- Global bonds rocked by Bank of Japan changes, Fitch downgrade, and Fed's outlook.

- Long-term bond market sees rare turbulence.

- Investors split: Buffett and Musk optimistic, Ackman bearish.

A triple whammy hit global bond markets last week, with the Bank of Japan loosening its yield curve control program, Fitch downgrading U.S. Treasurys, and rising commodity prices reviving the narrative of “higher for longer” for the Fed funds futures.

This combination of factors led to extraordinary volatility in the usually stable long-term bond market. Japanese 10-year yields shot up roughly 27% on the curve control news and went on to rise another 10% in the following days.  The U.S. 30-year yield, in turn, increased roughly 4.2% last week, which is a huge change for those unfamiliar with the long-term bond market.

The U.S. 30-year yield, in turn, increased roughly 4.2% last week, which is a huge change for those unfamiliar with the long-term bond market.  Similarly, U.S. 10-Year yields rose roughly 5.6% last week before correcting by 3.3% on Friday.

Similarly, U.S. 10-Year yields rose roughly 5.6% last week before correcting by 3.3% on Friday.  Things have been much less volatile on the short end of the curve, with the 2-year and 3-month yields remaining nearly flat through the week.

Things have been much less volatile on the short end of the curve, with the 2-year and 3-month yields remaining nearly flat through the week.  This has led to an improvement in the yield curve inversion, with longer-term bonds yielding closer to short-term ones. However, the inversion remains deep from a historical perspective, indicating a 66% chance of a U.S. recession over the next 12 months, according to the N.Y. Fed’s model.

This has led to an improvement in the yield curve inversion, with longer-term bonds yielding closer to short-term ones. However, the inversion remains deep from a historical perspective, indicating a 66% chance of a U.S. recession over the next 12 months, according to the N.Y. Fed’s model.

While the general stock market responded to the numerous events by producing its first negative week in quite a while, it is safe to say that stocks remained overall unfazed by the big undergoing shift in global capital markets.

Stocks generally dominate the headlines because they are an easier, sexier way to assess the day-to-day movements of the economy — plus, they offer the illusion of making you rich quickly. However, the most important variable for capital markets over the long run is the cost of money over time.

The current combination of factors suggests that investors are progressively pricing in higher interest rates and inflation for longer, along with increased default risks to higher debt and swift changes in the global bond market.

While this has produced a general selloff in U.S. bonds (remember, bond yields and bonds prices move in opposite directions), some investors of the likes of Warren Buffett and Ellon Musk see the situation as a contrarian opportunity to add some juicy short- and long-term maturities into their portfolios. Conversely, billionaire Bill Ackman has been massively shorting 30-year bonds.

Let’s take a look at their cases to evaluate whether it is a good time to get into action or not.

