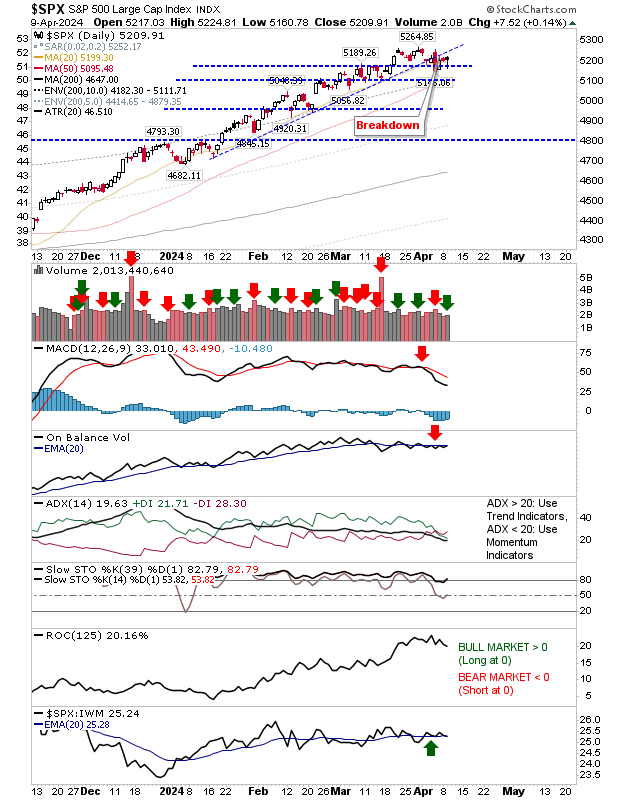

Markets threatened a rout after sellers struck at Tuesday's open, but a rally after the hour managed to right the ship, and by the close of business lead markets were showing "dragonfly doji" candlesticks.

A dragonfly doji is typically a bullish reversal candlestick, but only in the context of an oversold market which is not the case here. Of course, later today we have a slew of economic data that could deliver dramatic swings in the market (both ways), so there is a certain level of pent-up tension leading into this.

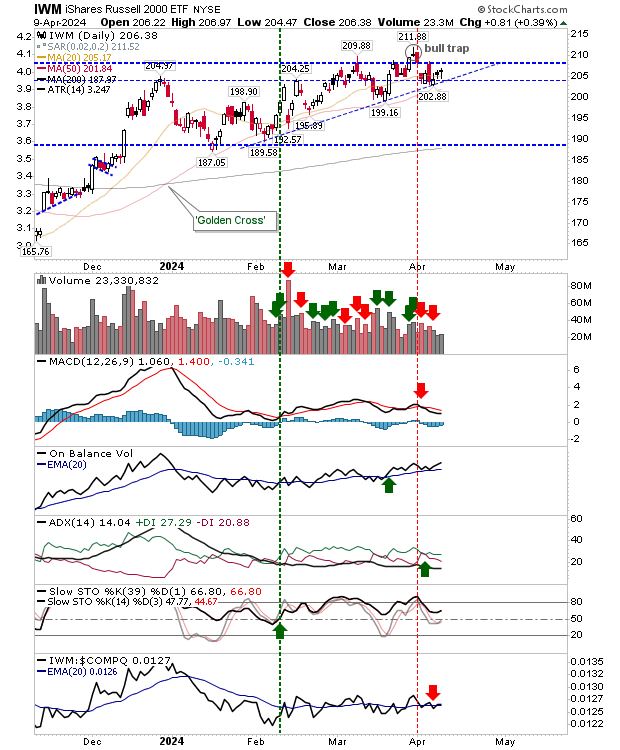

With that in mind, we have a Russell 2000 (IWM) that continues to feel the squeeze as the ascending triangle trendline squeezes into breakout resistance and the March "bull trap".

Trading volume has been very tepid over the last few days - typical of a consolidation - so look for this to pick up when support or resistance is broken.

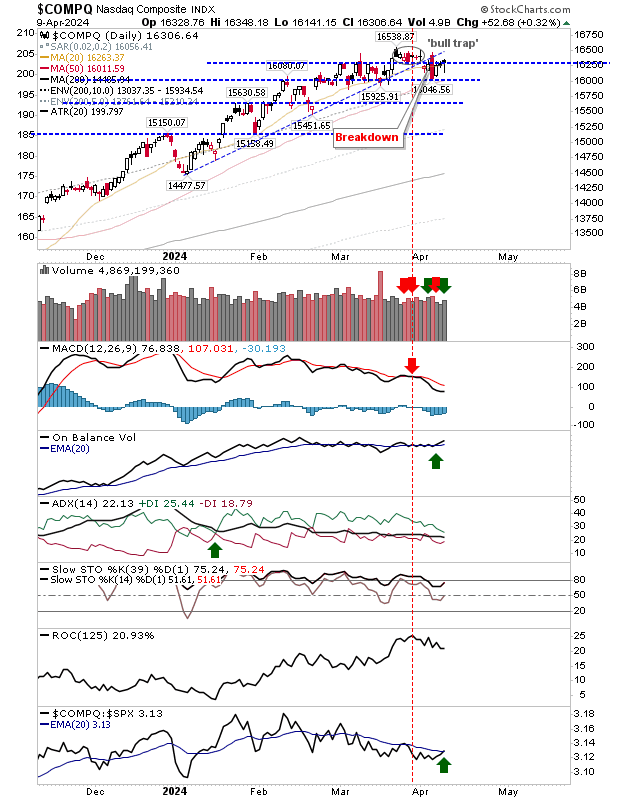

The Nasdaq did a little better than the Russell 2000 ($IWM) in that it was able to register an accumulation day. So far, it has managed to rebuff the influence of last week's large bearish engulfing pattern that came with the break of the 3-month rising trend.

The overall trend is bullish, and the MACD histogram is showing a little uptick that could lead to a new 'buy' signal above the bullish zero line (a good sign) if it can hang on here.

As for the Nasdaq goes the S&P. The S&P picture is a little stronger as while it lost trendline support, it hasn't yet lost *breakout* support. Yesterday's volume ranked as accumulation, but really, it was quite light overall.