Originally published by Guppytraders.com

The Shanghai index is developing some of the characteristics of a trend reversal. The key feature investors were watching was the behavior of the index consolidation between 3265 and 3290. The 3265 support level failed and the index rapidly moved to test the lower edge of the long term Guppy Multiple Moving Average (GMMA) indicator as a support level.

The significant feature now is that the lower edge of the long term GMMA was successful in acting as a support level. This is a similar behavior to the behavior following the market dip and rebound rally on July 17.

In the current situation the long term GMMA is more widely separated than it was on July 17. This suggests that the underlying uptrend is stronger and more resilient. This gives a stronger support base for a continuation of the rebound rally. This has two consequences.

The first consequence is that the strong base gives a bullish outlook because it is used for the next rally towards resistance near 3265 and 3290. The resistance forces in this resistance band are strong so it is not surprising that the index will fail it the first attempt to breakout above this level.

A rally move into this narrow resistance band is bullish. A rally move above 3290 is very bullish.

The second consequence is also related to the strength of the long term GMMA support. If this support fails then the market retreat will be severe. A sustained close below the value of the long term GMMA has a downside target near 3130. If the support level breaks then the market can retreat very quickly. This is the main danger in the current situation.

The Shanghai index characteristic behavior includes days of substantial volatility. The market can dip and rally in very large movements. This is normal behavior. The important feature in the market analyses is to consider this behavior in relation to the strength of the underlying trend. When the trends is strong then the volatility dips provide a buying opportunity.

Investors watch for the index to move above the upper edge of the short term GMMA. They also watch for the short term GMMA to compress and move upwards because this shows that traders have more confidence in the uptrend continuation.

The current index behavior shows a significant pullback and test of the uptrend. This is complicated because the pullback starts from the long term resistance level that has created a triple top. However a strong rally can develop into a successful breakout above the triple top pattern. Investors watch for evidence of this developing momentum.

The Shanghai index is developing the characteristics of a trend reversal .

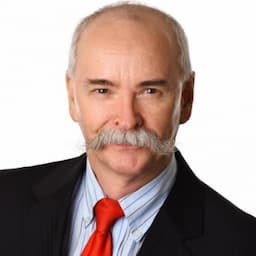

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.