DXY formed last might:

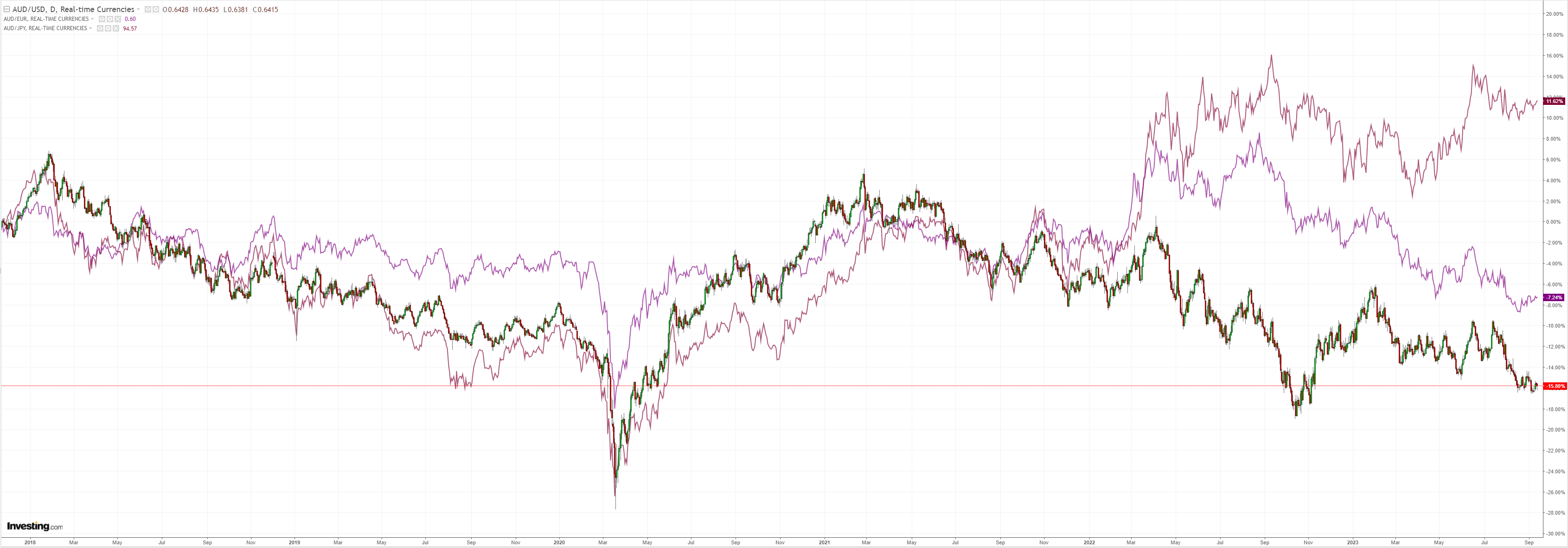

AUD was down:

CNY managed another up day:

Oil is the only game in town:

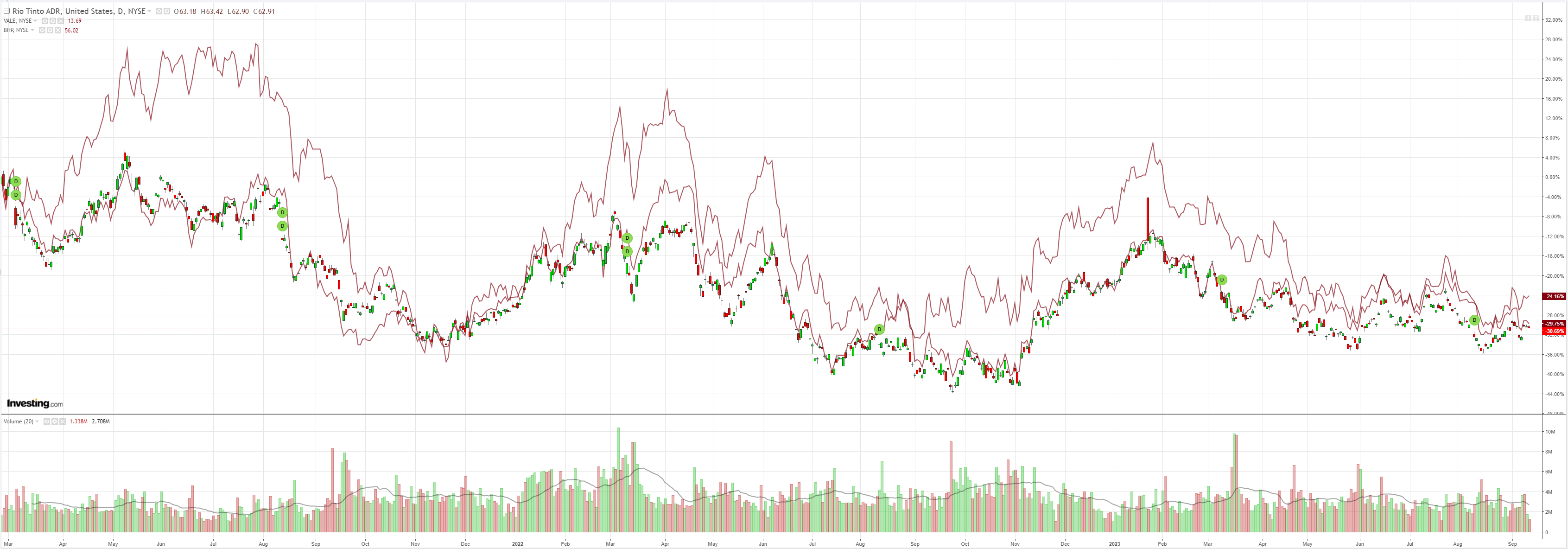

Everything else is asleep:

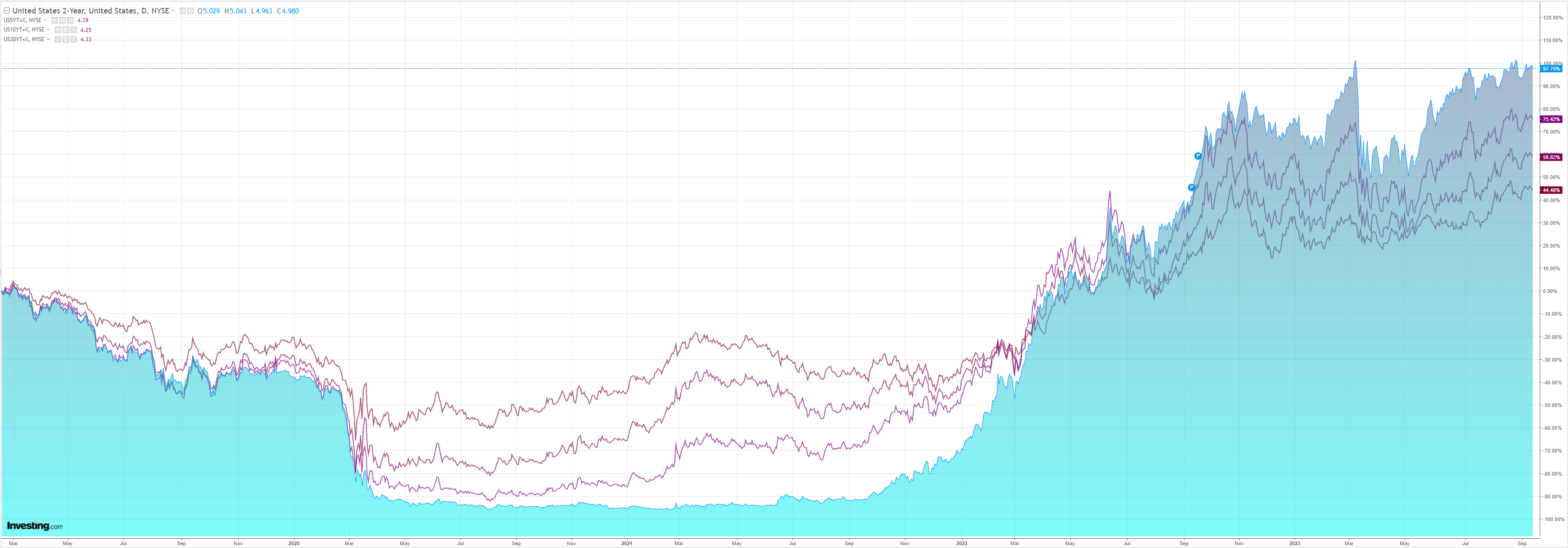

The curve steepened:

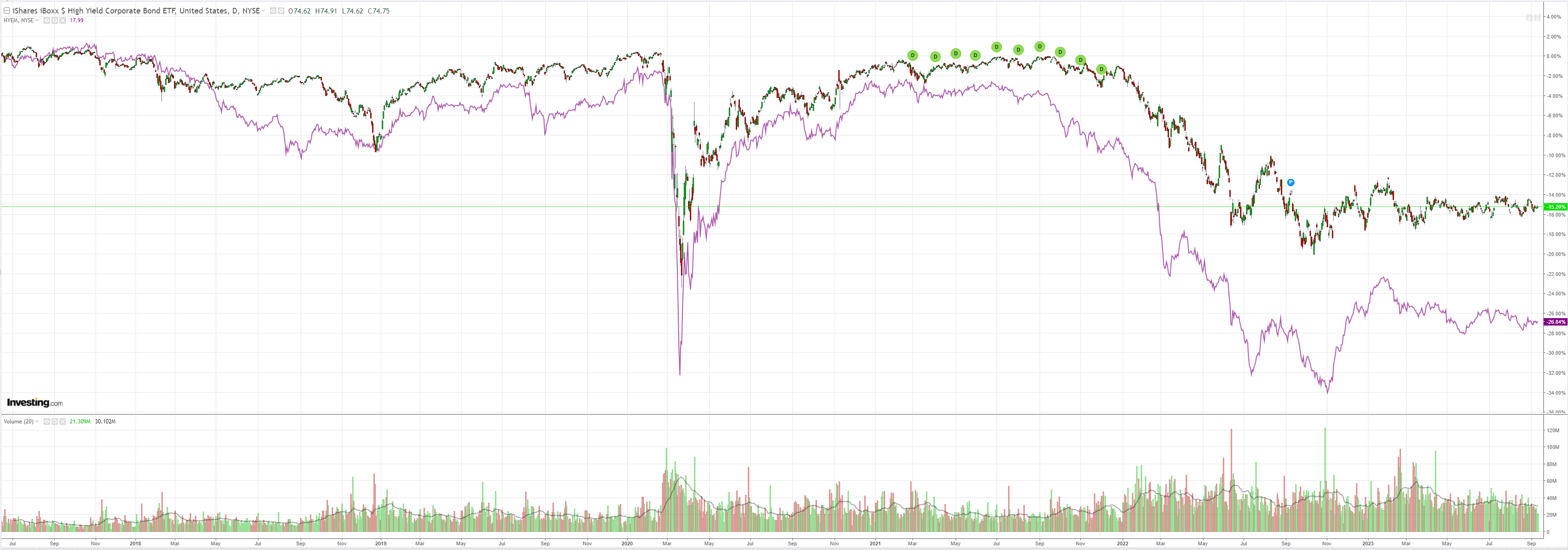

Stocks eased:

