Yesterday was a strange day. After a hot CPI report, stocks rose, then fell, then rallied back, and once again, it was the few leading the many.

Anyway, the reflexive nature of the market tells us that what we are witnessing here is much more mechanical than anything and probably has nothing to do with what is happening in the real world.

I’m sorry to say that we have a few more days of this. The good news is that today is Friday, so Systematics can sell Vol all day ahead of the 3-day weekend, while the call wall at 4,800 can keep the S&P 500 pegged below 4,800.

Then, on Tuesday morning, we can wake up to a higher VIX that gets sold all day. Then, we have VIX OPEX on Wednesday and can get on with our lives.

Make it an even longer weekend; take off today and Tuesday, too.

All of this flow stuff got me looking around at the positioning for some of these mega-cap names heading into OPEX next week. When I looked at names like Meta (NASDAQ:META), I saw a lot of call delta due to come off next Friday.

I summed up the 12 largest open delta positions, according to Bloomberg, and got $8.1 billion in call deltas expiring on Friday.

I summed up the next 12 values and got another $3.2 billion positive deltas. I summed the 12 largest put deltas and got roughly $250 million.

It seems to suggest a lot of Meta will need to be unhedged after OPEX.

(Bloomberg)

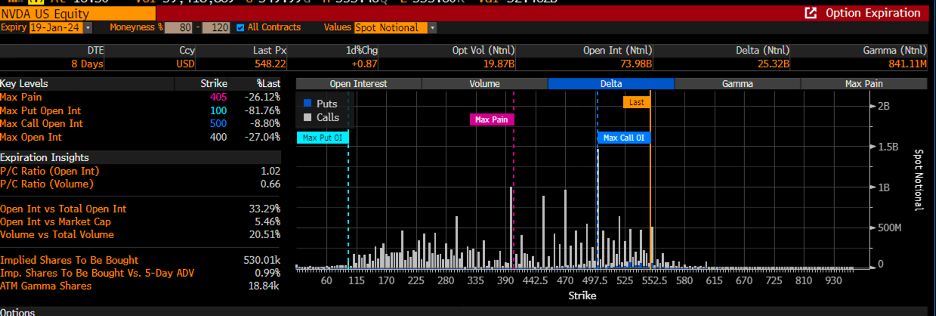

The problem is that this type of positioning also exists in other names, like Nvidia (NASDAQ:NVDA).

(Bloomberg)

Of course, it assumes that these in-the-money calls have all been bought, and the market maker was the seller and bought the underlying to hedge.

It is probably safe to say they haven’t all been bought, and there are some covered calls out there.

But still, I think given how much positive delta has been built in these stocks, there is going to be a lot that will need to be unwound flowing January 19 OPEX.

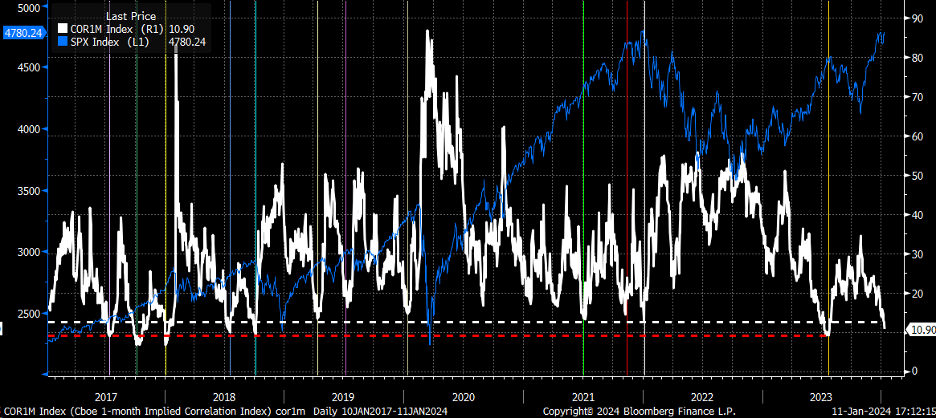

Of course, this comes when the 1-month Implied Correlation Index closed under 11, at 10.9 yesterday.

Can it fall further? Of course, it can. It fell below 10 in July, but the lower it falls, the more extremes it reaches, like January 2018, Fall 2018, and July 2023. All had some nice sell-off that took place.

YouTube Video: