Originally published by Guppytraders.com

President Trump's illegal tariff trade war has smashed the Shanghai Index. In this environment it is difficult to apply technical and chart analysis because the emotion in the market is so strong and volatile.

However past price activity can provide some guide to how the market may react in the future.

This shock reaction is a clear change in the developing upside trend break. The pattern of Guppy Multiple Moving Average (GMMA) trend test and retest pattern has ended.

The potential for a return to new uptrend behavior has also ended. This is confirmed with the gap down behavior and the clear close below the potential uptrend line A.

The fall below the trading band between 3260 and 3290 confirms that this trading band is no longer acting as a stable support level. However it will act as a strong resistance level for any future index rally.

These observations may seem obvious, but they are important because they show that the index collapse is not temporary. This is not a repeat of the situation seen when the market fell in February and then rapidly recovered. The January and February retreat was a change in trend behavior. The market retreat on March 23 Friday is a continuation of an established downtrend and a failure of breakout activity. This makes the environment much more bearish.

The trading band between 3260 and 3290 will now become a major obstacle for any index rebound or new uptrend development.

The potential support targets are best seen on the weekly chart. The next support level is near 3000. This is a long term and reliable support level starting from around 2016 July.

The market may move quickly towards this level and then find some stability. Investors will watch for the index to consolidate near this level and move sideways. Days of extreme volatility may temporarily push the index below 3000.

There is a low probability of a rapid rebound form near the 3000 level. However any rebound is initially treated as a rally rather than a trend change because the downside

resistance features are very strong. In this environment the long term GMMA will remain well separated and this is a major resistance feature that limits any rally and makes it more difficult to establish a new long term uptrend.

In the short term traders watch for fast rally and retreat behavior between 3000 and 3260. This is a good trading environment but a dangerous environment for investors.

A fall below 3000 has long term support near 2650. A fall below 3000 is very bearish.

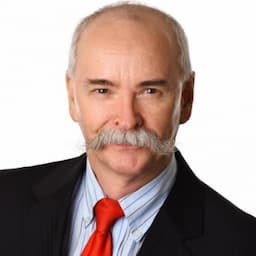

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.