Bear Case

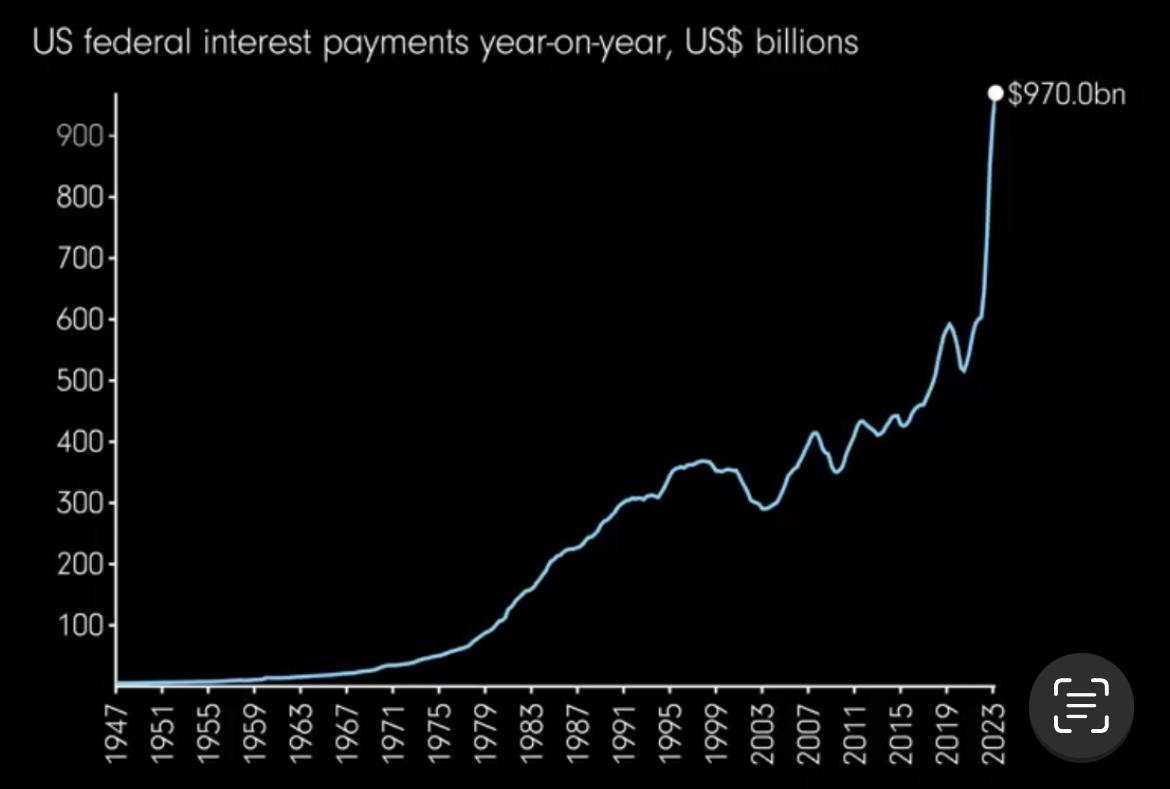

Higher interest rates for longer mean that the Federal Government has to pay a higher price on its own debt. According to recent estimates, interest rates on U.S. debt are close to reaching an astronomic $1 trillion per year. Does this mean the U.S. will default on its debt? Hardly so. However, with increased costs, the chance of a governmental default needs to be priced into the market — hence why Fitch downgraded the U.S. debt —, leading to a higher premium for a riskier asset.

Does this mean the U.S. will default on its debt? Hardly so. However, with increased costs, the chance of a governmental default needs to be priced into the market — hence why Fitch downgraded the U.S. debt —, leading to a higher premium for a riskier asset.

Moreover, Ackman made the case that if long-term U.S. inflation were to settle at 3% instead of the current 2%, the probability is that 30-year Treasury yields would reach as high as 5.5%.

“I have been surprised how low U.S. long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation, including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining power of workers,” he said.

During June, U.S. inflation marked a reading of 3%, coinciding with a climb in 30-year Treasury yields to 4.2%, a level not reached since early November.

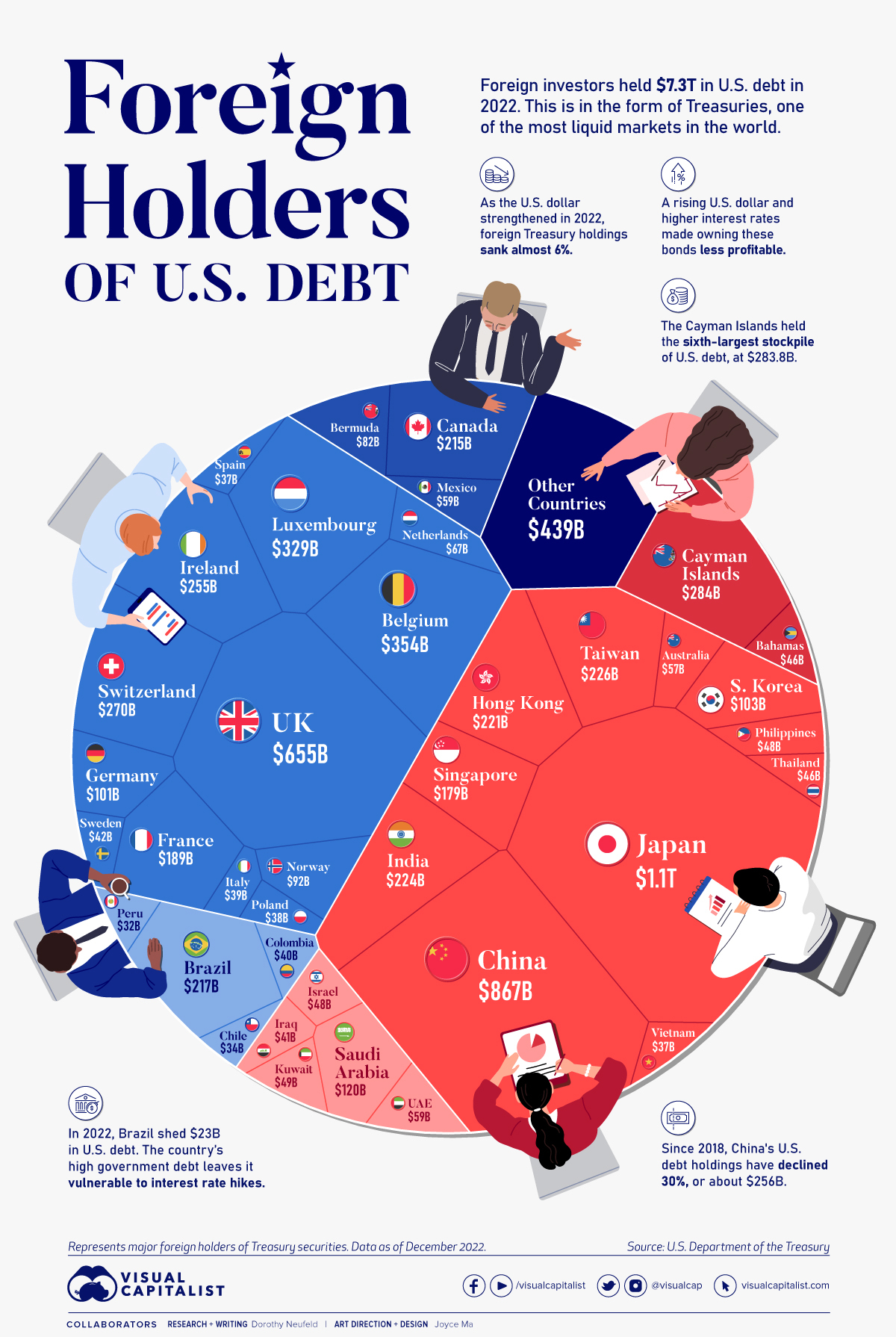

The second part of the bear case for long-term Treasurys is that Japan is currently the biggest buyer of U.S. debt, surpassing China.  Source: U.S. Department of the Treasury, Visual Capitalist

Source: U.S. Department of the Treasury, Visual Capitalist

By permitting its own Treasurys to trade freely, the BoJ will enhance the relative attractiveness of its government bonds in comparison to U.S. Treasurys. This strategic move positions it as a potential purchaser of its own debt.

Finally, the combination of economic factors along with the perceived geopolitical changes aimed by China in the near future could propel the second-biggest holder of U.S. debt to seek other government Treasurys.

To which Ackman concludes:

“With $32 trillion of debt and large deficits as far as the eye can see and higher refinancing rates, an increasing supply of Treasurys is assured,” he said.

"When you couple new issuance with quantitative tightening, it is hard to imagine how the market absorbs such a large increase in supply without materially higher rates.”

Bull Case

Ackman’s position is being challenged by some of the greatest investors on the planet. Last Friday, Buffett told NBC he remains unfazed by the perceived risks surrounding U.S. Treasurys, quoting:

“Berkshire bought $10 billion in U.S. Treasurys last Monday. We bought $10 billion in Treasurys this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month” T-bills, Buffett said.

“There are some things people shouldn’t worry about. This is one.”

Similarly, Billionaire Telsa owner Ellon Musk said last week that short-term U.S. T-bills are a “no-brainer” at this point.

