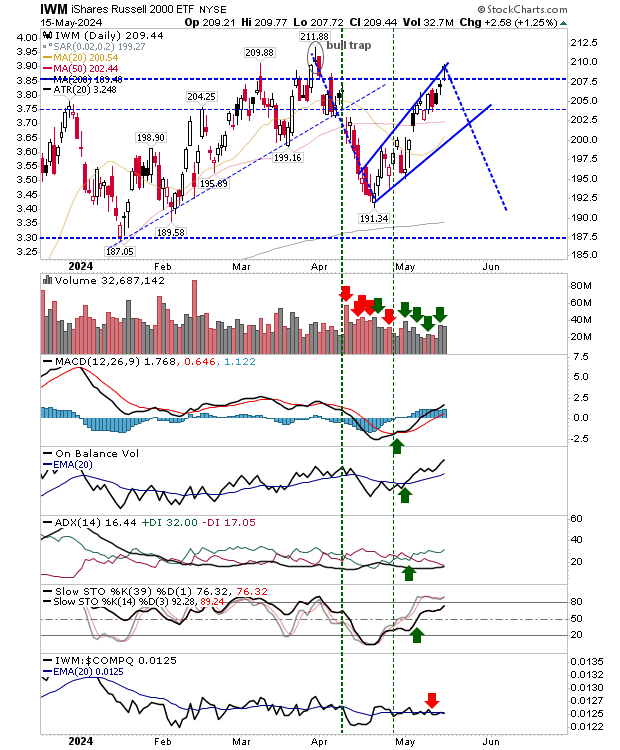

Bit by bit, the bearish thesis I had outlined in April is no more. Yesterday delivered strong breakouts for the Nasdaq and S&P, although the Russell 2000 (IWM) still has some work to do.

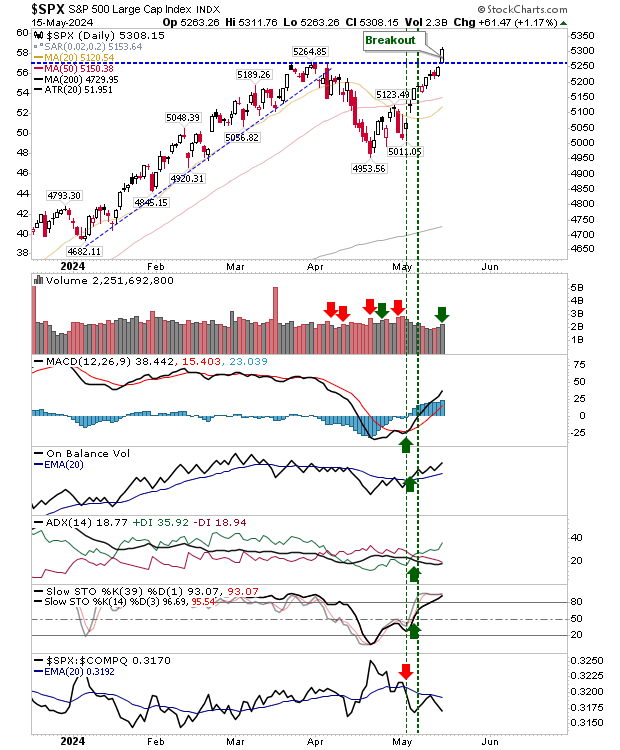

The S&P 500 delivered a clean breakout on higher volume accumulation. A technician couldn't ask for a better move. Now it's up to the market to deliver on this promise.

One thing we need to watch is the relationship of the S&P to its 200-day MA; at the moment it's 12.2% above this moving average which is in the 10% extreme zone of historic overboughtness. If it gets to 14.4%, it will be at the 5% level, and at 18.1% it will be at the 1% level, and becomes a strong 'sell'.

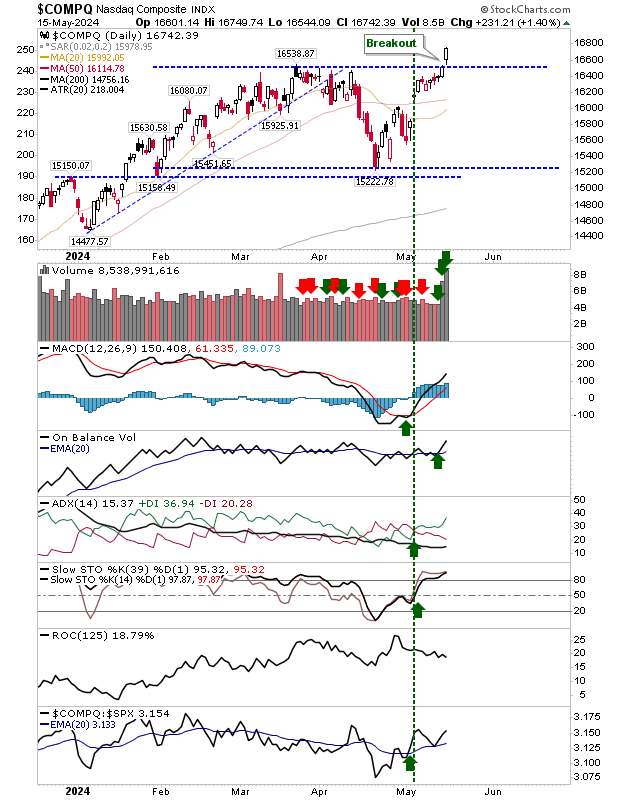

The Nasdaq delivered its breakout on a significant surge in buying volume. This was combined with an acceleration in the relative performance against the S&P.

The Russell 2000 ($IWM) is working on a challenge of its 'bull trap' and hasn't cleared its trading range. Consequently, the buying volume - while higher - didn't enjoy the same surge as the Nasdaq. Technicals are net positive, but momentum is not yet overbought, so look for more upside.

With the S&P and Nasdaq breakouts in play we need to consider the possibility of 'bull traps', but we also need to keep an eye as to how far these indices extend from their 200-day MAs and are at risk from another April style correction.