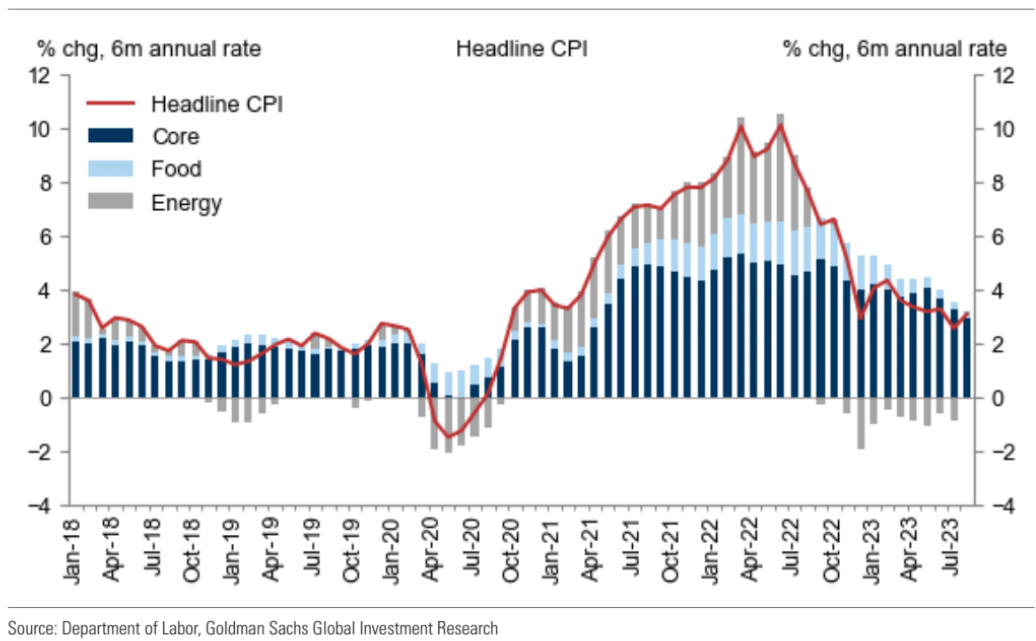

US inflation came in hot driven by oil. Goldman has more:

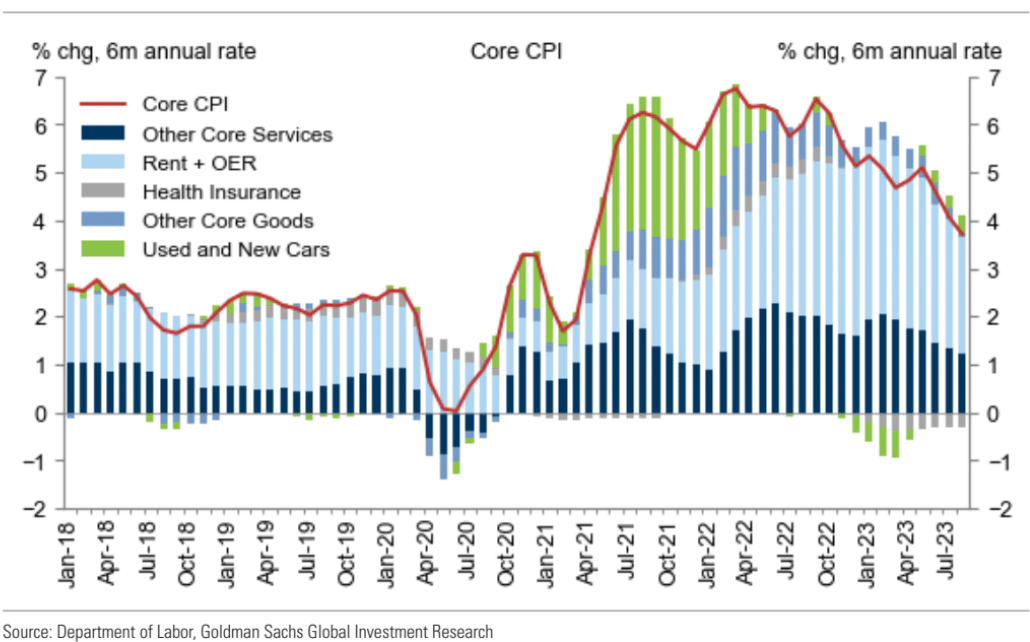

August core CPI rose by 0.28%—a three-month high and 8bpabove consensus expectations—but the year-on-year rate nonetheless fell fourtenths to4.3%. The composition was firm on net: while the volatile airfares category contributed +3bp to the core, the more-persistent rent, healthcare, and car insurance categories were stronger than we expected. Our measure of trimmed core inflation picked up only marginally, at 0.30% in August compared to 0.29% in July. While somewhat above consensus, we do not expect today’s report to affect the outcome of the September FOMC meeting—for which we expect unchanged policy—and we continue to believe that the FOMC will view a final hike at the November meeting as unnecessary.

