It was a dull day for stocks, with the S&P 500 finishing the day slightly lower while rates rose and the US dollar sank. There isn’t much to take away from yesterday except that the VIX and the shorter duration measures of volatility were down, too. You rarely see the VIX down and the S&P 500 down on the same day, but that is what happened.

1. S&P 500 Traded Sideways Despite Lower Volatility

The index did nothing and traded sideways throughout the day, showing no ability to rise despite the move lower in implied volatility. This is not something we see very often, and it suggests the market could have been weaker if not for the move down in implied volatility.

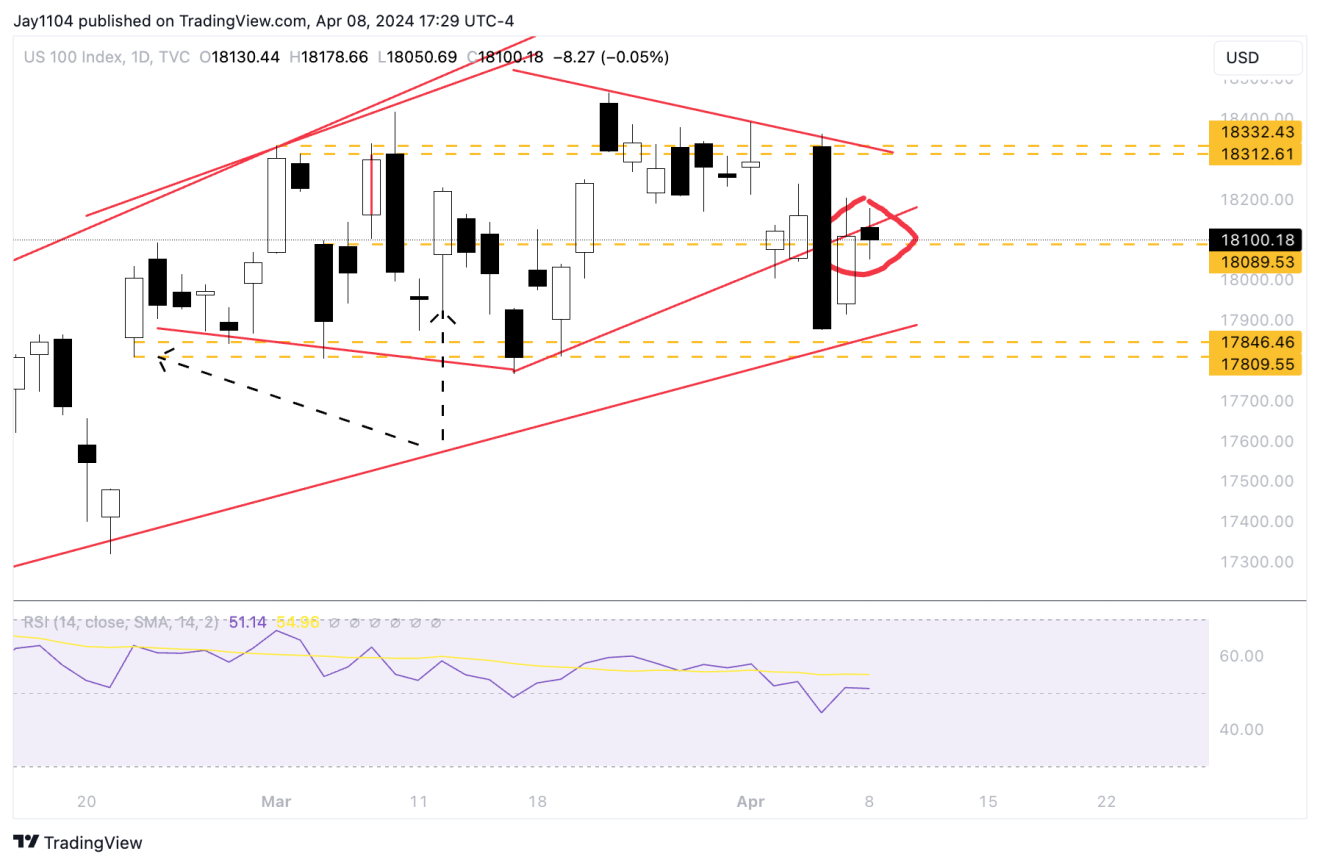

2. NASDAQ 100 Remained Below the 10-day Exponential Average

The NASDAQ was equally boring, dropping by five bps and remaining below that 10-day exponential average. Since Thursday’s decline, we have seen the NASDAQ come up and test the lower right trendline of the diamond pattern two times, and both times, it has failed to close above that trend line.

However, if the pattern is correct and completed, I expect the NASDAQ to begin to fall more aggressively from this point forward. The longer it stalls out at its current level, the more likely the diamond pattern is incorrect.

3. 2-Yr Rate Rises and Could Push to the 5% Level

The 2-year rate did break out yesterday, rising above 4.75% to close at 4.79%, which seems pretty clean. As mentioned over the weekend, if the 2-year has completed a cup and handle pattern, the move-up in the yield should continue from here and push back toward the 5% level in the coming weeks.

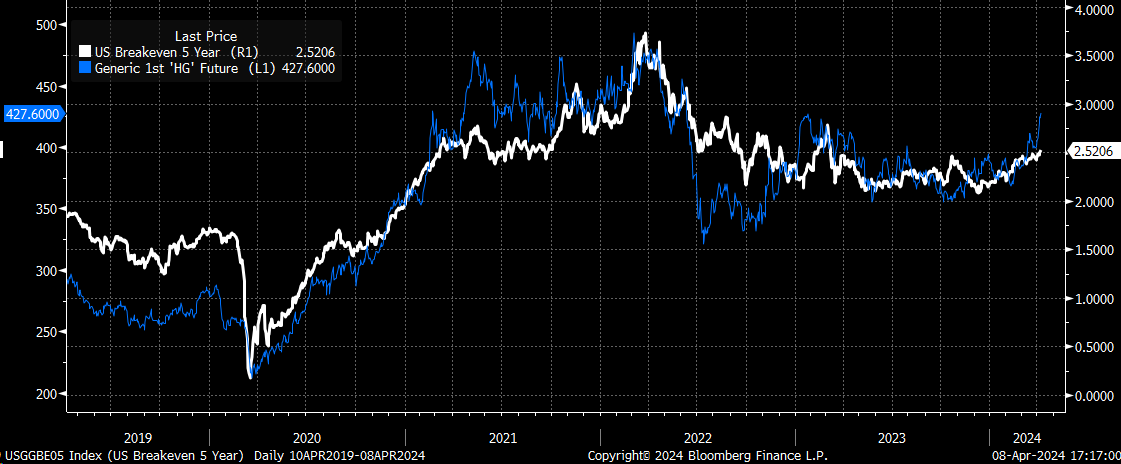

4. Copper Prices Jump

Copper prices jumped another 1% yesterday and managed to move past resistance at 4.29%, with the next level to watch coming around $4.40. It does appear to be getting a bit overbought currently, with the price moving above the upper Bollinger band and the RSI now at 76. So, copper prices could consolidate before the next leg higher starts.

5. Inflation Impacted by Higher Copper Prices

The higher copper price seems to be impacting 5-year breakeven inflation rates, which is not surprising as the relationship has a long history. So, the higher copper goes, the less promising it is for the inflation outlook.

