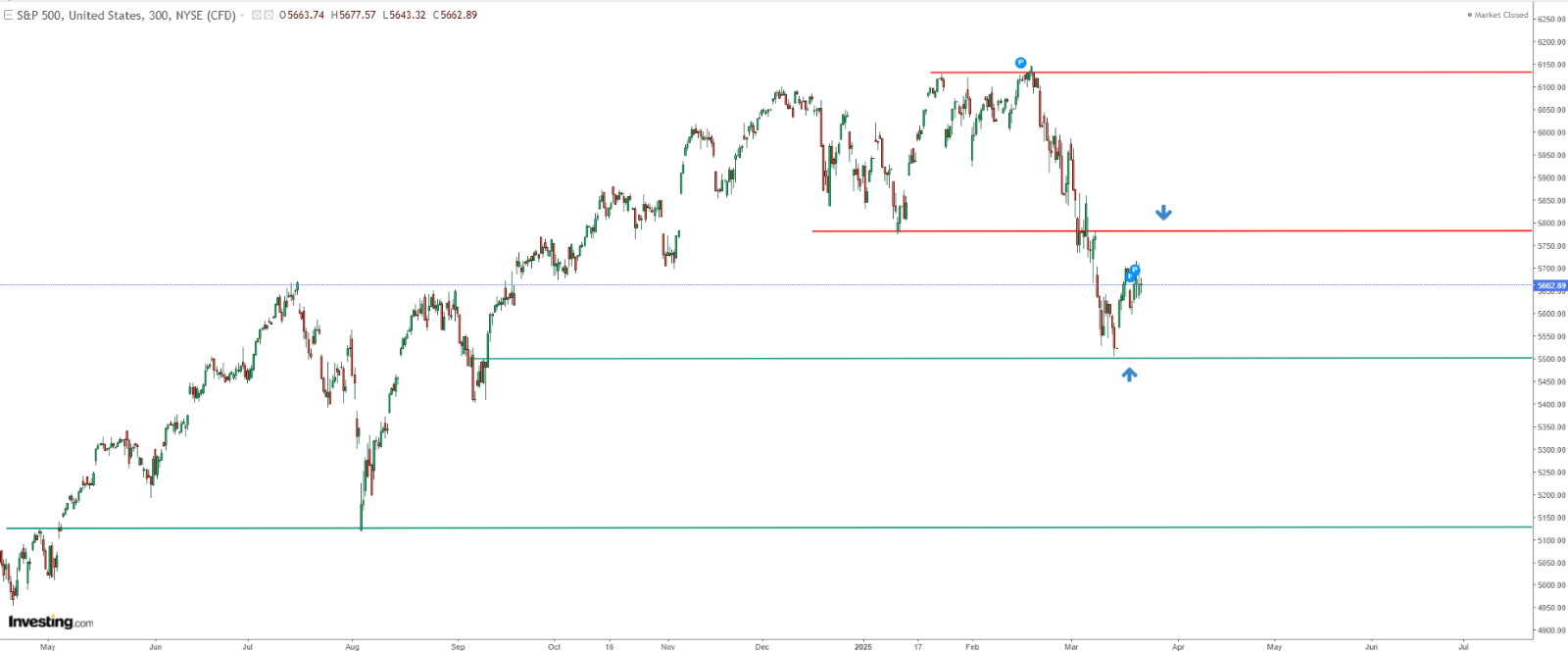

S&P 500 Trading Between Key Price Levels

The sharp decline in the S&P 500 halted around the 5500-point support zone, leading to a rebound and a period of consolidation. The index is now trading between the 5500 support level and the 5780 resistance level.

From a technical perspective, the recent rebound looks corrective, suggesting the downward trend may continue. If sellers break through the current support zone, the S&P 500 could fall further, potentially reaching the 5100-point level.

