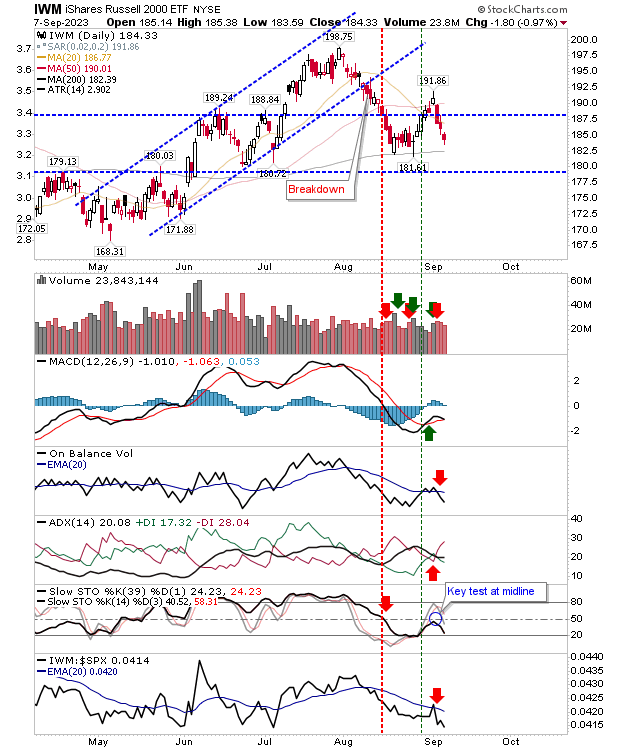

The selling of the last few days hasn't abated, and we have a situation where the Russell 2000 (IWM) is now looking at a test of its 200-day MA.

There is a mix of technical strength, with On-Balance-Volume and ADX on bearish signals, keeping with the initial bearish signal in stochastics (a signal which, ultimately, didn't get to challenge the mid-line).

The index is also underperforming relative to the S&P 500 and could soon be making a new swing low in this regard.

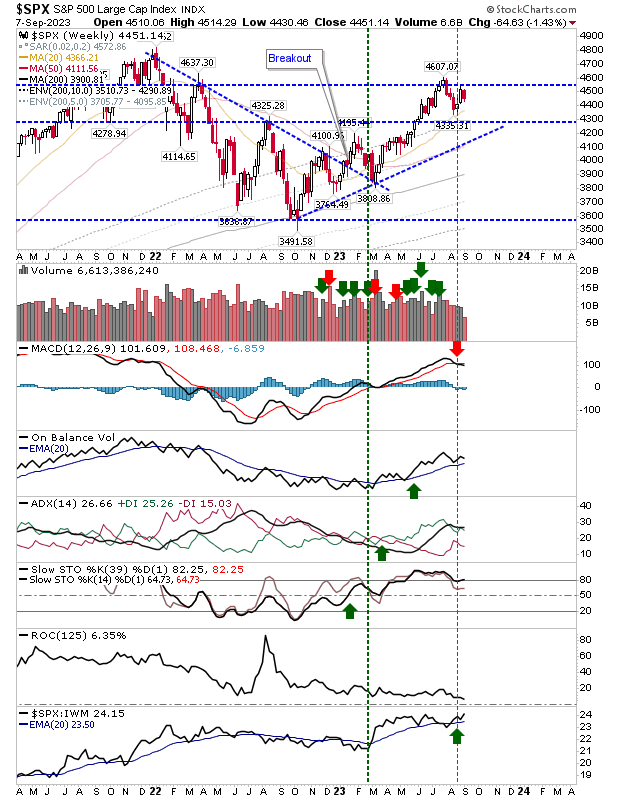

The only positive to today's action in the Russell 2000 was the lack of higher volume distribution. Unfortunately, this was not the case for the S&P 500.

There was a clear shift to bearishness, marked by higher volume distribution. However, the index is trading below its 50-day MA. There is a significant gap to 200-day MA support, so bulls must hope that nearer 4,325 holds.

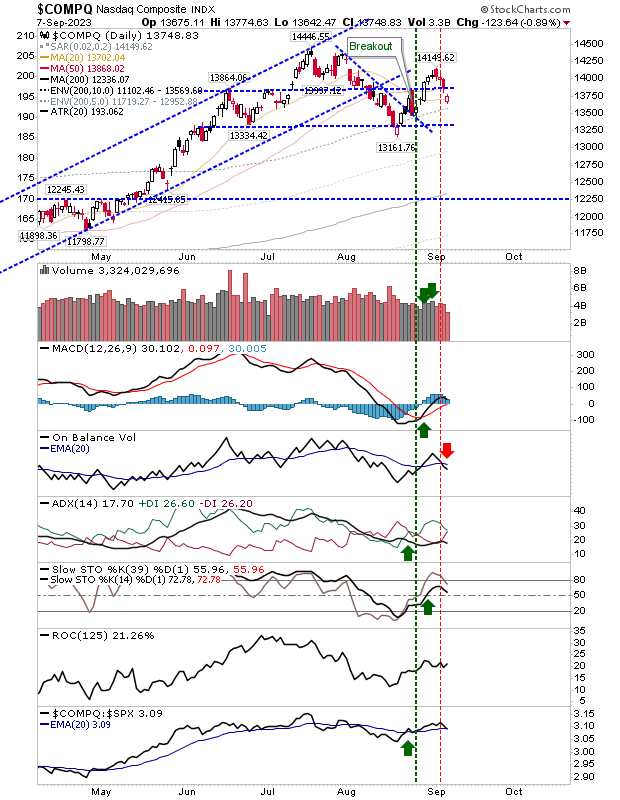

The Nasdaq finished at its 20-day MA, managing a higher close to open price. Technicals were mixed; there was a firm 'sell' commitment in On-Balance-Volume, but other technicals are positive.

Today's action did offer some relative weakness against the S&P 500, enough to see a cross-over trigger, but nothing to suggest a significant move lower is soon to happen.

Aside from today's distribution selling in the S&P 500, the indexes have been playing with relatively orderly selling.

Technically, the Nasdaq is best placed to bounce higher, but it's the Russell 2000 that is edging towards something more bearish.

The 200-day MA test for the latter index will be important as it will determine if Small Caps are moving into a bullish or bearish state.