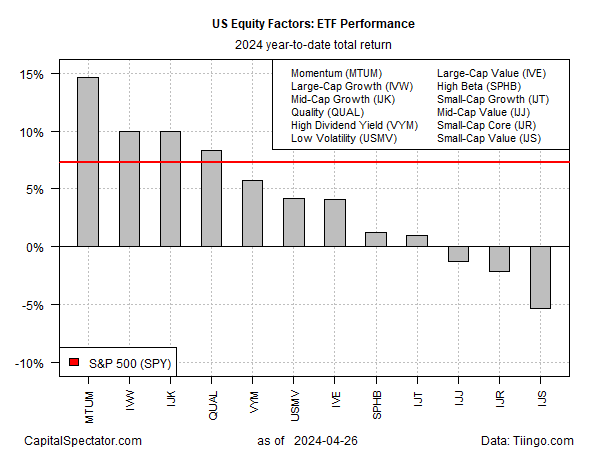

The momentum factor is on track to end April as it began: the strongest year-to-date performer among US equity factors, based on a set of ETFs through Friday’s close (Apr. 26).

In line with the broad market, iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) has taken a hit in recent weeks after touching a record high earlier in the year. In relative terms, however, MTUM’s factor-leading performance in 2024 is intact, courtesy of a 14.6% year-to-date gain.

MTUM’s rally this year is twice the gain for the broad market via S&P 500 (NYSE:SPY). MTUM is also comfortably ahead of its nearest would-be factor leaders in 2024: large-cap growth (IVW) and mid-cap growth (IJK), which are tied for second place with 10% returns each so far this year.

Meanwhile, the red-ink brigade for equity factors admitted new members for year-to-date results since our Apr. 10 update: small-cap value (IJJ) and small-cap core (IJR). Joining small-cap value (IJS), it’s now a clean sweep of losses in 2024 for the small-stock category.

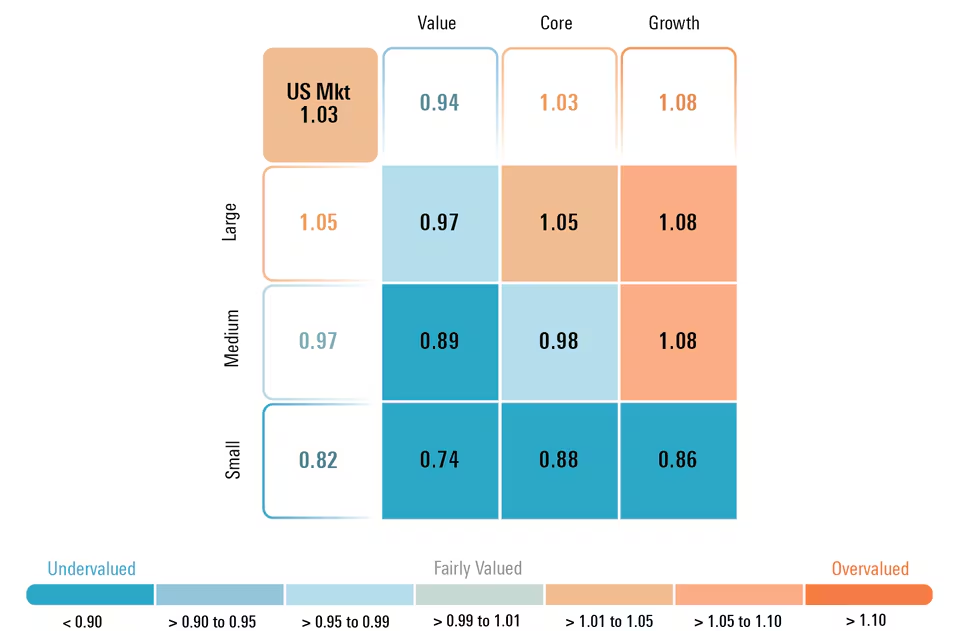

The weakness in low-capitalization stocks is disappointing for investors in this corner, but for contrarians, the valuations look compelling. Morningstar reports:

“Small-cap stocks trade at an 18% discount to fair value, making them the cheapest US asset class across the Morningstar Style Box,” according to analysis by the firm’s senior US market strategist Dave Sekera.

The question is whether an attractive valuation will soon lead to strong performance. The long-running underperformance of small-cap shares suggests caution (still), but hope springs eternal in this slice of the factor realm.

In an interview published yesterday by TheStreet.com, Ward Sexton, a manager of the William Blair Small-Cap Growth Fund (WBSNX), an actively managed open-end fund, says:

“There are a lot of opportunities to find misunderstood or lesser-known names that will grow to become large-caps.”

Music to the ears of small-cap investors. So far this year, however, this corner of the market is still singing off-key.