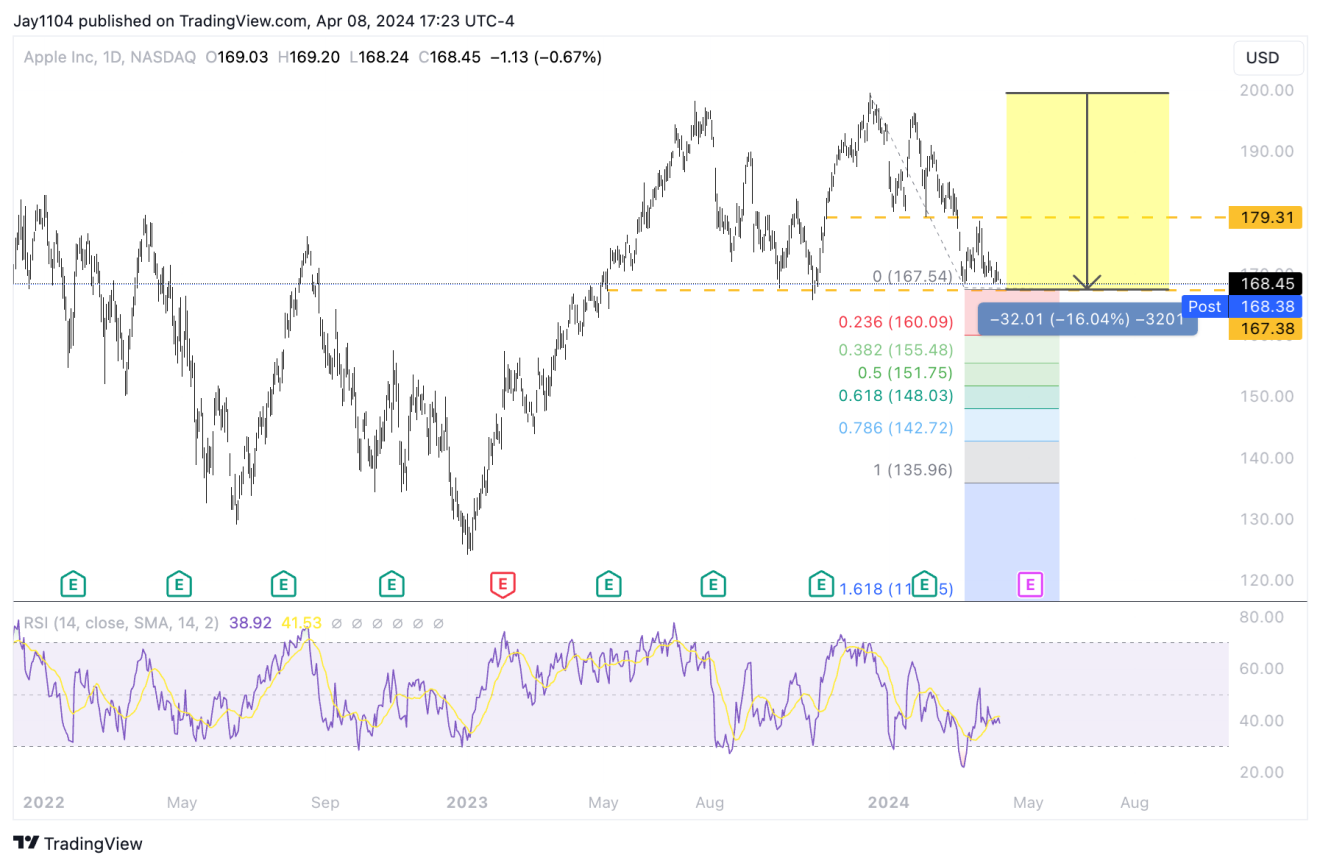

6. Apple (AAPL) Stock Could Drop Given the Potential Double-Top Pattern.

Not a great look for Apple (NASDAQ:AAPL) here with a potential double-top, with the stock sitting on the neckline. I don’t think many people would have guessed that Apple would be down nearly 16% since the middle of December and the S&P 500 near an all-time high, but that is where it is currently.

The stock has given back all of the gains it saw off the October lows, and a break of support around $167 would probably set the stock up to drop another $31 to fall back to $136, given the potential double-top pattern.

7. Nvidia Contending With Its Own Double-Top

That really shows just how important NVIDIA (NASDAQ:NVDA) has been to the index. Nvidia is currently contending with its own double top and a giant gap at $680 that needs to be filled at some point.