- Square stock has had an impressive year

- Fintech investors who also want Bitcoin exposure typically consider SQ stock as a proxy

- Despite the bullish long-term outlook, investors should be ready for short-term volatility, with a potential decline toward $260 in the coming weeks

Investors in financial technology stock Square (NYSE:SQ) have seen robust returns so far in 2021. SQ shares, which are up more than 23% year-to-date, hit an all-time high of $289.23 on Aug. 5. Since then, however, the shares have come under pressure. They closed yesterday just over $267.

The 52-week range has been $134.00–$289.23, and the company’s market capitalization stands at $124 billion.

San Francisco-based Square is well-known for its ecosystem of payment services for merchants as well as its Cash App for individual users who can trade and store Bitcoin through the app.

Since October 2020, the company has also been buying Bitcoin at different intervals. Therefore, it carries Bitcoin on its balance sheet both as an asset and as a revenue segment. As a result, moves in cryptocurrencies, especially in Bitcoin, typically affect the price of SQ stock, at least in the short run.

For example, PayPal (NASDAQ:PYPL) recently announced that its UK-based customers can soon trade and store a number of digital currencies on the platform. The news headline saw both PYPL and SQ shares move up.

Recent metrics highlight:

“The cryptocurrency market size is expected to grow from US$1.6 billion in 2021 to US$2.2 billion by 2026, at a CAGR of 7.1%.”

Investors are therefore excited that companies like Square and PayPal could benefit from this growth.

Square recently released robust Q2 metrics. Total revenue was $4.68 billion, up 143% year-over-year. Excluding Bitcoin, revenue in the second quarter was $1.96 billion, up 87% YOY. Bitcoin revenue was $2.72 billion.

Adjusted earnings came in at 66 cents, up 266.7%. The company ended the quarter with $4.6 billion cash and equivalents. Wall Street was pleased with growth in transaction, subscription as well as hardware revenues.

In a shareholder letter, management said:

“We delivered strong growth at scale during the second quarter of 2021. Gross profit grew 91% year over year to $1.14 billion, which was 57% on a two-year compound annual growth rate (CAGR) basis.”

In April, Square acquired a majority ownership stake in TIDAL, a global music and entertainment platform. It recently announced it will purchase Australian “buy now, pay later” group Afterpay (ASX:APT).

What To Expect From SQ Stock

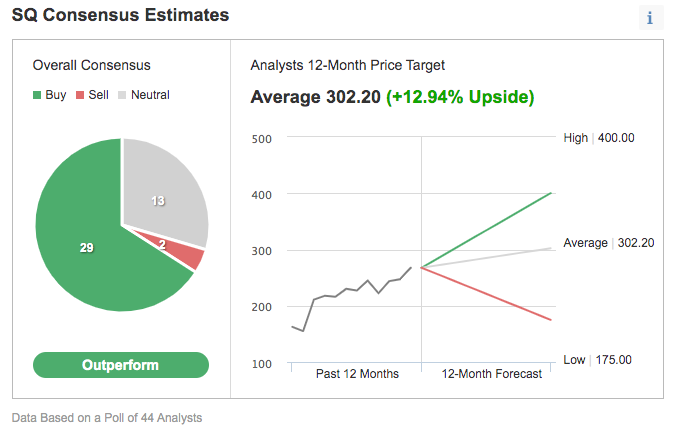

Among 44 analysts polled via Investing.com, Square stock has an ‘outperform’ rating. The shares have a 12-month price target of $302.20, implying a return of about 13% from current levels.

Source: Investing.com

The stock's trailing P/E, P/S and P/B ratios stand at 263.6, 7.8 and 46, respectively. This means the valuation level is overstretched even for a fintech giant like Square. By comparison, PayPal’s trailing P/E, P/S and P/B ratios are 68.26, 13.77 and 15.71.

Investors who watch technical charts might be interested in knowing that the recent decline in SQ stock could possibly continue, taking it toward the $250 level. In that case, we’d expect the shares to build a base between $240 and $260 for several weeks before a new up-leg begins.

We should also note that the beta (β) of SQ is 2.13, a measure of a security's volatility in relation to the overall market.

For a company whose β is greater than 1, that means it's more volatile than the market. With a beta of 2.13, SQ stock will likely be at least twice as volatile as the overall market. In other words, we should expect swings in its share price, especially in the short run.

Our first expectation for the stock is for a potential pullback toward $260, or even below. In case of such a decline, long-term investors would find better value.

3 Possible Trades

1. Buy SQ Stock At Current Levels

Investors who are not concerned with daily moves in price and believe in the long-term potential of the company could consider investing in Square now.

Yesterday, SQ closed at $267.57. Buy-and-hold investors should expect to keep this long position for several months while the stock potentially makes an attempt at the record high of $289.23, or even higher, possibly going above $300.

Assuming an investor enters this trade at the current price and then exits around $290, the return would be about 8.5%. However, investors who are concerned about large declines might also consider placing a stop-loss about 3-5% below their entry point.

2. Bear Put Spread

Readers who believe there could be some more profit-taking in SQ stock in the short run might consider initiating a bear put spread strategy.

It might also be appropriate for these long-term investors to use this strategy in conjunction with their long stock option. The set-up would offer some short-term protection against a decline in price in the coming weeks.

This trade requires a trader to have one long Square put with a higher strike price and one short SQ put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if Square shares decline in price.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the SQ Dec.17 260-strike put option. This option is currently offered at $21.70. Thus, it would cost the trader $2,170 to own this put option, which expires in slightly less than four months.

At the same time, the trader would sell another put option with a lower strike, like the SQ Dec.15 240-strike put option. This option is currently offered at $13.55. Thus, the trader would receive $1,355 to sell this put option, which also expires in slightly less than two months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss would be ($21.70-13.55) X 100 = $815 (plus commissions).

This maximum loss of $815 could be realized if the position is held to expiry and both SQ puts expire worthless. Both puts will expire worthless if the Square share price at expiration is above the strike price of the long put (higher strike), which is $260 at this point.

This trade’s potential profit is limited to the difference between the strike prices (i.e, ($260.00-$240.00) X 100) minus the net cost of the spread (i.e., $815) plus commissions.

In our example, the difference between the strike prices is $2,000. Therefore, the profit potential is $2,000-$815 = $1,185.

This trade would break even at $251.85 on the day of the expiry (excluding brokerage commissions).

3. Buy An ETF That Has Square As A Top Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that could be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to SQ stock but would still like to have sizeable exposure to the shares could consider buying a fund that holds the company as a leading name.

Examples of these ETFs include:

- Simplify Volt Fintech Disruption ETF (NYSE:VFIN): the fund is down 6.9% YTD, and SQ stock’s weighting is 17.14% (we covered two other, similar ETFs by this issuer;

- ARK Fintech Innovation ETF (NYSE:ARKF): the fund is up 34.4% YTD, and SQ stock’s weighting is 10.87% (covered here);

- VanEck Vectors® Digital Transformation ETF (NASDAQ:DAPP): this new fund is down about 15.5% since inception in April 2020, and SQ stock’s weighting is 9.82% (covered here).

Bottom Line

Since going public in 2015, Square stock has become a top performer. We expect the shares to hit new highs in the coming quarters.

However, there could be some more profit-taking in the short run, giving buy-and-hold investors a better entry opportunity.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI