- After rebounding strongly from pandemic-era market crash, Simon Property’s shares are under selling pressure again

- With the Federal Reserve adamant to claw back inflation, property owners, like Simon Group, can’t remain insulated from economic headwinds

- Malls are most exposed to discretionary consumer spending, facing greater challenges when the economy slows

America’s biggest mall operator, Simon Property Group (NYSE:SPG), is offering an interesting risk-reward proposition to investors. While traffic at the company's malls has fully recovered after taking the pandemic-triggered hit, the risk of a recession is making many investors cautious.

These market sentiments are reflected in the Indianapolis-based Simon Property’s stock. After rebounding strongly from the pandemic-era market crash in March 2020, SPG shares have remained under pressure during the past year. They are down about 25% this year, against the 15% weakness in the S&P 500.

Source: Investing.com

Real estate has a long history as an inflation hedge, based on the principle that income generated by buildings tends to keep pace with consumer prices. But this time, it could be different. With the Federal Reserve adamant to bring back inflation from its highest level in four decades by aggressively hiking interest rates, it’s hard for property owners, like Simon Group, to remain insulated from economic headwinds.

Malls are most exposed to discretionary consumer spending, facing greater challenges when the economy slows. While high-end consumers are still absorbing higher fuel, housing and food costs, low- and middle-income consumers are not, as last year’s government stimulus checks are no longer available to help.

Simon, which is a real estate investment trust (REIT) having the ownership of premier shopping, dining, entertainment and mixed-use destinations throughout the U.S., hasn’t faced such pressures so far.

Mall Activity is Strong

On the earnings conference call last month, Chief Executive Officer David Simon reported that mall activity remains quite strong in the U.S. Sales per square foot for its tenants rose 14% year over year, which is a record. Occupancy for Simon’s malls was 94.5% by the end of September, compared with 92.8% during the same period a year ago. Base minimum rent per square foot was $54.80 for the third quarter, compared with $53.91 a year ago.

While these numbers look encouraging, they don’t show a normal pattern. After the pandemic-related restrictions, consumers are resuming their outside activities, including more visits to malls and other places of community gathering.

If the recession hits with full force next year, as anticipated by many economists, Simon may find it challenging to maintain a strong occupancy rate. A slower economic environment reduces demand for expansion by better retail operators and forces weaker retailers to close their operations.

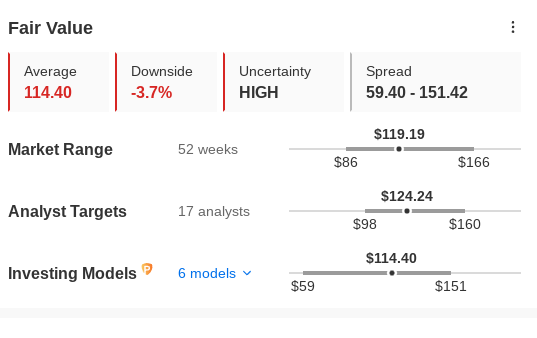

Due to these risks, InvestingPro’s various models don’t provide a buy signal for Simon stock at these levels. In fact, these models show that SPG stock is trading close to its fair value.

Source: InvestingPro

Another big attraction of buying REITs, such as Simon, is their potential for income.

REITs offer investors exposure to the real estate sector, but without the requirement for a large capital outlay or mortgage debt to buy equity in a physical property, while maintaining the benefits of a steady income stream.

But that proposition becomes less attractive when rates are surging. After years of attracting investors chasing yield at a time of rock-bottom interest rates, the equation is changing fast. According to Bankrate.com, investors these days can get up to 4% per annum on a low-risk certificate of deposit (CD) on a three-year term.

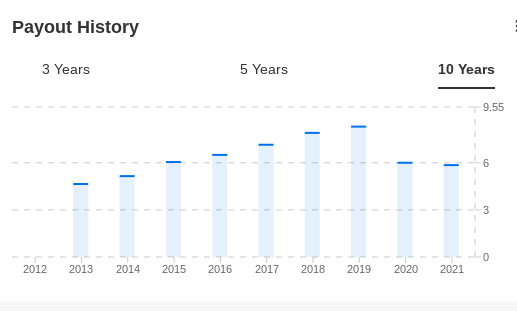

Source: InvestingPro

On the dividend front, Simon Property doesn’t have a very impressive track record either. Payouts are still lower than they were before the pandemic after the company slashed them in 2020 to deal with the revenue slump. The mall giant currently pays $7.20 annual dividend, which translates into a 6% yield.

As the mall giant reaps the benefit of a pent-up demand for brick-and-mortar visits, there is a possibility of further dividend increases this year. According to Simon’s latest guidance, comparable FFO (funds from operations) will be within a range of $11.83 to $11.88 per diluted share for the year ending December. That compares to the $12.04 they generated in 2019 when they paid a dividend of $8.30.

But that was the time when interest rates were too low. With interest rates on the rise and other costs escalating, it seems quite tough for the rate-sensitive REIT to distribute more cash among investors.

Bottom Line

Simon Group isn’t the kind of stock that investors should buy when interest rates are rising. Mall operators could come under pressure if the economy takes an ugly turn and retailers start closing their shops. Investing in real-estate stocks is behind us in the current economic cycle.

Disclaimer: At the time of writing, the author doesn’t own SPG shares. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.