The Fed should hike. It has already let equities carry this cycle into an inflationary base above its target. Next, it will confront a re-acceleration thanks to oil.

Whether it will in September or November is neither here nor there. That it must is the thermal that DXY is riding.

Societe General has the implications for AUD:

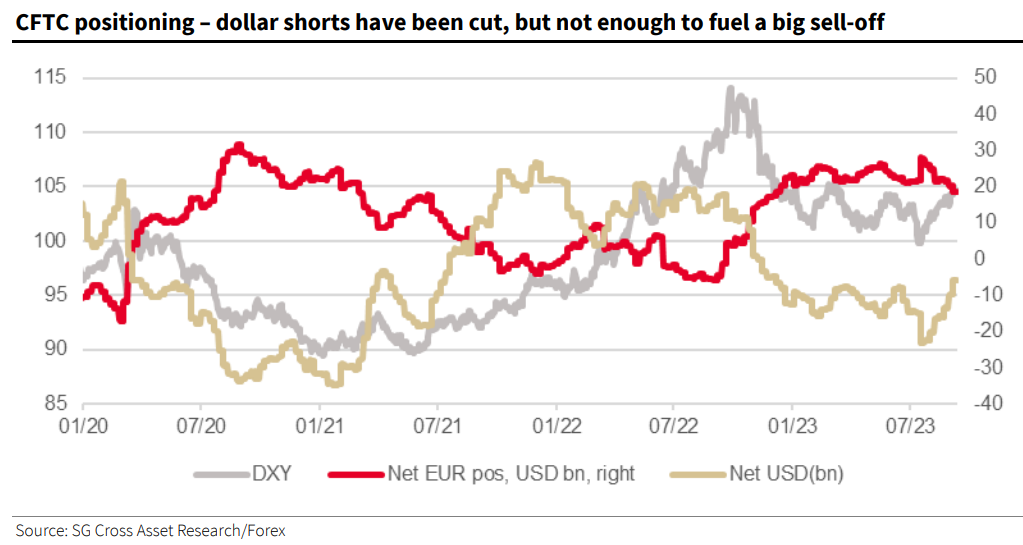

CFTC positioning data suggest the market remains short USD, not long at all. The chart shows the net speculative position in USD, and EUR as well, in billions of dollars. It suggests that euro longs and dollar shorts peaked in late July and the reduction in those positions drove the dollar’s bounce. Enough for a correction, clearly, but not enough for a sustained move without a more convincing story behind it, surely!

The catalyst for the move this morning came from Japan and China. BOJ Governor Ueda suggested, in an interview for Yomiuri, that wage data could possibly allow a monetary policy adjustment by December. That was all it took to scare USD/JPY back down, while in China, inflation is back above zero and loan growth was strong, allowing the AUD to rally as much as JPY

has, while ZAR did better than either.

As ever, it will be the data which determines whether it turns into more than a pothole in the road to a deeper dollar correction. EUR/USD still targets 1.05, even if a ‘hawkish hold’ on Thursday doesn’t immediately send it tumbling. USD/JPY will struggle to break 145, let alone 140, until there are clearer signs of change. This week sees minimal news today, but UK jobs tomorrow, US CPI on Wednesday, the ECB, and US retail sales on Thursday. The risk is that CPI is high enough (Stephen expects 3.7% headline and 4.4% core) to feed fears of a plateau before the next leg down, and prompts talk of a further hike in due course. The combination of Australian jobs data on Thursday and Chinese IP/retail sales on Friday could stretch the AUD rally a little further. But if that happens, we’ll look to sell AUD again.

The big short position in AUD will act as some downside protection but oil and DXY are still dominant.