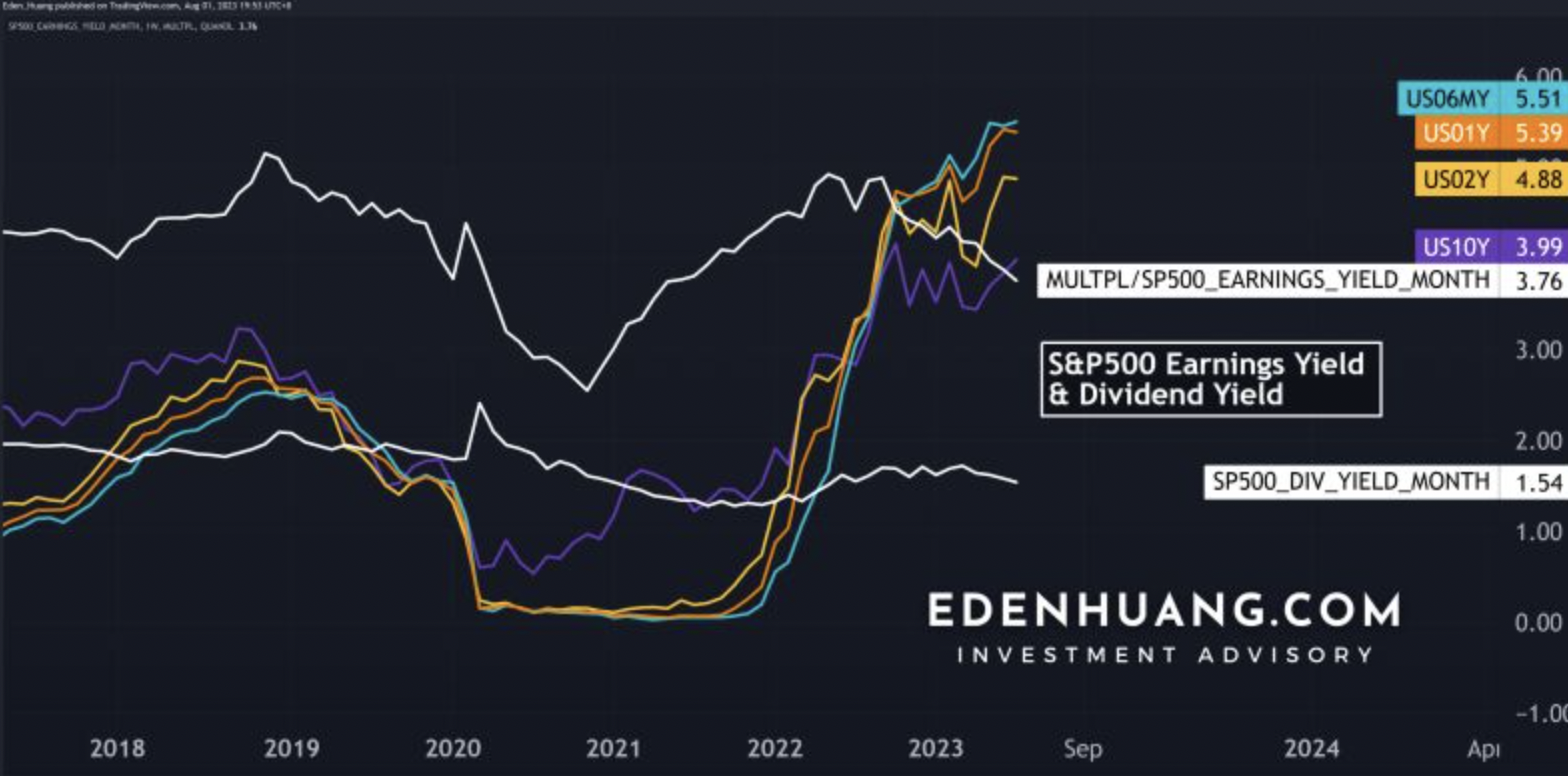

Indeed, both S&P 500 earnings (3.89) and average dividend (1.52) are trading below both the 10-year yield and short-term Treasurys. And remarkably close to Treasurys even when added up.  Source: Eden Huang

Source: Eden Huang

This implies a problematic correlation for stocks but a positive one for bonds going forward, as it drives yield-hungry investors into seemingly “risk-free” bonds.

The gap between Treasurys and the Nasdaq has widened to the greatest level since the beginning of 2021, implying that something is gotta give. With the Nasdaq apparently reaching oversold levels, it is not difficult to claim the correlation is poised for an inversion soon.  Source: Tavi Costa, Bloomberg

Source: Tavi Costa, Bloomberg

Moreover, the U.S. Treasury Department announced its intention to repurchase U.S. government debt in the upcoming year. This move, a departure from practices seen in previous decades, is aimed at bolstering liquidity within the expansive $23 trillion government bond market. This would be the Treasury’s first buyback program since the early 2000s.

For investors, it is another sign that demand will remain high in the near future, despite the remaining risks.

Finally, from a historical perspective, long-term Treasurys (i.e., those maturing in ten or more years) have gained 10% in the six months that proceeded the peak of the Fed’s rate hikes, according to Bloomberg data. In the 12 months after the peak, results are even better, with longer-dated rates gaining on average 13% and outpacing every other financial asset in the same timeframe.

That vision is supported by Bank of America:

“Going long duration at the end of the hiking cycle is a more consistent trade than the steepener, which is more conditional on a harder landing outcome from the Fed,” wrote BofA’s strategists Mark Cabana and Meghan Swiber.

Similarly, Goldman Sachs and JPMorgan are also recommending that investors explore the potential of purchasing longer-term U.S. Treasurys.

Goldman Sachs refuted the idea that Japanese investors are offloading their Treasury assets or that investors are seeking an increased risk premium in anticipation of upcoming auctions. Moreover, the bank's strategists underscored that the credit downgrade from Fitch did not introduce novel information, as the concerns raised by the agency, such as political uncertainties in Washington, were already in the public domain.

Analysts from JPMorgan, in turn, observed that given the reduced saturation of investor positions in long-term debt and the persistence of yields around their peak levels for the current cycle, there is a growing attractiveness in considering investments within these timeframes.

Bottom Line

With stock prices growing increasingly stretched (at least in the short term), there is no argument for investors to stay away from short-term Treasurys at this point. This doesn’t mean investors should sell all their assets and jump straight into bonds. However, short-term yields at these levels offer great protection from market volatility at a time when inflation appears to be subsiding.

The discussion grows more complex in the longer-term spectrum as several headwinds may arise for those looking to hold those assets into maturity. However, good bond traders are known for spotting great contrarian opportunities, and this may just be one of them.

After all, if it’s good enough for Warren Buffett, it’s good enough for me.

Disclosure: The author currently holds 2-year bonds and may be looking to buy into 10-years soon.