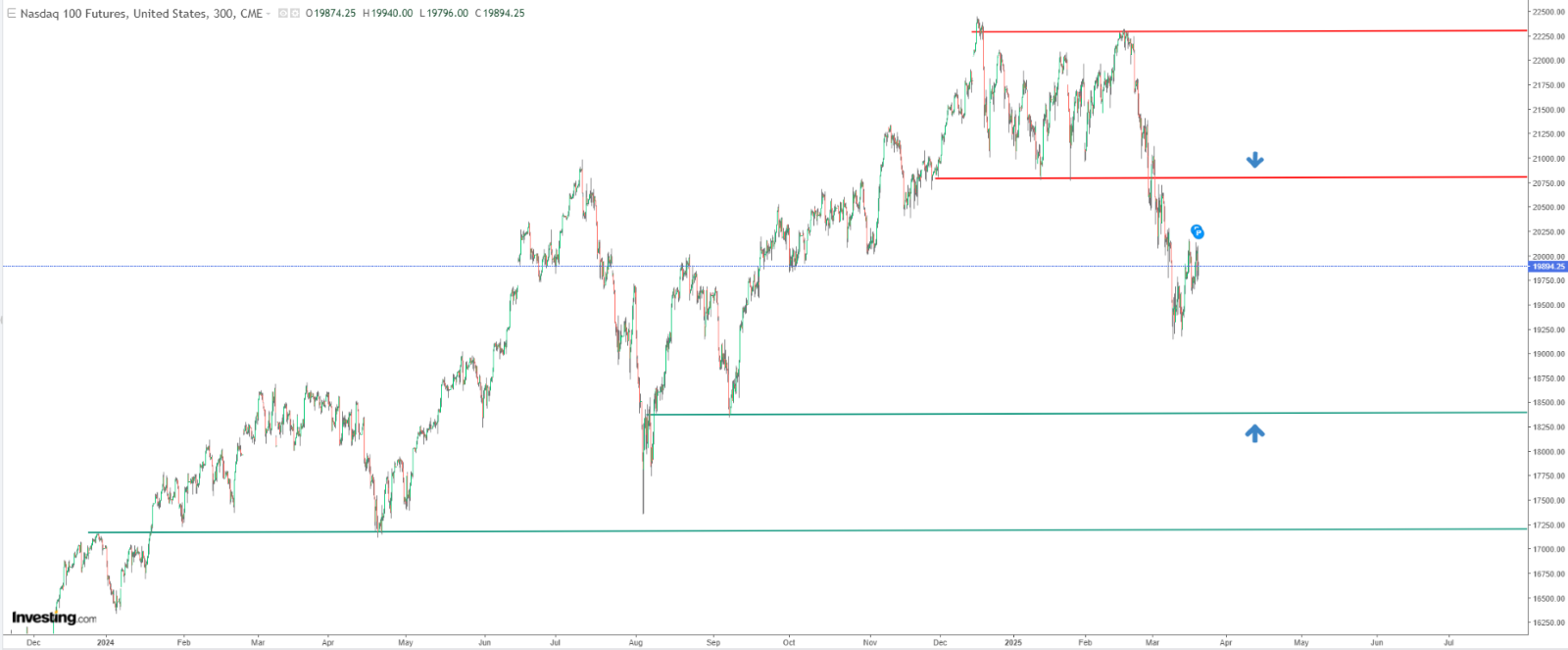

Nasdaq 100 Declines Losing Momentum

The Nasdaq 100, like the S&P 500, has slowed its decline just above the 19,000-point level. The next sessions will be crucial in determining the market’s short-term direction. If a rebound continues, resistance around 20,800 points could become a key focus.

If buyers push past this level, the uptrend could continue, with a chance to challenge previous highs. If declines resume, the next support level to watch is 18,400 points.

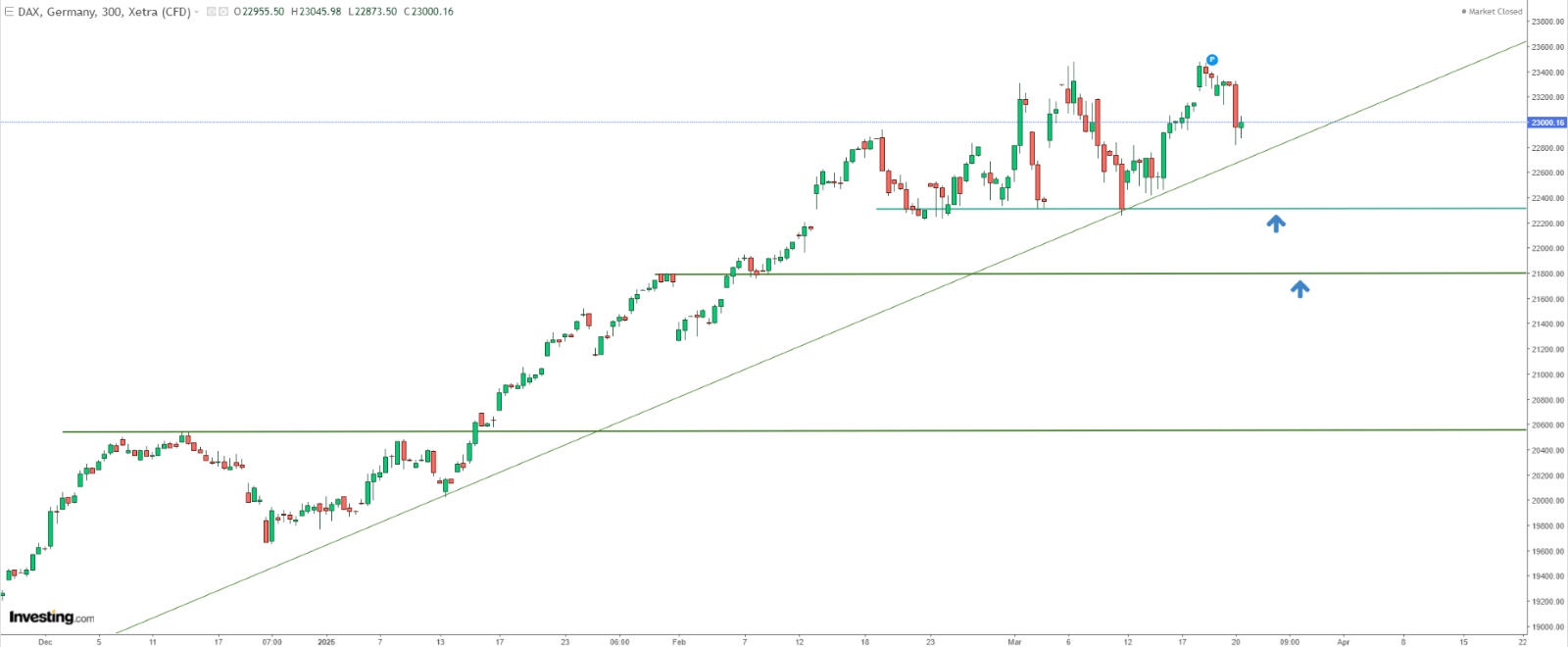

DAX Facing Another Trend Line Test?

Buyers of the DAX struggled to break new highs, leading to a pullback and the potential formation of a double top. The first key test for sellers is the uptrend line—if it breaks, the next target could be the 22,300-point support level, which has been tested multiple times.

Figure 3: Technical analysis of the DAX

A deeper decline could occur if the DAX falls below 21,800 points, with the next target at 20,500 points. However, the overall uptrend remains intact, meaning such a drop would likely require external factors like geopolitical or economic events.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.